Asus 2010 Annual Report Download - page 151

Download and view the complete annual report

Please find page 151 of the 2010 Asus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

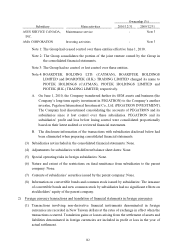

147

assets not currently used in operations are all transferred to idle assets, and depreciated.

(3) Depreciation is provided under the straight-line method over the estimated lives of the

assets. Salvage value of the fully depreciated assets that are still in use is depreciated

over the re-estimated useful lives. The estimated useful lives of buildings are 3~60

years, machinery and equipment are 2~10 years and other equipment are 1~20 years.

11) Intangible assets and deferred expenses

Intangible assets represent trademarks, technological know-how, computer software and land

use rights, which are amortized using the straight-line method over their estimated economic

lives. Deferred expense represents office decoration, molds and fixtures which are amortized

using the straight-line method over 1 ~ 5 years.

12) Impairment of non-financial assets

(1) The Group assesses all applicable assets subject to R.O.C. Statement of Financial

Accounting Standards (‘SFAS’) No. 35 for indication of impairment on the balance sheet

date. If any indication of impairment exists, the Group then compares the carrying

amount with the recoverable amount of the assets or the cash-generating unit (“CGU”)

and writes down the carrying amount to the recoverable amount. If the recoverable

amount of an asset other than goodwill has increased as a result of the increase in its

estimated service potential, the Group reverses the impairment loss to the extent that the

carrying amount after the reversal would not exceed the amount (net of amortization or

depreciation) that would otherwise result had no impairment loss been recognized in prior

periods.

(2) The Group assesses the goodwill and intangible assets that have indefinite lives or that

are not yet available for use periodically on an annual basis and recognizes an impairment

loss on the carrying value in excess of the recoverable amount. The loss is first recorded

against the goodwill allocated to the CGU, with any remaining loss allocated to other

assets on a pro rata basis proportionate to their carrying amounts. The write-down of

goodwill cannot be reversed in subsequent periods under any circumstances.

13) Convertible bonds payable

(1) According to R.O.C. SFAS No. 36, “Financial Instruments: Disclosure and Presentation”

and Interpretation (95) 078 by the Accounting Research and Development Foundation

(ARDF), convertible bonds with a put option issued by the Group before December 31,

2005, are accounted for in accordance with SFAS No. 21. The derivative instrument

embedded in a non-derivative host debt instrument is not separated from the equity

component of the instrument. Costs incurred for the issuance of redeemable convertible

bonds are deferred and amortized during the period between the issuance date and the last

redeemable date.

(2) Bonds issued after January 1, 2006 are accounted for in accordance with R.O.C. SFAS

No. 36 and Interpretations (95) 290, (97) 331 and (98) 046 by the ARDF as follows:

A. The issuance costs are allocated to the related liability and equity components in

proportion of the initially recognized amounts.