Asus 2010 Annual Report Download - page 167

Download and view the complete annual report

Please find page 167 of the 2010 Asus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211

|

|

163

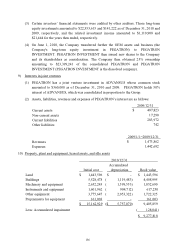

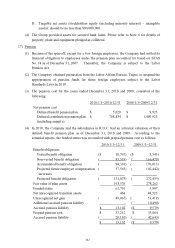

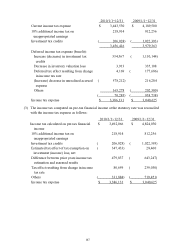

Actuarial assumptions are as follows:

2010/1/1~2010/12/31 2009/1/1~2009/12/31

Discount rate 2.00%~2.25% 2.00%~2.25%

Future salary increase rate 2.25%~3.00% 1.00%~3.00%

Expected long-term rate of return on

plan assets

2.00% 2.00%~2.50%

The net pension costs in 2010 and 2009 consisted of the following:

2010/1/1~2010/12/31 2009/1/1~2009/12/31

Service cost $ 3,719 $ 4,524

Interest cost 3,739 6,425

Expected return on plan assets ( 4,594) ( 6,959)

Amortization and deferral 1,905 4,372

Net pension cost $ 4,769 $ 8,362

As of December 31, 2010 and 2009, the vested benefits were approximately $12,107 and

$3,964, respectively.

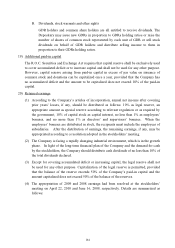

18) Common stock

(1) As of December 31, 2010, the Company’s authorized capital was $47,500,000, consisting

of 4,750,000,000 shares of common stock (including 50,000,000 shares reserved for

employee stock options), and the paid-in capital was $6,270,166 with a par value of $10

dollars per share.

(2) On June 16, 2009, the stockholders resolved to increase the Company’s capital by

26,851,000 shares by capitalizing its retained earnings and employees’ bonuses of

$268,512.

(3) In order to maximize the efficiency of the own-brand business and to dedicate the OEM

business, the Company held a special shareholders’ meeting on February 9, 2010 and

resolved to decrease its authorized capital by 85% and transfer its OEM business. The

record date for the capital reduction and transfer is June 1, 2010. The capital reduction,

which amounted to $36,097,609, was authorized by Financial Supervisory Commission,

Executive Yuan, R.O.C. on April 9, 2010. The registration procedures related to the

reduction were completed on June 21, 2010.

(4) As of December 31, 2010, the Company issued Global Depositary Receipts (GDRs), of

which 4,617,000 units of the GDRs are now listed on the London Stock Exchange. Per

unit of GDR represents 5 shares of the Company’s common stock and total GDRs

represent 23,085,000 shares of the Company’s common stock. The terms of GDR are as

follows:

A. Voting Rights

GDR holders may, pursuant to the Depositary Agreement and the relevant laws and

regulations of the R.O.C., exercise the voting rights pertaining to the underlying

common shares represented by the GDRs.