Xerox 2002 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2002 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

37

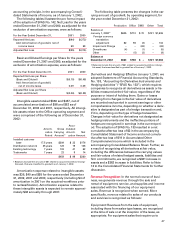

Interest Rate Risk Management: Virtually all cus-

tomer-financing assets earn fixed rates of interest,

while a significant portion of our debt bears interest at

variable rates. Historically we have attempted to man-

age our interest rate risk by “match-funding” the

financing assets and related debt, including through

the use of interest rate swap agreements. However, as

our credit ratings declined, our ability to continue this

practice became constrained.

At December 31, 2002, we had $7 billion of variable

rate debt, including the $3.5 billion outstanding under

the New Credit Facility and the notional value of our

pay-variable interest-rate swaps. The notional value

of our offsetting pay-fixed interest-rate swaps was

$1.2 billion.

Our loans related to vendor financing, from parties

including GE, are secured by customer-financing

assets and are designed to mature ratably with our

collection of principal payments on the financing

assets which secure them. The interest rates on those

loans are fixed. As a result, the vendor financing loan

programs create natural match-funding of the financ-

ing assets to the related debt. As we implement addi-

tional finance receivable securitizations and continue

to repay existing debt, the portion of our financing

assets which is match-funded against related secured

debt will increase. On a consolidated basis, including

the impact of our hedging activities, weighted-aver-

age interest rates for 2002, 2001 and 2000 approximat-

ed 5.0 percent, 5.5 percent and 6.2 percent,

respectively.

Many of the financial instruments we use are sensi-

tive to changes in interest rates. Interest rate changes

result in fair value gains or losses on our term debt

and interest rate swaps, due to differences between

current market interest rates and the stated interest

rates within the instrument. The loss in fair value at

December 31, 2002, from a 10 percent change in mar-

ket interest rates would be approximately $201 mil-

lion for our interest rate sensitive financial

instruments. Our currency and interest rate hedging

are typically unaffected by changes in market condi-

tions as forward contracts, options and swaps are

normally held to maturity consistent with our objec-

tive to lock in currency rates and interest rate spreads

on the underlying transactions.

We anticipate continued volatility in our results of

operations due to market changes in interest rates

and foreign currency rates which we are currently

unable to hedge.

Forward-Looking Cautionary

Statements:

This Annual Report contains forward-looking state-

ments and information relating to Xerox that are

based on our beliefs, as well as assumptions made by

and information currently available to us. The words

“anticipate,” “believe,” “estimate,” “expect,”

“intend,” “will” and similar expressions, as they

relate to us, are intended to identify forward-looking

statements. Actual results could differ materially from

those projected in such forward-looking statements.

Information concerning certain factors that could

cause actual results to differ materially is included in

our 2002 Annual Report on Form 10-K filed with the

SEC. We do not intend to update these forward-

looking statements.