Xerox 2002 Annual Report Download - page 21

Download and view the complete annual report

Please find page 21 of the 2002 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

19

Finance income is primarily impacted by equipment

lease originations and interest rates. The most signifi-

cant factor is the level of equipment lease originations;

accordingly, we expect that Finance income will decline

in 2003, reflecting lower equipment lease originations

in recent years. In addition, Finance income will be

reduced to the extent we sell portions of our financing

businesses, similar to the Nordic countries and Italy, or

enter into agreements with third-parties to provide

financing directly to our customers. Since the vast

majority of our third-party financing arrangements

have been structured as secured borrowings, the lease

receivables remain on our balance sheet and are

expected to continue generating Finance income. As a

result of the above factors, we expect the trend of the

decreasing Finance income to stabilize, although peri-

odic fluctuations will occur as a result of the level of

equipment sales and interest rates.

We expect equipment sales to grow modestly in

2003, as our 2002 and planned 2003 product launches

should enable us to strengthen our market position. Our

ability to increase post sale revenue is dependent on

our success increasing the amount of our equipment at

customer locations and the volume of pages generated

on that equipment. In 2003, we expect post sale and

other revenue declines will continue to moderate as

equipment sales increase and our services and solu-

tions increase utilization of the equipment. Accordingly,

we expect a modest total revenue decline in 2003.

Employee Stock Ownership Plan: As more fully

discussed in Note 16 to the Consolidated Financial

Statements, our Board of Directors reinstated the

dividend on our Employee Stock Ownership Plan

(“ESOP”) in 2002, which resulted in a reversal of com-

pensation expense previously recorded. The reversal

of compensation expense corresponded to the line

item in the Consolidated Statement of Income for

2002 where the charge was originally recorded and

included $28 million in both Cost of Sales and Selling,

administrative and general expenses and $11 million

in Research and Development expenses. Of the total

compensation expense originally recorded, $34 million

and $33 million was recognized in 2002 and 2001,

respectively. As such, 2002 benefited by $33 million

of excess compensation expense reversal that was

recorded in 2001. There is no corresponding earnings

per share improvement in 2002, since the EPS calcula-

tion requires deduction of dividends declared from

reported net income in arriving at net income avail-

able to common shareholders. In the fourth quarter

2002, an additional $11 million of dividends were

declared.

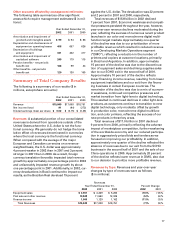

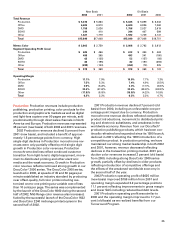

Gross Margin: Gross margin by revenue classification

was as follows:

Year Ended December 31,

2002 2001 2000

Total gross margin 42.4% 38.2% 37.4%

Sales 37.8% 30.5% 31.2%

Service, outsourcing

and rentals 44.0% 42.2% 41.1%

Finance income 59.9% 59.5% 57.1%

The 2002 gross margin of 42.4 percent improved

4.2 percentage points from 2001. 1.4 percentage

points of the increase reflects our second half 2001

SOHO exit. Improved manufacturing and service pro-

ductivity, which was more than offset by lower prices,

accounted for approximately one percentage point of

improvement and higher margins in our DMO operat-

ing segment and also contributed about 0.5 percent-

age point of the improvement. The balance of the

increase includes the favorable ESOP compensation

expense adjustment, favorable transaction currency,

lower inventory charges associated with restructuring

actions and improved document outsourcing margins

associated with our focus on profitable revenue.

2002 Sales gross margin improved by 7.3 percent-

age points from 2001. Approximately 2.6 percentage

points of the improvement was due to our SOHO exit,

about 1.3 percentage points of the improvement was

due to increases in DMO, 0.6 percentage point was

due to lower inventory charges associated with

restructuring actions and the balance was largely due

to manufacturing productivity, which was more than

offset by competitive price pressures. 2002 Service,

outsourcing and rentals margins improved by 1.8 per-

centage points from 2001 reflecting the benefits of

expense productivity actions and more profitable doc-

ument outsourcing contracts.

The 2001 gross margin of 38.2 percent increased

0.8 percentage point from 2000, as improved manu-

facturing and service productivity more than offset

unfavorable mix and competitive price pressures, par-

ticularly in the production monochrome area. 2001

Sales gross margin declined by 0.7 percentage points

due to higher manufacturing expenses resulting from

lower volume and plant utilization as well as a lower

level of high margin licensing and software revenues.

These improvements were partially offset by increased

margins in our printer business. 2001 Service, out-

sourcing and rentals margin improved by 1.1 percent-

age points due primarily to service expense reductions

and facilities maintenance gross margin improve-

ments, partially offset by declines in DMO.