Asus 2010 Annual Report Download - page 192

Download and view the complete annual report

Please find page 192 of the 2010 Asus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.188

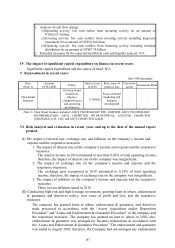

and guarantee on December 31, 2010.

(III) R&D plans and budgeted R&D expense:

ASUS cannot stress enough the importance of R&D team cultivation and training since

the incorporation. ASUS is able to have the key technology of products controlled to

secure the timing of mass production. ASUS will base on the said fine tradition to

reinforce the R&D capability of the company and add it with market movement to

have unique and innovative information products developed.

1. Products development planned in 2008:

(1) Digital control wireless transmission technology dual core CPU MB

(2) Advanced 3D image display and wireless TV transmission graphic card

(3) Intelligent phone GPS

(4) Ultra Mobile PC

(5) High-speed router / exchanger / firewall / VPN

(6) New-generation advanced server

(7) Professional LED display

(8) WiMAX broadband products

(9) Eee PC touch, long-lasting computer

(10) Eee Top PC and Eee Box PC

(11) Eee Note

(12) Eee Pad

2. R&D budget in 2011: NT$4 billion

(IV) The impact of domestic and international policies and law change on the company’s

finance and the responsive measures: None.

(V) The impact of technology change and industrial change on the company’s finance and

the responsive measures:

ASUS constantly strives to be an integrated 3C solution provider (Computer,

Communications, Consumer electronics). Technology change provides the company

with business opportunity for new products. The company was with 15.96 times of

inventory turnover in 2010; apparently, there was not any significant negative impact

on finance.

(VI) The impact of industrial image change on business risk management and the responsive

measures:

ASUS has maintained a fine industrial image and there is not any negative report on

the company’s image.

(VII) The expected effect, potential risk, and responsive measures of merger:

The company’s did not have any merger conducted in 2010 and up to the date of the

annual report printed: N/A

(VIII) The expected effect, potential risk, and responsive measures of plant expansion: N/A

(IX) The risk faced by procurements and sales hub and the responsive measures:

The company’s procurements and sales are not centralized and with a good customer

relationship established; therefore, no risk of procurements and sales centralization.

(X) The impact of massive stock transfer or change by directors, supervisors, and shareholders

with over 10% shareholding, the risk, and the responsive measures:

There was not any massive stock transfer or change by directors, supervisors, and

shareholders with over 10% shareholding in 2010 and up to the date of the annual

report printed.

(XI) The impact of right to operation change on the company, the risk, and the responsive