Xerox 2002 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2002 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

46

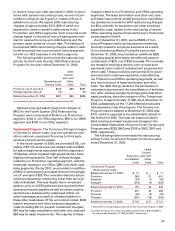

to Other expenses, net of $63 and an increase to

Income taxes of $25, from amounts previously report-

ed, for the year ended December 31, 2001.

Impairment or Disposal of Long-Lived Assets: In 2001,

the FASB issued Statement of Financial Accounting

Standards No. 144, “Accounting for the Impairment

or Disposal of Long-Lived Assets” (“SFAS No. 144”).

SFAS No. 144 retains the previously existing account-

ing requirements related to the recognition and meas-

urement of the impairment of long-lived assets to be

held and used, while expanding the measurement

requirements of long-lived assets to be disposed of

by sale to include discontinued operations. It also

expands on the previously existing reporting require-

ments for discontinued operations to include a

component of an entity that either has been disposed

of or is classified as held for sale. We adopted SFAS

No. 144 on January 1, 2002. The adoption of this stan-

dard did not have a material effect on our financial

position or results of operations.

Asset Retirement Obligations: In 2001, the FASB

issued Statement of Financial Accounting Standards

No. 143, “Accounting for Asset Retirement

Obligations” (“SFAS No. 143”). This statement

addresses financial accounting and reporting for obli-

gations associated with the retirement of tangible

long-lived assets and associated asset retirement

costs. We will adopt SFAS No. 143 on January 1, 2003

and do not expect this standard to have any effect on

our financial position or results of operations.

Business Combinations: In 2001, the FASB issued

Statement of Financial Accounting Standards No. 141,

“Business Combinations” (“SFAS No. 141”), which

requires the use of the purchase method of account-

ing for business combinations and prohibits the use

of the pooling of interests method. We have not his-

torically engaged in transactions that qualify for the

use of the pooling of interests method and therefore,

this aspect of the new standard will not have an

impact on our financial results. SFAS No. 141 also

changes the definition of intangible assets acquired in

a purchase business combination, providing specific

criteria for the initial recognition and measurement of

intangible assets apart from goodwill. As a result, the

purchase price allocation of future business combina-

tions may be different than the allocation that would

have resulted under the previous rules. SFAS No. 141

also requires that upon adoption of Statement of

Financial Accounting Standards No. 142 “Goodwill

and Other Intangible Assets” (“SFAS No. 142”), we

reclassify the carrying amounts of certain intangible

assets into or out of goodwill, based on certain crite-

ria. Upon adoption of SFAS No. 142, we reclassified

$61 of intangible assets related to acquired workforce

to goodwill that was required by this standard.

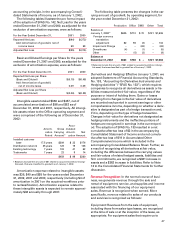

Goodwill and Other Intangible Assets: Goodwill repre-

sents the cost of acquired businesses in excess of the

fair value of identifiable tangible and intangible net

assets purchased, and prior to 2002 was amortized on

a straight-line basis over periods ranging from 5 to 40

years. Other intangible assets represent the fair value

of identifiable intangible assets acquired in purchase

business combinations and include an acquired cus-

tomer base, distribution network, technology and

trademarks. Intangible assets are amortized on a

straight-line basis over periods ranging from 7 to 25

years. We adopted SFAS No. 142 on January 1, 2002

and as a result, goodwill is no longer amortized.

SFAS No. 142 addresses financial accounting and

reporting for acquired goodwill and other intangible

assets subsequent to their initial recognition. This

statement recognizes that goodwill has an indefinite

life and will no longer be subject to periodic amortiza-

tion. However, goodwill is to be tested at least annual-

ly for impairment, using a fair value methodology, in

lieu of amortization. The provisions of this standard

also required that amortization of goodwill related to

equity investments be discontinued, and that these

goodwill amounts continue to be evaluated for

impairment in accordance with Accounting Principles

Board Opinion No. 18 “The Equity Method of

Accounting for Investments in Common Stock.”

SFAS No. 142 also requires performance of annual

and transitional impairment tests on goodwill using a

two-step approach. The first step is to identify a poten-

tial impairment and the second step is to measure the

amount of any impairment loss. The first step requires

a comparison of the carrying value of reporting units,

as defined, to the fair value of these units. The

standard requires that if a reporting unit’s fair value is

below its carrying value, a potential goodwill impair-

ment exists and we would be required to complete the

second step of the transitional impairment test to

quantify the amount of the potential goodwill impair-

ment charge. Based on the results of the first step

of the transitional impairment test, we identified

potential goodwill impairments in the reporting units

included in our Developing Markets Operations

(“DMO”) operating segment. We subsequently com-

pleted the second step of the transitional goodwill

impairment test, which required us to estimate the

implied fair value of goodwill for each DMO reporting

unit by allocating the fair value of each reporting unit

to all of the reporting unit’s assets and liabilities. The

fair value of the reporting units giving rise to the tran-

sitional impairment loss was estimated using the

present value of future expected cash flows. Because

the carrying amount of each reporting unit’s assets

and liabilities (excluding goodwill) exceeded the fair

value of each reporting unit, we recorded a goodwill

impairment charge of $63. This non-cash charge

was recorded as a cumulative effect of change in