Asus 2010 Annual Report Download - page 163

Download and view the complete annual report

Please find page 163 of the 2010 Asus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211

|

|

159

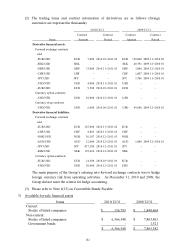

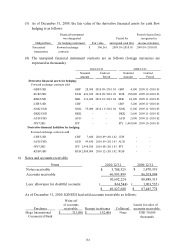

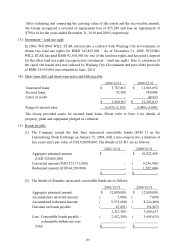

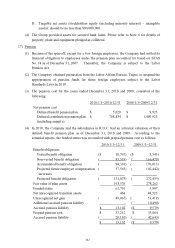

2010/12/31 2009/12/31

Debt-component embedded derivative:

-call/put option and conversion option

price reset

$- $ 9,417

-conversion rights 104,525 273,455

$ 104,525 $ 282,872

2010/1/1~12/31 2009/1/1~12/31

Gain on valuation of financial liabilities $ 151,382 $ 179,298

Interest expense $ 81,039 $ 128,051

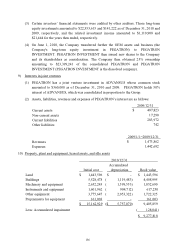

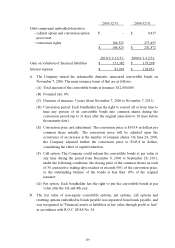

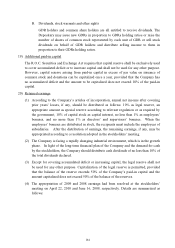

A. The Company issued the redeemable domestic unsecured convertible bonds on

November 7, 2006. The main issuance terms of that are as follows:

(A) Total amount of the convertible bonds at issuance: $12,000,000

(B) Nominal rate: 0%

(C) Duration of issuance: 5 years (from November 7, 2006 to November 7, 2011)

(D) Conversion period: Each bondholder has the right to convert all or from time to

time any portion of its convertible bonds into common shares during the

conversion period (up to 31 days after the original issue date to 10 days before

the maturity date).

(E) Conversion price and adjustment: The conversion price is $105.4 in dollars per

common share initially. The conversion price will be adjusted upon the

occurrence of an increase in the number of common shares. On June 24, 2010,

the Company adjusted further the conversion price to $345.8 in dollars,

considering the effect of capital reduction.

(F) Call option: The Company could redeem the convertible bonds at par value at

any time during the period from December 8, 2006 to September 28, 2011,

under the following conditions: the closing price of the common shares on each

of 30 consecutive trading days reaches or exceeds 50% of the conversion price,

or the outstanding balance of the bonds is less than 10% of the original

issuance.

(G) Put option: Each bondholder has the right to put the convertible bonds at par

value after the 3rd and 4th year.

B. The fair value of non-equity convertible options, put options, call options and

resetting options embedded in bonds payable was separated from bonds payable, and

was recognized in “Financial assets or liabilities at fair value through profit or loss”

in accordance with R.O.C. SFAS No. 34.