Asus 2010 Annual Report Download - page 184

Download and view the complete annual report

Please find page 184 of the 2010 Asus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211

|

|

180

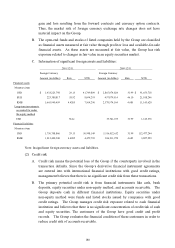

gain and loss resulting from the forward contracts and currency option contracts.

Thus, the market risk of foreign currency exchange rate changes does not have

material impact on the Group.

B. The open-end funds and stocks of listed companies held by the Group are classified

as financial assets measured at fair value through profit or loss and available-for-sale

financial assets. As these assets are measured at fair value, the Group has risk

exposure related to changes in fair value in an equity securities market.

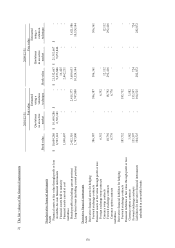

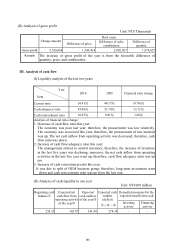

C. Information of significant foreign assets and liabilities:

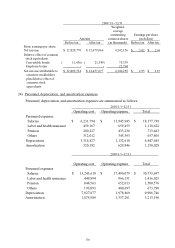

2010/12/31 2009/12/31

Foreign Currency

Foreign Currency

Amount

(in dollars) Rate NTD

Amount

(in dollars) Rate NTD

Financial a

ssets

Monetary item

USD

$

1,433,223,798 29.13 41,749,809

$

2,865,074,024 31.99

$

91,653,718

EUR 223,388,817 38.92 8,694,293 ,457,879,514 46.10 21,108,246

RMB 1,665,940,459 4.4205 7,364,290 2,378,574,164 4.685 11,143,620

Long-term investments

accounted for under

the equity method

USD Note 35,741,675 31.99 1,143,376

Financial l

iabilities

Monetary item

USD 1,750,708,860 29.13 50,998,149 3,516,012,632 31.99 112,477,244

RMB 1,013,400,940 4.4205 4,479,739 816,911,270 4.685 3,827,229

Note: Insignificant foreign currency assets and liabilities.

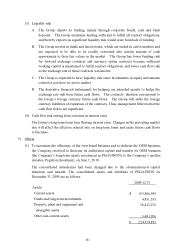

(2) Credit risk

A. Credit risk means the potential loss of the Group if the counterparty involved in the

transaction defaults. Since the Group’s derivative financial instrument agreements

are entered into with international financial institutions with good credit ratings,

management believes that there is no significant credit risk from these transactions.

B. The primary potential credit risk is from financial instruments like cash, bank

deposits, equity securities under non-equity method, and accounts receivable. The

Group deposits cash in different financial institutions. Equity securities under

non-equity method were funds and listed stocks issued by companies with good

credit ratings. The Group manages credit risk exposure related to each financial

institution and believes that there is no significant concentration of credit risk of cash

and equity securities. The customers of the Group have good credit and profit

records. The Group evaluates the financial condition of these customers in order to

reduce credit risk of accounts receivable.