Asus 2010 Annual Report Download - page 160

Download and view the complete annual report

Please find page 160 of the 2010 Asus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211

|

|

156

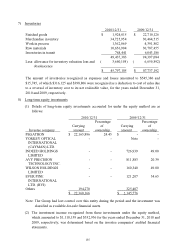

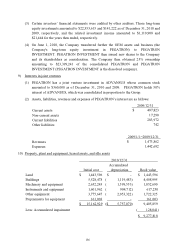

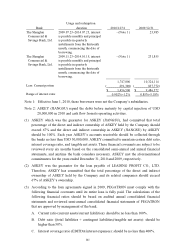

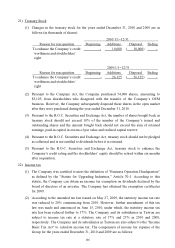

(3) Certain investees’ financial statements were audited by other auditors. Those long-term

equity investments amounted to $22,353,615 and $141,222 as of December 31, 2010 and

2009, respectively, and the related investment income amounted to $1,110,908 and

$21,444 for the years then ended, respectively.

(4) On June 1, 2010, the Company transferred further the OEM assets and business (the

Company's long-term equity investment in PEGATRON) to PEGATRON

INVESTMENT. PEGATRON INVESTMENT then issued new shares to the Company

and its shareholders as consideration. The Company then obtained 25% ownership

amounting to $23,399,241 of the consolidated PEGATRON and PEGATRON

INVESTMENT (PEGATRON INVESTMENT is the dissolved company).

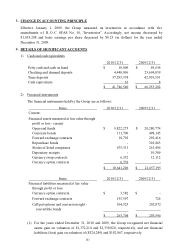

9) Interests in joint ventures

(1) PEGATRON has a joint venture investment in ADVANSUS whose common stock

amounted to $360,000 as of December 31, 2010 and 2009. PEGATRON holds 50%

interest of ADVANSUS, which was consolidated in proportion to the Group.

(2) Assets, liabilities, revenues and expenses of PEGATRON’s interest are as follows:

2009/12/31

Current assets $ 487,823

Non-current assets 17,290

Current liabilities 283,972

Other liabilities 742

2009/1/1~2009/12/31

Revenues $ 1,473,862

Expenses 1,442,692

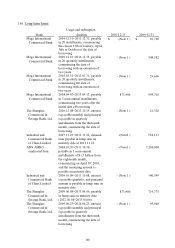

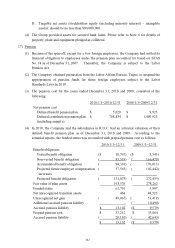

10) Property, plant and equipment, leased assets, and idle assets

2010/12/31

Accumulated

Initial cost depreciation Book value

Land $ 1,443,596 $ - $ 1,443,596

Buildings 5,528,478 ( 1,119,483) 4,408,995

Machinery and equipment 2,652,243 ( 1,599,553) 1,052,690

Instruments and equipment 1,601,962 ( 984,712) 617,250

Other equipment 3,775,647 ( 2,053,322) 1,722,325

Prepayments for equipment 161,003 - 161,003

$ 15,162,929 ($ 5,757,070) 9,405,859

Less: Accumulated impairment ( 128,041)

$ 9,277,818