Asus 2010 Annual Report Download - page 113

Download and view the complete annual report

Please find page 113 of the 2010 Asus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

109

stockholders’ meeting and those recognized in the financial statements, if any, are

accounted for as changes in accounting estimates and recognized as profit or loss in the

year of distribution.

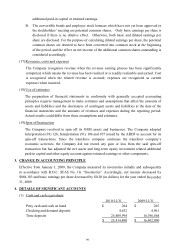

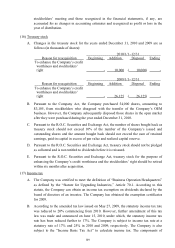

(16) Treasury stock

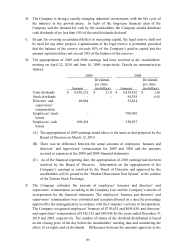

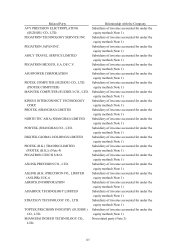

A. Changes in the treasury stock for the years ended December 31, 2010 and 2009 are as

follows (in thousands of shares):

2010

/1/1~12/31

Reason for reacquisition

Beginning

Addition

Disposal

Ending

To enhance the Company’s credit

worthiness and stockholders’

right -10,000 ( 10,000) -

2009/1/1~12/31

Reason for reacquisition Beginning Addition Disposal Ending

To enhance the Company’s credit

worthiness and stockholders’

right -26,125 ( 26,125) -

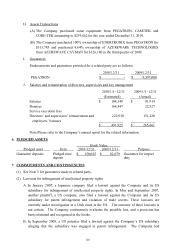

B. Pursuant to the Company Act, the Company purchased 54,000 shares, amounting to

$3,105, from stockholders who disagreed with the transfer of the Company’s OEM

business. However, the Company subsequently disposed those shares in the open market

after they were purchased during the year ended December 31, 2010.

C. Pursuant to the R.O.C. Securities and Exchange Act, the number of shares bought back as

treasury stock should not exceed 10% of the number of the Company’s issued and

outstanding shares and the amount bought back should not exceed the sum of retained

earnings, paid-in capital in excess of par value and realized capital reserve.

D. Pursuant to the R.O.C. Securities and Exchange Act, treasury stock should not be pledged

as collateral and is not entitled to dividends before it is reissued.

E. Pursuant to the R.O.C. Securities and Exchange Act, treasury stock for the purpose of

enhancing the Company’s credit worthiness and the stockholders’ right should be retired

within six months after acquisition.

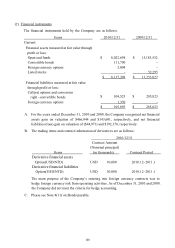

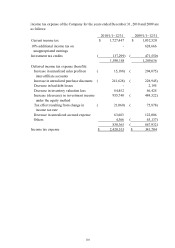

(17) Income tax

A. The Company was certified to meet the definition of “Business Operation Headquarters”

as defined by the “Statute for Upgrading Industries,” Article 70-1. According to this

statute, the Company can obtain an income tax exemption on dividends declared by the

board of directors of an investee. The Company has obtained the exemption certificates

for 2009.

B. According to the amended tax law issued on May 27, 2009, the statutory income tax rate

was reduced to 20% commencing from 2010. However, further amendment of this tax

law was made and announced on June 15, 2010, under which, the statutory income tax

rate has been reduced further to 17%. The Company is subject to income tax rate at a

statutory rate of 17% and 25% in 2010 and 2009, respectively. The Company is also

subject to the “Income Basic Tax Act” to calculate income tax. The components of