Asus 2010 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2010 Asus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

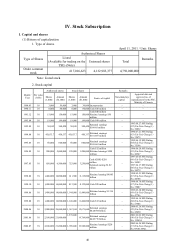

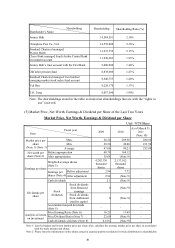

50

meeting.

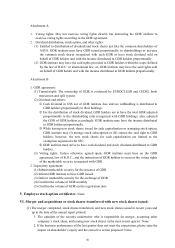

Note 3: ASUS arranged split and capital reduction in 2010. The base date for capital reduction by 85% was on June 1,

2010 with 3,609,761 thousand shares cancelled; also, ASUS was listed for trade again at NT$225.1 on June 24,

2010.

Note 4: If the stock dividend is to be adjusted retroactively, please list the earnings per share before and after the

adjustment.

Note 5: According to the regulations of security issuance, if the dividend that is not distributed can be accumulated till

the year with retained earnings, the accumulated unpaid dividend of the year must be disclosed.

Note 6: Profit ratio = Closing price per share of the year / Earning per share

Note 7: Earning ratio = Closing price per share of the year / Cash dividend per share

Note 8: Cash dividend yield rate = Cash dividend per share / Closing price per share of the year

Note 9: Subject to the approval of the annual shareholders meeting.

Note 10: The data collected up to March 31, 2011 were included in the report printed on April 21, 2011 for data accuracy.

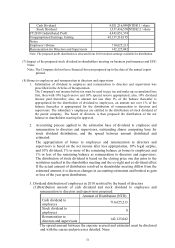

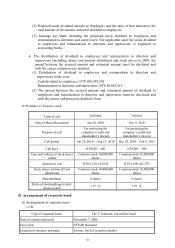

(6) Execution of Dividend Policy

1. Dividend Policy

The company is in a changing industrial environment and a growing industrial life cycle. For the

company’s long-term financial planning and the shareholder’s need for cash inflow, the annual

distribution of cash dividend may not be for an amount below 10% of cash dividend and stock

dividend together.

2. Proposed Distribution of Dividends:

(1) The company’s had appropriated legal surplus for an amount of $16,488,356,518 equivalent

to 10% of net income, $1,648,835,652, in 2010. Therefore, an amount of $14,839,520,866

was available for distribution in 2010 and with the retained earnings of prior periods available

for distribution amounted $58,313,658,621 for a grand total of $73,153,179,487 at yearend

that was distributed in accordance with the “Articles of Incorporation” as follows (Please

refer to the distribution of retained earrings table for details):

i. Shareholder dividend: NT$ 617,016,623, distributed in cash.

ii. Shareholder cash dividends: NT$ 8,021,216,099.

iii. Shareholder stock dividends: NT$ 1,357,436,570.

(2) If shareholder’s cash dividend is less than NT$ 1, the distribution will be made in the form of

cash rounded and adjusted by a specific represent arranged by the Chairman of the Board of

Directors.

(3) For earnings distribution, if the stock dividend and dividend rate must be adjusted due to the

change in outstanding stock share by the conversion of convertible bond to stock shares or the

buy back of Treasury stock, the shareholder meeting is hereby requested to authorize the

board of directors for process within the scope of the said amount and stock shares.

(4) The board of directors is authorized upon the resolution of the general shareholder meeting to

define the dividend, distribution base date, and the related events.

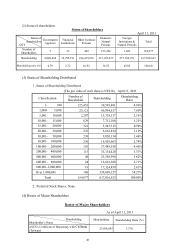

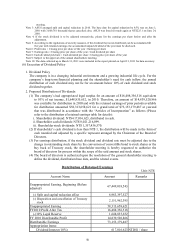

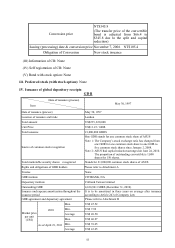

Distribution of Retained Earnings

Unit: NT$

Account Name Amount Remarks

Unappropriated Earning, Beginning (Before

adjusted) 67,449,018,543

(-) Split and capital reduction effect 6,983,397,527

(-) Disposition and cancellation of Treasury

stock 2,151,962,395

Unappropriated Earning 58,313,658,621

FY2010 Profit After Tax 16,488,356,518

(-)10% Legal Reserve 1,648,835,652

FY 2010 Distributable Profit 14,839,520,866

Distributable Earnings 73,153,179,487

Appropriation Items:

Dividend Interest (10%) 617,016,623 NTD$1 / share