Asus 2010 Annual Report Download - page 155

Download and view the complete annual report

Please find page 155 of the 2010 Asus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211

|

|

151

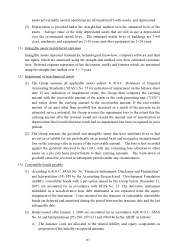

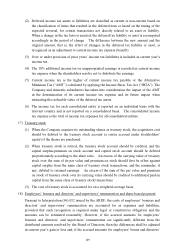

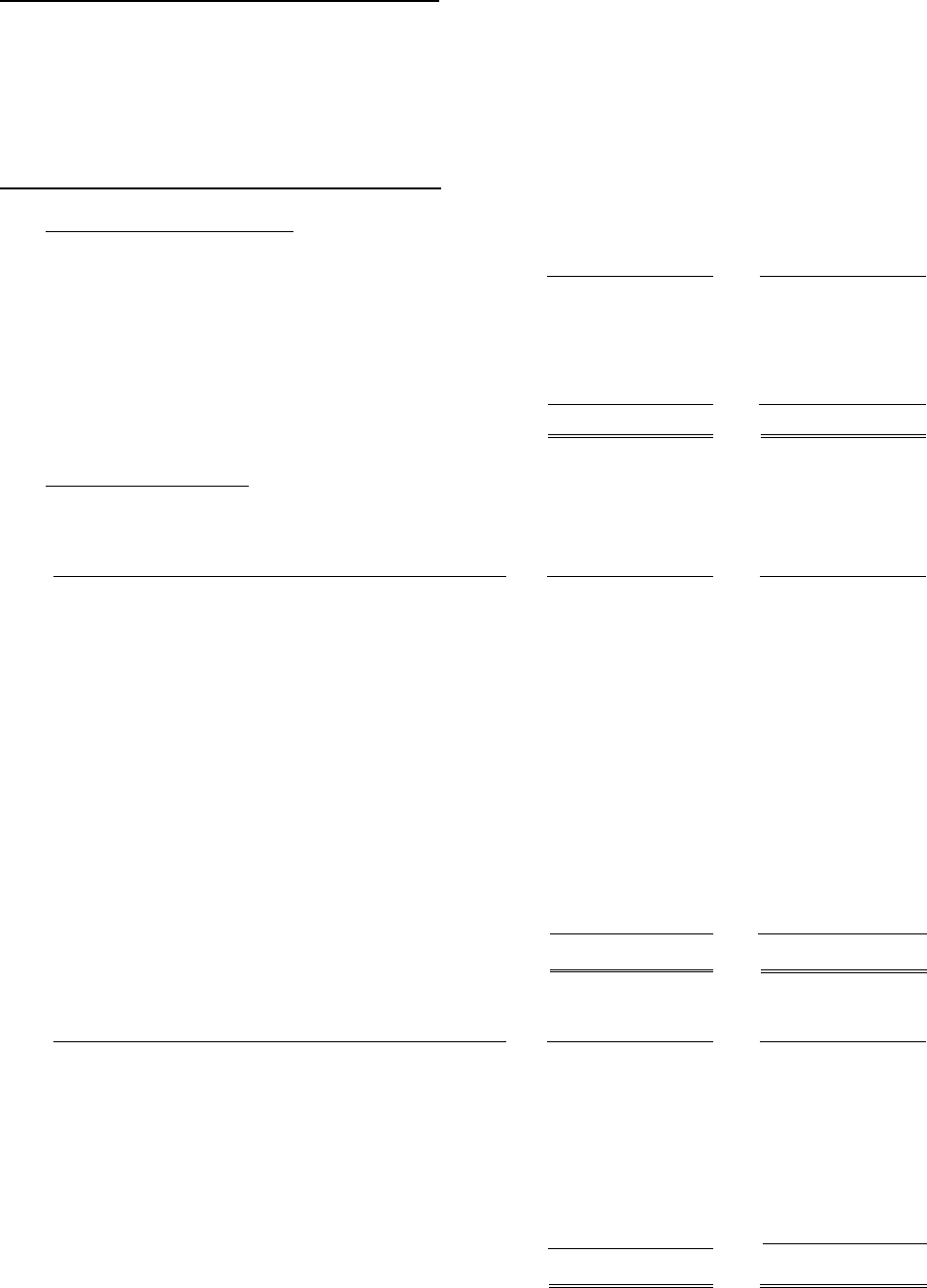

3. CHANGE IN ACCOUNTING PRINCIPLE

Effective January 1, 2009, the Group measured its inventories in accordance with the

amendments o f R . O . C SFAS No. 10, “Inventories”. Accordingly, net income decreased by

$1,053,208 and basic earnings per share decreased by $0.25 (in dollars) for the year ended

December 31, 2009.

4. DETAILS OF SIGNIFICANT ACCOUNTS

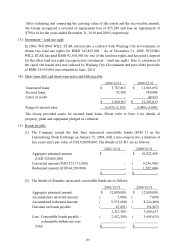

1) Cash and cash equivalents

2010/12/31 2009/12/31

Petty cash and cash on hand $ 10,809 $ 49,634

Checking and demand deposits 4,440,096 23,694,059

Time deposits 37,295,574 42,509,501

Cash equivalents 61 8

$ 41,746,540 $ 66,253,202

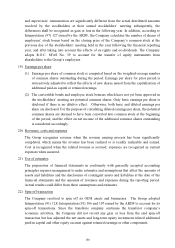

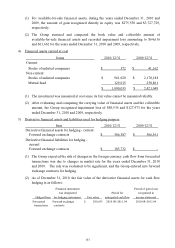

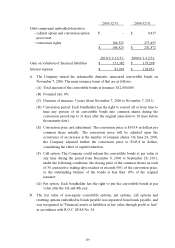

2) Financial instruments

The financial instruments held by the Group are as follows:

Items 2010/12/31 2009/12/31

Current:

Financial assets measured at fair value through

profit or loss - current:

Open-end funds $ 9,822,275 $ 20,280,774

Corporate bonds 111,700 498,145

Forward exchange contracts 18,792 292,416

Repurchase bonds - 301,863

Stocks of listed companies 675,311 261,496

Depositary receipts - 10,389

Currency swap contracts 6,352 12,112

Currency option contracts 6,776 -

$ 10,641,206 $ 21,657,195

Items 2010/12/31 2009/12/31

Financial liabilities measured at fair value

through profit or loss:

Currency option contracts $ 3,582 $ -

Forward exchange contracts 155,597 724

Call/put options and conversion right -

convertible bonds

104,525 282,872

$ 263,704 $ 283,596

(1) For the years ended December 31, 2010 and 2009, the Group recognized net financial

assets gain on valuation of $1,372,218 and $1,339,020, respectively, and net financial

liabilities (loss) gain on valuation of ($324,249) and $192,867, respectively.