Asus 2010 Annual Report Download - page 110

Download and view the complete annual report

Please find page 110 of the 2010 Asus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

106

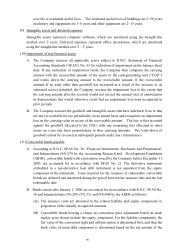

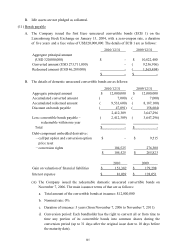

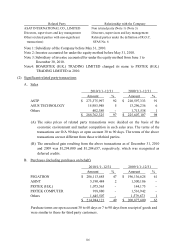

e. Conversion price and adjustment: The conversion price is $105.4 (in dollars) per

common share initially. The conversion price will be adjusted upon the

occurrence of an increase in the number of common shares. On June 24, 2010,

the Company adjusted further the conversion price to $345.8 (in dollars),

considering the effect of capital reduction.

f. Call option: The Company could redeem the convertible bonds at par value at

any time during the period from December 8, 2006 to September 28, 2011, under

the following conditions: the closing price of the common shares on each of 30

consecutive trading days reaches or exceeds 50% of the conversion price, or the

outstanding balance of the bonds is less than 10% of the original issuance.

g. Put option: Each bondholder has the right to put the convertible bonds at par

value after the 3rd and 4th year.

(B) The fair value of non-equity convertible options, put options, call options and

resetting options embedded in bonds payable was separated from bonds payable, and

was recognized in “Financial assets or liabilities at fair value through profit or loss”

in accordance with R.O.C. SFAS No. 34.

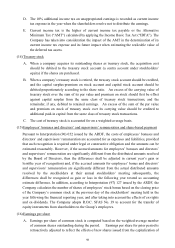

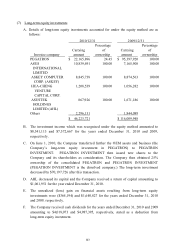

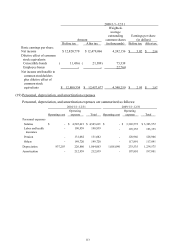

(12) Pension

A. Effective from 1995, the Company adopted R.O.C. SFAS No. 18, “Accounting for

Pensions”. The funding status of the pension plan as of December 31, 1995, was

measured on an actuarial basis. In accordance with R.O.C. SFAS No. 18, net pension cost

was recognized from January 1, 1996. Because the accrued pension liability was equal to

the funding status of the pension plan, no unrecognized transitional net assets or net

obligations shall be amortized in the future. In addition, except for a few foreign

employees, the Company had settled its financial obligations to its employees’ under the

pension plan accounted for based on SFAS No. 18 at December 31, 2007.

B. Effective July 1, 2005, the Company has established a funded defined contribution

pension plan (the “New Plan”) under the Labor Pension (the “Act”) for all employees

except for few foreign employees. Under the New Plan, the Company contributes

monthly an amount based on no less than 6% of the employees’ monthly salaries and

wages to the employees’ individual pension accounts at the Bureau of Labor Insurance.

The benefits accrued are portable monthly or once when the employees are terminated.

The pension costs under defined contribution pension plan for the years ended December

31, 2010 and 2009 were $131,082 and $128,966, respectively.

C. In 2010, the Company obtained permission from the Labor Affairs Bureau, Taipei, to

suspend the appropriation of pension funds for those foreign employees, which makes

monthly contributions to the pension fund at 2% of the total monthly salaries and wages

are required by the Labor Standard Law.

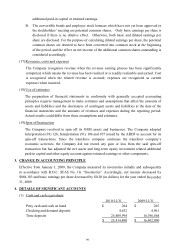

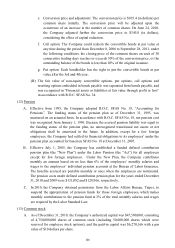

(13) Common stock

A. As of December 31, 2010, the Company’s authorized capital was $47,500,000, consisting

of 4,750,000,000 shares of common stock (including 50,000,000 shares which were

reserved for employee stock options), and the paid-in capital was $6,270,166 with a par

value of $10 dollars per share.