Asus 2010 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2010 Asus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

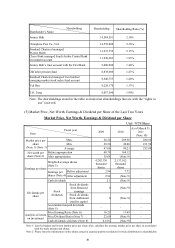

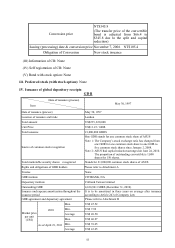

51

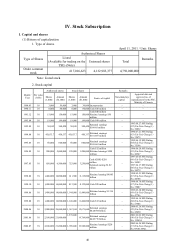

Cash Dividend 8,021,216,099 NTD$13 / share

Stock Dividend 1,357,436,570 NTD$2.2 / share

FY2010 Undistributed Profit 4,843,851,574

Unappropriated Earnings, Ending 65,157,510,195

Notes:

Employee’s Bonus 710,625,213

Remuneration for Directors and Supervisors 142,125,042

Note: The proposed profit distribution is allocated from 2010 retained earnings available for distribution.

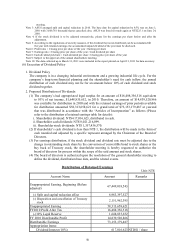

(7) Impact of the proposed stock dividend in shareholders meeting on business performances and EPS:

None

Note: The Company did not have financial forecast proposed up to the date of the annual report

printed.

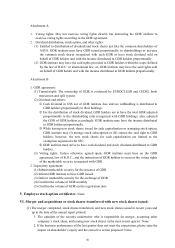

(8) Bonus to employees and remuneration to directors and supervisors

1. Information of dividend to employee and remuneration to directors and supervisors was

prescribed in the Articles of Incorporation.

The Company's net income before tax must be used to pay tax and make up accumulated loss

first, then with 10% legal reserve and 10% special reserve appropriated; also, 10% dividend

interest paid thereafter; also, an amount not less than 1% of the balance thereafter is

appropriated for the distribution of dividend to employees, an amount not over 1% of the

balance thereafter is appropriated for the distribution of remuneration to directors and

supervisors. The subsidiary’s employees are entitled to the distribution of stock dividend of

the parent company. The board of directors is then proposed the distribution of the net

balance in shareholders meeting for approval.

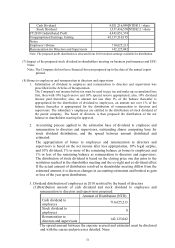

2. Accounting process applied to the estimation base of dividend to employee and

remuneration to directors and supervisors, outstanding shares computing base for

stock dividend distribution, and the spread between amount distributed and

estimated:

The appropriation of bonus to employees and remuneration to directors and

supervisors is based on the net income after loss appropriation, 10% legal surplus,

and 10% dividend; 1% or more of the remaining balance as bonus to employees and

1% or less of the remaining balance as remuneration to directors and supervisors.

The distribution of stock dividend is based on the closing price one day prior to the

resolution reached in the shareholder meeting and the ex-right and ex-dividend effect.

If the actual amount of distribution resolved in shareholder meeting differs from the

estimated amount, it is deem as changes in accounting estimation and booked as gain

or loss of the year upon distribution.

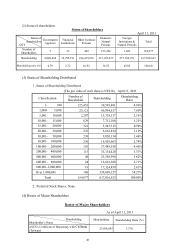

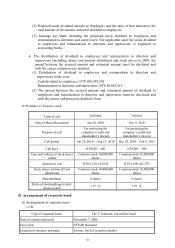

3. Dividend distribution of employees in 2010 resolved by the board of directors

(1)Distribution amount of cash dividend and stock dividend to employees and

remuneration to directors and supervisors proposed:

Amount of Distribution (NTD)

Cash dividend to

employees 710,625,213

Stock dividend to

employees 0

Remuneration to

directors and supervisors 142,125,042

The spread amount between the expense accrued and estimated must be disclosed

and with the causes and processes detailed: None