Xerox 2002 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2002 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

42

Note 1 — Summary of Significant

Accounting Policies

References herein to “we,” “us” or “our” refer to

Xerox Corporation and its subsidiaries unless the con-

text specifically requires otherwise.

Description of Business and Basis of Presentation: We

are The Document Company®, and a leader in the global

document market, developing, manufacturing, market-

ing, servicing and financing a complete range of docu-

ment equipment, software, solutions and services.

Liquidity, Financial Flexibility and Funding Plans: We

manage our worldwide liquidity using internal cash

management practices, which are subject to (1) the

statutes, regulations and practices of each of the local

jurisdictions in which we operate, (2) the legal

requirements of the agreements to which we are par-

ties and (3) the policies and cooperation of the finan-

cial institutions we utilize to maintain such cash

management practices. In 2000, our operational

issues were exacerbated by significant competitive

and industry changes, adverse economic conditions,

and significant technology and acquisition spending.

Together, these conditions negatively impacted our

liquidity, which from 2000 to 2002 led to a series of

credit rating downgrades, eventually to below invest-

ment grade. Consequently, our access to capital

and derivative markets has been restricted. The down-

grades also required us to cash-collateralize certain

derivative and securitization arrangements to prevent

them from terminating, and to immediately settle ter-

minating derivative contracts. Further, we are required

to maintain minimum cash balances in escrow on

certain borrowings and letters of credit. In addition, as

discussed in Note 15, the Securities and Exchange

Commission (the “SEC”) would not allow us to publicly

register any securities offerings while its investigation,

which commenced in June 2000, was ongoing. This

additional constraint essentially prevented us from

raising funds from sources other than unregistered

capital markets offerings and private lending or equity

sources. Consequently, our credit ratings, which were

already under pressure, came under greater pressure

since credit rating agencies often include access to

capital sources in their rating criteria.

While the conclusion of the SEC investigation in

2002 removed our previous inability to access public

capital markets, we expect our ability to access unse-

cured credit sources to remain restricted as long as

our credit ratings remain below investment grade,

and we expect our incremental cost of borrowing to

increase as a result of such credit ratings.

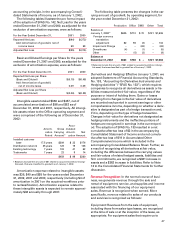

In June 2002, we entered into an Amended and

Restated Credit Agreement (the “New Credit Facility”)

with a group of lenders, replacing our prior $7 billion

facility (the “Old Revolver”). At that time, we perma-

nently repaid $2.8 billion of the Old Revolver and

subsequently paid $710 million on the New Credit

Facility. At December 31, 2002, the New Credit Facility

consisted of two tranches of term loans totaling $2.0

billion and a $1.5 billion revolving credit facility that

includes a $200 letter of credit subfacility. At December

31, 2002, $3.5 billion was outstanding under the New

Credit Facility. At December 31, 2002 we had no addi-

tional borrowing capacity under the New Credit Facility

since the entire revolving facility was outstanding,

including a $10 letter of credit under the subfacility.

The New Credit Facility contains affirmative and

negative covenants. The New Credit Facility contains

financial covenants that the Old Revolver did not con-

tain. Certain of the more significant covenants under

the New Credit Facility are summarized below (this

summary is not complete and is in all respects subject

to the actual provisions of the New Credit Facility):

• Excess cash of certain foreign subsidiaries and of

Xerox Credit Corporation, a wholly-owned

subsidiary, must be transferred to Xerox at the end

of each fiscal quarter; for this purpose, “excess

cash” generally means cash maintained by certain

foreign subsidiaries taken as a whole in excess of

their aggregate working capital and other needs in

the ordinary course of business (net of sources of

funds from third parties), including reasonably antic-

ipated needs for repaying debt and other obligations

and making investments in their businesses. In cer-

tain circumstances, we are not required to transfer

cash to Xerox Corporation, the parent company, if

the transfer cannot be made in a tax efficient manner

or if it would be considered a breach of fiduciary

duty by the directors of the foreign subsidiary;

• Minimum EBITDA (a quarterly test that is based on

rolling four quarters) ranging from $1.0 to $1.3 billion;

for this purpose, “EBITDA” (Earnings before interest,

taxes, depreciation and amortization) generally

means EBITDA (excluding interest and financing

income to the extent included in consolidated net

income), less any amounts spent for software devel-

opment that are capitalized;

• Maximum leverage ratio (a quarterly test that is cal-

culated as total adjusted debt divided by EBITDA)

ranging from 4.3 to 6.0;

• Maximum capital expenditures (annual test) of $330

per fiscal year plus up to $75 of any unused amount

carried over from the previous year; for this purpose,

“capital expenditures” generally mean the amounts

included on our Statement of Cash Flows as “addi-

Notes to the Consolidated Financial Statements

(Dollars in millions, except per-share data and unless otherwise indicated)