Asus 2010 Annual Report Download - page 172

Download and view the complete annual report

Please find page 172 of the 2010 Asus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211

|

|

168

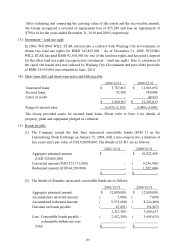

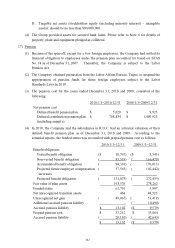

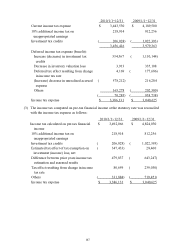

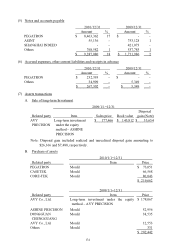

(4) The components of deferred income tax assets (liabilities) are as follows:

2010/12/31 2009/12/31

Deferred income tax assets:

Unrealized sales profit $ 238,628 $ 283,562

Unrealized purchase discount 436,231 228,945

Inventory provisions 642,029 890,363

Unrealized accrued expenses 1,023,288 523,103

Loss carryforward 353,898 480,393

Investment tax credits 567,236 2,145,185

Others 588,285 332,287

Deferred tax assets 3,849,595 4,883,838

Valuation allowance ( 840,927)( 1,828,144)

3,008,668 3,055,694

Deferred income tax liabilities:

Investment income recognized under the

equity method (overseas)

( 1,939,835) ( 1,518,182)

Others ( 185,948)( 385,581)

( 2,125,783) ( 1,903,763)

Net deferred tax assets $ 882,885 $ 1,151,931

2010/12/31 2009/12/31

Deferred income tax assets - current $ 1,638,031 $ 2,607,912

Deferred income tax assets - non-current 1,150,216 245,995

Deferred income tax liabilities - current - ( 415)

Deferred income tax liabilities - non-current ( 1,905,362) ( 1,701,561)

$ 882,885 $ 1,151,931

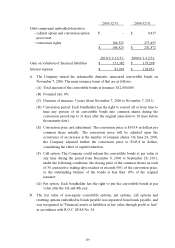

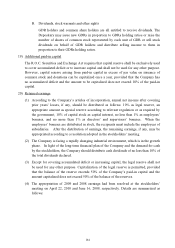

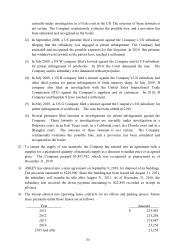

(5) Tax appeals of the Group:

The R.O.C. tax authorities have examined the Company’s income tax returns through

2008 except for the year 2006. The tax authorities assessed the Company for additional

income tax of $870,587 for the years 1996, 1998 and 2008. The Company disagreed with

the assessment and filed formal tax appeals. The additional income tax liability for

these assessments was recognized in the financial statements.

(6) Imputation credit account and creditable ratio

2010/12/31 2009/12/31

ICA balance $ 12,282,090 $ 12,833,212

2010 (expected) 2009 (Actual)

Creditable ratio for earnings distribution 18.07%(Note) 20.34%

Note: Creditable ratio is calculated based on ICA balance plus income tax payable as of

December 31, 2010 divided by the balance of the undistributed earnings after 1998

.

The ratio shall not be higher than the upper limit under Income Tax Act.