Asus 2010 Annual Report Download - page 112

Download and view the complete annual report

Please find page 112 of the 2010 Asus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

108

B. The Company is facing a rapidly changing industrial environment, with the life cycle of

the industry in the growth phase. In light of the long-term financial plan of the

Company and the demand for cash by the stockholders, the Company should distribute

cash dividends of no less than 10% of the total dividends declared.

C. Except for covering accumulated deficit or increasing capital, the legal reserve shall not

be used for any other purpose. Capitalization of the legal reserve is permitted, provided

that the balance of the reserve exceeds 50% of the Company’s paid-in capital and the

amount capitalized does not exceed 50% of the balance of the reserves.

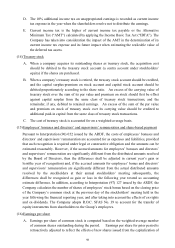

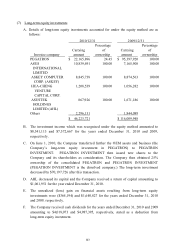

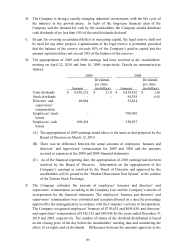

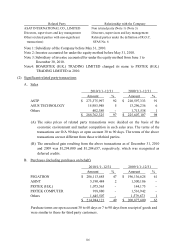

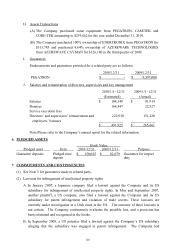

D. The appropriation of 2009 and 2008 earnings had been resolved at the stockholders’

meeting on April 22, 2010 and June 16, 2009, respectively. Details are summarized as

follows:

20

09

200

8

Dividends Dividends

per share

per share

Amount

(in dollars)

Amount

(in dollars)

Cash dividends $ 8,918,232 $ 2.10 $ 8,439,852 $ 2.00

Stock dividends

-

-

84,398

0.02

Directors’ and

supervisors’

remuneration

69,844 52,824

Employees’ stock

bonus

- 700,000

Employees’ cash

bonus

698,438 250,837

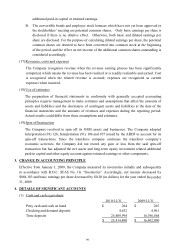

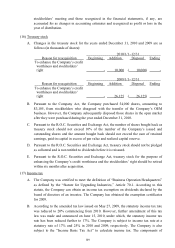

(A) The appropriation of 2009 earnings stated above is the same as that proposed by the

Board of Directors on March 12, 2010.

(B) There was no difference between the actual amounts of employees’ bonuses and

directors’ and supervisors’ remuneration for 2009 and 2008 and the amounts

accrued as expenses in the 2009 and 2008 financial statements.

(C) As of the financial reporting date, the appropriation of 2010 earnings had not been

resolved by the Board of Directors. Information on the appropriation of the

Company’s earnings as resolved by the Board of Directors and approved by the

stockholders will be posted in the “Market Observation Post System” at the website

of the Taiwan Stock Exchange.

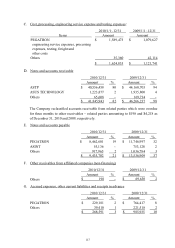

E. The Company estimates the amount of employees’ bonuses and directors’ and

supervisors’ remuneration according to the Company Law and the Company’s articles of

incorporation for the financial statements. The employees’ bonuses and directors’ and

supervisors’ remuneration were estimated and recognized based on a specific percentage

approved by the management in accordance with the Company’s articles of incorporation.

The Company recognized employees’ bonuses of $710,625 and $698,438, and directors’

and supervisors’ remuneration of $142,125 and $69,844 for the years ended December 31,

2010 and 2009, respectively. The number of shares of the dividend distribution is based

on the closing price of the day before the shareholders’ meeting date and considering the

effect of ex-rights and ex-dividends. Differences between the amounts approved in the