Asus 2010 Annual Report Download - page 165

Download and view the complete annual report

Please find page 165 of the 2010 Asus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

161

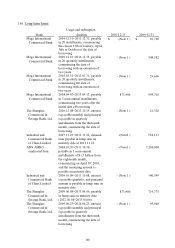

Usage and redemption

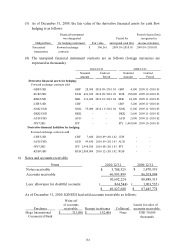

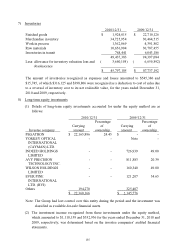

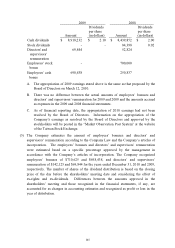

Bank duration 2010/12/31 2009/12/31

The Shanghai

Commercial &

Savings Bank, Ltd.

2009.07.23~2014.07.23, interest

is payable monthly and principal

is payable in quarterly

installments from the thirteenth

month, commencing the date of

borrowing.

- (Note 1 ) 23,985

The Shanghai

Commercial &

Savings Bank, Ltd.

2009.11.23~2014.10.15, interest

is payable monthly and principal

is payable in quarterly

installments from the thirteenth

month, commencing the date of

borrowing.

- (Note 1 ) 231,855

1,747,800 10,324,114

Less: Current portion ( 291,300) ( 837,772)

$1,456,500 $ 9,486,372

Range of interest rates 0.902%~1.2% 0.85%~5.18%

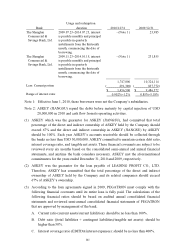

Note 1: Effective June 1, 2010, these borrowers were not the Company’s subsidiaries.

Note 2: ASKEY (JIANGSU) repaid the debts before maturity by capital injection of USD

20,000,000 in 2010 and cash flow from its operating activities.

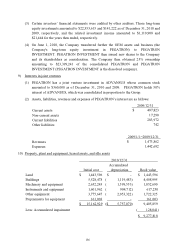

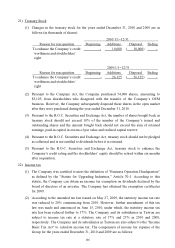

(1) ASKEY which was the guarantor for ASKEY (JIANGSU), had committed that total

percentage of the direct and indirect ownership of ASKEY held by the Company should

exceed 67% and the direct and indirect ownership in ASKEY (JIANGSU) by ASKEY

should be 100%. Each year ASKEY’s accounts receivable should be collected through

the banks no less than USD 30,000,000. ASKEY committed to maintain certain debt ratio,

interest coverage ratio, and tangible net assets. These financial covenants are subject to be

reviewed every six months based on the consolidated semi-annual and annual financial

statements, and anytime the bank considers necessary. ASKEY met the aforementioned

commitments for the years ended December 31, 2010 and 2009, respectively.

(2) ASKEY was the guarantor for the loan payable of LEADING PROFIT CO., LTD.

Therefore, ASKEY has committed that the total percentage of the direct and indirect

ownership of ASKEY held by the Company and its related companies should exceed

67% of ASKEY’s ownership.

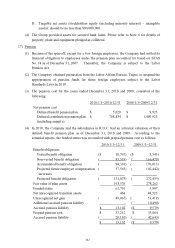

(3) According to the loan agreements signed in 2009, PEGATRON must comply with the

following financial covenants until its entire loan is fully paid. The calculations of the

following financial ratios should be based on audited annual consolidated financial

statements and reviewed semi-annual consolidated financial statements of PEGATRON

that are approved by management of the bank.

A. Current ratio (current assets/current liabilities): should be no less than 100%.

B. Debt ratio ((total liabilities + contingent liabilities)/tangible net assets): should be

higher than 50%.

C. Interest coverage ratio (EBITDA/interest expenses): should be no less than 400%.