Asus 2010 Annual Report Download - page 115

Download and view the complete annual report

Please find page 115 of the 2010 Asus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211

|

|

111

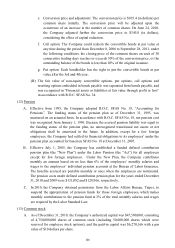

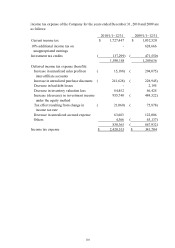

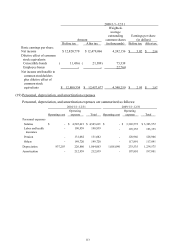

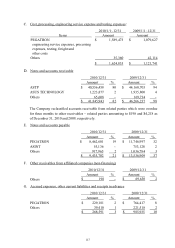

C. The income tax computed on pre-tax financial income at the statutory rate was

reconciled with the income tax expense as follows:

2010/1/1~12/31 2009/1/1~12/31

Income tax calculated on pre-tax financial

income

$ 3,214,508 $ 3,205,183

10% additional income tax on

unappropriated earnings

-628,666

Investment tax credits ( 137,299) ( 471,550)

Estimated tax effect of tax exemption on

investment income, net

( 322,635) ( 1,442,598)

Business operation headquarters income tax

exemption on dividends declared by

investees

- ( 806,620)

Difference between prior years income tax

estimation and assessed results

( 16,321) ( 477,451)

Tax effect resulting from change in income

tax rate

( 21,060) ( 183,843)

Tax-exempt cash dividend ( 57,622) ( 58,750)

Unrealized valuation gain or loss ( 64,051) ( 83,995)

Effect of change in exchange rate ( 173,614) ( 27,667)

Others ( 1,393) 60,329

Income tax expense $ 2,420,513 $ 341,704

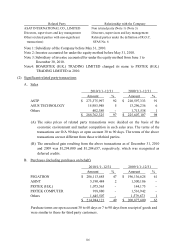

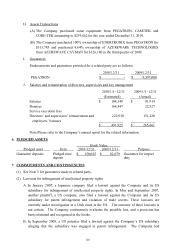

D. The components of deferred income tax assets (liabilities) are as follows:

2010/12/31 2009/12/31

Deferred income tax assets:

Unrealized sales profit $ 219,980 $ 240,931

Unrealized purchase discounts 436,231 228,945

Inventory provisions 321,517 477,611

Unrealized accrued expenses 147,767 248,764

Others 51,371 64,689

1,176,866 1,260,940

Deferred income tax liabilities:

Investment income recognized under the

equity method (overseas)

( 1,939,835) ( 1,157,758)

Others ( 126,259) ( 282,115)

( 2,066,094) ( 1,439,873)

($ 889,228) ($ 178,933)

2010/12/31 2009/12/31

Net deferred income tax assets – current $ 1,014,641 $ 1,192,244

Net deferred income tax liabilities –

non-current

( 1,903,869) ( 1,371,177)

($ 889,228) ($ 178,933)