Asus 2010 Annual Report Download - page 191

Download and view the complete annual report

Please find page 191 of the 2010 Asus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

187

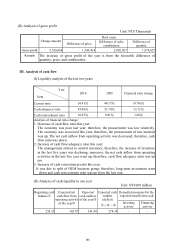

1. Analysis of cash flow change:

(1)Operating activity: Net cash inflow from operating activity for an amount o

f

NT$165.87 billion

(2)Investing activity: Net cash outflow from investing activity including long-term

investment for an amount of NT$54.10 billion

(3)Financing activity: Net cash outflow from financing activity including dividend

distribution for an amount of NT$87.78 billion

2. Remedial measures for the expected insufficient cash and liquidity analysis: N/A

IV. The impact of significant capital expenditure on finance in recent years:

Significant capital expenditure and the source of fund: N/A

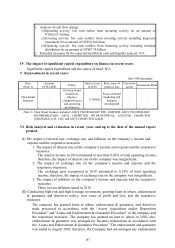

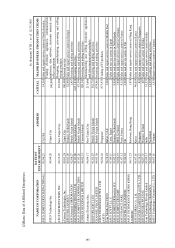

V. Reinvestment in recent years:

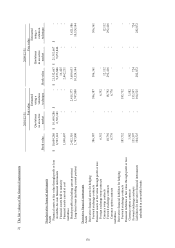

Unit: NT$ thousands

Item

(Note 1)

Amount

(NT$1,000) Policy Gain or Loss

in 2010

Root cause of

profit or loss

Corrective

action Investment Plans

Own brand

business -

Develop brand

business to

improve

competitiveness

and operating

performance

3,749,641

Focus on brand

marketing and

business

development

- -

Note 1: Own brand business included: ASUS TECHNOLOGY PTE. LIMITED, ASUS TECHNOLOGY

INCORPORATION, ASUS COMPUTER INTERNATIONAL, ASUSTEK COMPUTER

(SHANGHAI) CO. LTD. and ASUS COMPUTER GmbH.

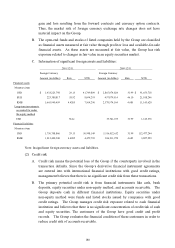

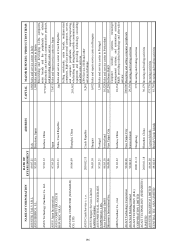

VI. Risk analysis and evaluation in recent years and up to the date of the annual report

printed:

(I) The impact of interest rate, exchange rate, and inflation on the company’s income and

expense and the responsive measures:

1. The impact of interest rate on the company’s income and expense and the responsive

measures:

The interest income in 2010 amounted to less than 0.03% of total operating income;

therefore, the impact of interest rate on the company was insignificant.

2. The impact of exchange rate on the company’s income and expense and the

responsive measures:

The exchange gain recognized in 2010 amounted to 0.14% of total operating

income; therefore, the impact of exchange rate on the company was insignificant.

3. The impact of inflation on the company’s income and expense and the responsive

measures:

There was no inflation issued in 2010

(II) Conducting high-risk and high-leverage investment, granting loans to others, endorsement

& guarantee and directives policy, root cause of profit and loss, and the responsive

measures:

The company has granted loans to others, endorsement & guarantee, and directives

trade processed in accordance with the “Assets Acquisition and/or Disposition

Procedure” and “Loans and Endorsement & Guarantee Procedure” of the company and

the responsive measures. The company has granted no loan to others in 2010; also,

endorsement & guarantee was arranged for business transactions in accordance with

the “Loans and Endorsement & Guarantee Procedure.” The endorsement and guarantee

was ended in August 2010; therefore, the Company had not arranged any endorsement