Xerox 2002 Annual Report Download - page 20

Download and view the complete annual report

Please find page 20 of the 2002 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

18

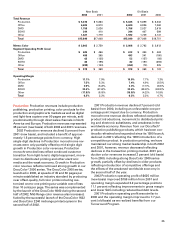

A reconciliation of the above presentation of

revenues to the revenue classifications included in

our Consolidated Statements of Income is as follows

($ in millions):

Year Ended December 31,

2002 2001 2000

Sales $ 6,752 $ 7,443 $ 8,839

Less: Supplies, paper and

other sales (2,851) (3,114) (3,575)

Equipment Sales $ 3,901 $ 4,329 $ 5,264

Service, outsourcing and rentals $ 8,097 $ 8,436 $ 8,750

Add: Supplies, paper and

other sales 2,851 3,114 3,575

Post sale and other revenue $10,948 $11,550 $12,325

2002 Equipment sales of $3.9 billion declined 10 per-

cent from $4.3 billion in 2001 and included a benefit of

one percentage point from currency. Year-over-year

equipment sales declines moderated throughout

2002, reflecting the success of our 2002 product

launches in the key areas of monochrome digital mul-

tifunction, as well as in Production and Office color.

Approximately 35 percent of the decline was due to a

decrease in light-lens equipment sales due to cus-

tomers that transitioned to digital technology. Less

than 5 percent of our 2002 Equipment sales were for

light-lens devices and we expect this declining trend

to continue. Approximately 30 percent of the

Equipment sales decline was due to our exit from the

SOHO segment in 2001 and the remainder of the

decline was caused by a combination of the weak

economy, marketplace competition and price pres-

sures which approximated 5 to 10 percent and our

decision to reduce participation in aggressively priced

bids and tenders in Europe, as we reoriented our

focus from market share to profitable revenue.

2001 Equipment sales of $4.3 billion declined

18 percent from $5.3 billion in 2000 and included an

unfavorable currency impact of one percentage point.

Over one-third of the decline was due to our exit from

the SOHO segment in 2001 and the sale of our China

operations in 2000. Approximately one-quarter of the

decline was due to customers that transitioned from

light lens to digital technology. The balance of the

decline reflected a combination of economic weak-

ness, competitive price pressures which approximat-

ed 5 to 10 percent and our decision to reduce

participation in aggressively priced bids and tenders

in Europe, as we reoriented our focus from market

share to profitable revenue.

Post sale and other revenue consists of service,

supplies, paper, rental, facilities management and

other revenues derived from the equipment installed

at customer locations and the volume of prints and

copies that our customers make on that equipment,

as well as associated services. 2002 Post sale and

other revenue of $10.9 billion, declined 5 percent from

$11.5 billion in 2001, including a favorable impact of

one percentage point from currency. Over half of the

total decline in 2002 Post sale and other revenue was

due to a reduction in the amount of equipment instal-

lations at certain DMO customer locations, as a result

of reduced placements in recent periods and our exit

from the SOHO segment in the second half of 2001.

The balance of the decline included lower page print

volumes and customers that transitioned from light-

lens to digital technology, reflecting weak mono-

chrome equipment installations in the Production and

Office segments which have not yet been offset by

growth in color. Within Post sale and other revenue,

2002 supplies, paper and other sales of $2.9 billion

declined 8 percent from 2001 predominantly due to

supplies declines reflecting our second half 2001

SOHO exit, lower DMO equipment installations and

production and office light-lens declines. Service, out-

sourcing and rental revenue of $8.1 billion declined

4 percent from 2001 predominantly due to lower

rental revenues as the result of a reduction in the level

of equipment installations at certain DMO customers

in both current and prior periods.

2001 Post sale and other revenue of $11.5 billion,

declined 6 percent from $12.3 billion in 2000 and

included the adverse impact from currency translation

of one percentage point. Approximately 40 percent of

the decline occurred in our DMO segment as a result of

reduced equipment installations in that segment and

15 percent was due to the sale of our China operations

in 2000. The remainder of the decline resulted from

decreases in Production monochrome and Office light

lens, and our decision to prioritize more profitable rev-

enue, which were only partially offset by strong dou-

ble-digit growth in color and monochrome digital

multifunction. Within Post sale and other revenue, 2001

supplies, paper and other sales of $3.1 billion declined

13 percent from 2000 due to lower paper sales reflect-

ing reduced volumes and reduced Production, Office

and DMO supplies revenues reflecting the declines dis-

cussed above. Service, outsourcing and rental revenue

of $8.4 billion were 4 percent lower than 2000 as lower

service and rental revenues were only partially offset

by document outsourcing growth.

2002 Finance income revenue declined 11 percent

from 2001, reflecting lower 2002 equipment sales, our

full exit from the financing business in the Nordic coun-

tries and in Italy, as well as our partial exit of this busi-

ness in The Netherlands and Germany. 2001 Finance

income revenue declined 3 percent from 2000, reflect-

ing lower equipment sales and the initial effects of our

transition to a third-party finance provider in the Nordic

countries.