Xerox 2002 Annual Report Download - page 96

Download and view the complete annual report

Please find page 96 of the 2002 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

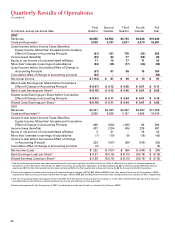

Quarterly Results of Operations

(Unaudited)

First Second Third Fourth Full

In millions, except per-share data Quarter Quarter Quarter Quarter Year

2002(1)

Revenues $3,858 $3,952 $3,793 $4,246 $15,849

Costs and Expenses(2) 3,919 3,791 3,617 4,270 15,597

(Loss) Income before Income Taxes (Benefits),

Equity Income, Minorities’ Interests and Cumulative

Effect of Change in Accounting Principle (61) 161 176 (24) 252

Income taxes (benefits) (23) 64 77 (58) 60

Equity in net income of unconsolidated affiliates 11 15 17 11 54

Minorities’ interests in earnings of subsidiaries (24) (25) (17) (26) (92)

(Loss) Income before Cumulative Effect of Change in

Accounting Principle (51) 87 99 19 154

Cumulative effect of change in accounting principle (63) – – – (63)

Net (Loss) Income $ (114) $ 87 $ 99 $ 19 $ 91

Basic (Loss) Earnings per Share before Cumulative

Effect of Change in Accounting Principle $ (0.07) $ 0.12 $ 0.05 $ 0.01 $ 0.11

Basic (Loss) Earnings per Share(3) $ (0.16) $ 0.12 $ 0.05 $ 0.01 $ 0.02

Diluted (Loss) Earnings per Share before Cumulative

Effect of Change in Accounting Principle $ (0.07) $ 0.11 $ 0.04 $ 0.01 $ 0.10

Diluted (Loss) Earnings per Share(3) $ (0.16) $ 0.11 $ 0.04 $ 0.01 $ 0.02

2001

Revenues $4,291 $4,283 $4,052 $4,382 $17,008

Costs and Expenses(2)(4) 3,626 4,535 4,157 4,296 16,614

Income (Loss) before Income Taxes (Benefits),

Equity Income, Minorities’ Interests and Cumulative

Effect of Change in Accounting Principle 665 (252) (105) 86 394

Income taxes (benefits) 437 (124) (45) 229 497

Equity in net income of unconsolidated affiliates 3 31 – 19 53

Minorities’ interests in earnings of subsidiaries (7) (10) (9) (16) (42)

Income (Loss) before Cumulative Effect of Change

in Accounting Principle 224 (107) (69) (140) (92)

Cumulative effect of change in accounting principle (2) – – – (2)

Net Income (Loss) $ 222 $ (107) $ (69) $ (140) $ (94)

Basic Earnings (Loss) per Share(3) $ 0.31 $ (0.15) $ (0.10) $ (0.19) $ (0.15)

Diluted Earnings (Loss) per Share(3) $ 0.28 $ (0.15) $ (0.10) $ (0.19) $ (0.15)

1 The amounts reported above have been revised from the amounts originally included in the Form 10-Qs to reflect the correction of interest expense as

reported in a Form 8-K filed on December 20, 2002. The pre-tax amounts were adjusted to increase expenses by $8 for the first quarter, $9 for the second

quarter and $10 for the third quarter and increase net loss by $5 for the first quarter and reduce net income by $6 for the second and third quarters.

2 Costs and expenses included restructuring and asset impairment charges of $146, $53, $63 and $408 for the first, second, third and fourth quarters of 2002,

respectively. Restructuring and asset impairment charges of $129, $295, $63 and $228 were incurred in the corresponding four quarters of 2001, respectively.

3 The sum of quarterly (loss) earnings per share may differ from the full-year amounts due to rounding, or in the case of diluted earnings per share, because

securities that are anti-dilutive in certain quarters may not be anti-dilutive on a full-year basis.

4 Costs and expenses for the first quarter of 2001 included gains on the sale of half our interest in Fuji Xerox of $769.

94