Xerox 2002 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2002 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

43

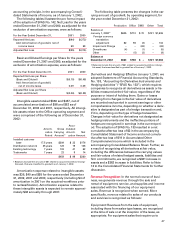

tions to land, buildings and equipment,” plus any

capital lease obligations incurred;

• Minimum consolidated net worth ranging from

$2.9 billion to $3.1 billion; for this purpose, “consoli-

dated net worth” generally means the sum of the

amounts included on our balance sheet as

“Common shareholders’ equity,” “Preferred stock,”

“Company-obligated, mandatorily redeemable pre-

ferred securities of subsidiary trust holding solely

subordinated debentures of the Company,” except

that the currency translation adjustment effects and

the effects of compliance with Statement of Financial

Accounting Standards No. 133, “Accounting for

Derivatives and Hedging” (“SFAS No.133”) occur-

ring after December 31, 2001 are disregarded, the

preferred securities (whether or not convertible)

issued by us or by our subsidiaries which were out-

standing on June 21, 2002 will always be included,

and any capital stock or similar equity interest issued

after June 21, 2002 which matures or generally

becomes mandatorily redeemable for cash or put-

table at holders’ option prior to November 1, 2005 is

always excluded; and

• Limitations on: (i) issuance of debt and preferred

stock; (ii) creation of liens; (iii) certain fundamental

changes to corporate structure and nature of busi-

ness, including mergers; (iv) investments and acqui-

sitions; (v) asset transfers; (vi) hedging transactions

other than those in the ordinary course of business

and certain types of synthetic equity or debt deriva-

tives, and (vii) certain types of restricted payments

relating to our, or our subsidiaries’, equity interests,

including payment of cash dividends on our

common stock; (viii) certain types of early retirement

of debt, and (ix) certain transactions with affiliates,

including intercompany loans and asset transfers.

The New Credit Facility generally does not affect

our ability to continue to monetize receivables under

the agreements with General Electric (“GE”) and oth-

ers. Although we cannot pay cash dividends on our

common stock during the term of the New Credit

Facility, we can pay cash dividends on our preferred

stock, provided there is then no event of default. In

addition to other defaults customary for facilities of

this type, defaults on other debt, or bankruptcy, of

Xerox Corporation, or certain of our subsidiaries,

would constitute defaults under the New Credit

Facility.

At December 31, 2002, we are in compliance with

all aspects of the New Credit Facility including finan-

cial covenants and expect to be in compliance for at

least the next twelve months. Failure to be in compli-

ance with any material provision or covenant of the

New Credit Facility could have a material adverse

effect on our liquidity and operations.

The New Credit Facility generally does not affect

our ability to continue to securitize receivables under

the agreements we have with GE and others, as

discussed further in Note 5. Although we cannot pay

cash dividends on our common stock during the term

of the New Credit Facility, we can pay cash dividends

on our preferred stock, provided there is then no event

of default. In addition to other defaults customary for

facilities of this type, defaults on our other debt, or

bankruptcy, or certain of our subsidiaries, would consti-

tute defaults under the New Credit Facility.

At December 31, 2002, we are in compliance with

all aspects of the New Credit Facility including finan-

cial covenants and expect to be in compliance for at

least the next twelve months. Failure to be in compli-

ance with any material provision or covenant of the

New Credit Facility could have a material adverse

effect on our liquidity and operations.

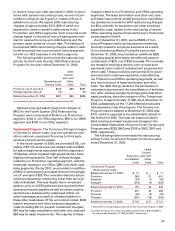

With $2.9 billion of cash and cash equivalents on

hand at December 31, 2002, we believe our liquidity

(including operating and other cash flows we expect

to generate) will be sufficient to meet operating cash

flow requirements as they occur and to satisfy all

scheduled debt maturities for at least the next twelve

months. Our ability to maintain sufficient liquidity

going forward is highly dependent on achieving

expected operating results, including capturing the

benefits from restructuring activities, and completing

announced finance receivables securitizations. There

is no assurance that these initiatives will be success-

ful. Failure to successfully complete these initiatives

could have a material adverse effect on our liquidity

and our operations, and could require us to consider

further measures, including deferring planned capital

expenditures, reducing discretionary spending, sell-

ing additional assets and, if necessary, restructuring

existing debt.

We also expect that our ability to fully access com-

mercial paper and other unsecured public debt mar-

kets will depend upon improvements in our credit

ratings, which in turn depend on our ability to demon-

strate sustained profitability growth and operating

cash generation and continued progress on our ven-

dor financing initiatives. Until such time, we expect

some bank credit lines to continue to be unavailable,

and we intend to access other segments of the capital

markets as business conditions allow, which could

provide significant sources of additional funds until

full access to the unsecured public debt markets is

restored.

Basis of Consolidation: The consolidated financial

statements include the accounts of Xerox Corporation

and all of our controlled subsidiary companies. All

significant intercompany accounts and transactions

have been eliminated. Investments in business enti-

ties in which we do not have control, but we have the

ability to exercise significant influence over operating

and financial policies (generally 20 to 50 percent own-

ership), are accounted for using the equity method of