Xerox 2002 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2002 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

35

over the next five years (in millions): 2003 – $331;

2004 – $320; 2005 – $311; 2006 – $299; 2007 – $288.

The estimated payments are the result of an EDS and

Xerox Global Demand Case process that has been in

place for eight years. Twice a year, using this estimat-

ing process based on historical activity, the parties

agree on a projected volume of services to be provid-

ed under each major element of the contract. Pricing

for the base services (which are comprised of global

mainframe system processing, application mainte-

nance and enhancements, desktop services and help

desk support, voice and data management) were

established when the contract was signed in 1994

based on our actual costs in preceding years. The

pricing was modified through comparisons to indus-

try benchmarks and through negotiations in subse-

quent amendments. Prices and services for the period

July 1, 2004 through June 30, 2009 are currently being

negotiated and should be finalized by December 31,

2003. As such, the amounts above are subject to

change. We can terminate the contract with six

months notice, as defined in the contract, with no ter-

mination fee. We have an option to purchase the

assets placed in service under the EDS contract,

should we elect to terminate such contract and either

operate those assets ourselves or enter a separate

contract with a similar service provider.

Pension and Other Post-Retirement Benefit Plans:

We sponsor pension and other post-retirement bene-

fit plans. As discussed in Note 13 to the Consolidated

Financial Statements, our collective pension plans

were underfunded by $2.0 billion at December 31,

2002. Our post-retirement plan, which is a non-funded

plan, had a benefit obligation of $1.6 billion at

December 31, 2002. Our 2002 cash outlays for these

plans were $138 million for pensions and $102 million

for other post-retirement plans. Our anticipated cash

outlays for 2003 are $170 million for pensions and

$115 million for other post-retirement plans.

Other Funding Arrangements:

Special Purpose Entities: From time to time, we have

generated liquidity by selling or securitizing portions

of our finance and accounts receivable portfolios. We

have typically utilized qualified special-purpose enti-

ties (“SPEs”) in order to implement these transactions

in a manner that isolates, for the benefit of the securi-

tization investors, the securitized receivables from our

other assets which would otherwise be available to

our creditors. These transactions are typically credit-

enhanced through over-collateralization. Such use of

SPEs is standard industry practice, is typically

required by securitization investors and makes the

securitizations easier to market. None of our officers,

directors or employees or those of any of our sub-

sidiaries or affiliates hold any direct or indirect owner-

ship interests in, or derive personal benefits from, any

of these SPEs. We typically act as service agent and

collect the securitized receivables on behalf of the

securitization investors. Under certain circumstances,

we can be terminated as servicing agent, in which

event the SPEs may engage another servicing agent

and we would cease to receive a servicing fee,

although no such circumstances have occurred to

date. We are not liable for non-collection of securi-

tized receivables, or otherwise required to make pay-

ments to the SPEs except to the limited extent that the

securitized receivables did not meet specified eligibili-

ty criteria at the time we sold the receivables to the

SPEs or we fail to observe agreed upon credit and col-

lection policies and procedures.

Substantially all of our SPE transactions were

accounted for as borrowings, with the debt and relat-

ed assets remaining on our balance sheets.

Specifically, in addition to the U.S. and Canadian

loans from GE and the ML loan in France discussed

above, which utilized SPEs as part of their structures,

we have entered into the following similar transactions:

• In 2000 through 2002, Xerox Corporation and

Xerox Canada Limited (“XCL”) operated securitiza-

tion facilities that engaged in continuous sales of

certain accounts receivable in the U.S. and Canada.

The facility allowed up to $315 million and $38 mil-

lion, respectively, of receivables to be outstanding

to investors in the facility. As these receivables

were collected, new receivables were purchased. In

May 2002, a Moody’s downgrade constituted an

event of termination under the U.S. agreement,

which we allowed to terminate in October 2002. In

February 2002, a downgrade of our Canadian debt

by Dominion Bond Rating Service caused the event

of termination, in turn causing the remaining

Canadian facility to no longer purchase receivables,

with collections used to repay previously repur-

chased receivables. This facility was fully repaid in

2002.

• In 1999, XCL securitized certain finance receivables,

generating gross proceeds of $345 million. At

December 31, 2002, approximately $30 million was

outstanding.

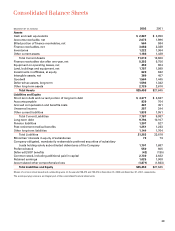

In summary, at December 31, 2002, amounts owed

by these receivable-related SPEs to their investors

totaled $3,195 million, $3,165 million of which is

reported as debt in our Consolidated Balance Sheet. A

detailed description of these transactions is included