Xerox 2002 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2002 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

67

We could be required to repay portions of the loans

earlier than their scheduled maturities with specified

percentages of any proceeds we receive from capital

market debt issuances, equity issuances or asset sales

during the term of the New Credit Facility, except that

the revolving loan commitment cannot be reduced

below $1 billion as a result of such prepayments.

Additionally, all loans under the New Credit Facility

become due and payable upon the occurrence of a

change in control.

The New Credit Facility loans bear interest at LIBOR

plus 4.50 percent, except that a $500 term-loan tranche

bears interest at LIBOR plus a spread that varies

between 4.00 percent and 4.50 percent, depending on

the amount secured.

In connection with the New Credit Facility we

incurred fees and other expenses of $120 which have

been capitalized and are being amortized over its term

on a basis consistent with the scheduled repayments

in relation to the total amount of the loan facility.

Subject to certain limits, all obligations under the

New Credit Facility are currently secured by liens on

substantially all domestic assets of Xerox Corporation

and substantially all our U.S. subsidiaries (other than

Xerox Credit Corporation) and are guaranteed by sub-

stantially all our U.S. subsidiaries. In addition, revolv-

ing loans outstanding from time to time to Xerox

Capital (Europe) plc (XCE) (none at December 31,

2002) are also secured by all XCE’s assets and are

guaranteed on an unsecured basis by certain foreign

subsidiaries that directly or indirectly own all the out-

standing stock of XCE. Revolving loans outstanding

from time to time to Xerox Canada Capital Limited

(XCCL) ($50 at December 31, 2002) are secured by all

XCCL’s assets and are guaranteed on an unsecured

basis by our material Canadian subsidiaries, as

defined.

The New Credit Facility contains affirmative and

negative covenants which are more fully discussed in

Note 1.

At December 31, 2002, we are in compliance with

all aspects of the New Credit Facility including finan-

cial covenants and expect to be in compliance for at

least the next twelve months. Failure to be in compli-

ance with any material provision or covenant of the

New Credit Facility could have a material adverse

effect on our liquidity and operations.

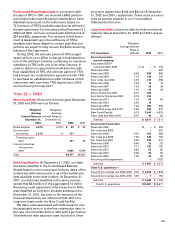

We are required to make scheduled amortization

payments of $202.5 on each of March 31, 2003 and

September 30, 2003, and $302.5 on each of March 31,

2004 and September 30, 2004. In addition, mandatory

prepayments are required from a portion of any pro-

ceeds we receive from certain asset transfers or debt

or equity issuances, as those terms are defined in the

New Credit Facility. Any such prepayments would be

credited toward the scheduled amortization payments

in direct order of maturity.

Senior Notes: In January 2002, we completed an

unregistered offering in the U.S. ($600) and Europe

(225) of 9.75 percent senior notes due in 2009

(“Senior Notes”) and received net cash proceeds of

$746, which included $559 and 209. The senior notes

were issued at a 4.833 percent discount and pay inter-

est semiannually on January 15 and July 15. In March

2002, we filed a registration statement to exchange

senior registered notes for these unregistered senior

notes. This registration statement has not yet been

declared effective. The terms of the debt include

increases in the interest rate to the extent the registra-

tion is delayed. Such increases will be up to 0.50 per-

cent and will be effective until the registration

effectiveness is complete. As of January 17, 2003, the

interest rate increased to 10.0 percent. Fees of $16

incurred in connection with this offering have been

capitalized as debt issue costs and are being

amortized over the term of the notes. These Senior

Notes are guaranteed by certain of our U.S.

subsidiaries and contain several affirmative and nega-

tive covenants similar to those in the New Credit

Facility, but taken as a whole are less restrictive than

those in the New Credit Facility. We were in compli-

ance with these covenants at December 31, 2002.

Guarantees: At December 31, 2002, we have guaran-

teed $1.9 billion of indebtedness of our foreign

wholly-owned subsidiaries. This debt is included in

our Consolidated Balance Sheet as of such date.

Interest: Interest paid by us on our short- and long-

term debt amounted to $772, $1,074, and $1,050 for

the years ended December 31, 2002, 2001 and 2000,

respectively.

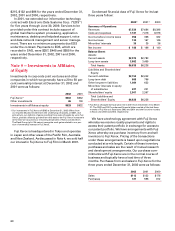

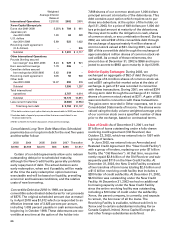

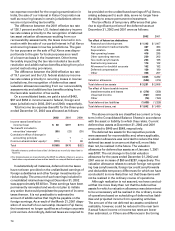

Interest expense and interest income consisted of:

Year Ended December 31, 2002 2001 2000

Interest expense(1) $ 751 $ 937 $ 1,090

Interest income(2) (1,077) (1,230) (1,239)

1 Includes Equipment financing interest, as well as non-financing interest

expense that is included in Other expenses, net in the Consolidated

Statements of Income.

2 Includes Finance income, as well as other interest income that is included in

Other expenses, net in the Consolidated Statements of Income.

Equipment financing interest is determined based

on a combination of actual interest expense incurred

on financing debt, as well as our estimated cost of

funds, applied against the estimated level of debt

required to support our financed receivables. The

estimate is based on an assumed ratio of debt as com-

pared to our finance receivables. This ratio ranges

from 80-90 percent of our average finance receivables.

This methodology has been consistently applied for

all periods presented.