Xerox 2002 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2002 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

45

45”). This interpretation expands the disclosure

requirements of guarantee obligations and requires the

guarantor to recognize a liability for the fair value of the

obligation assumed under a guarantee. In general, FIN

45 applies to contracts or indemnification agreements

that contingently require the guarantor to make pay-

ments to the guaranteed party based on changes in an

underlying instrument that is related to an asset, liabili-

ty, or equity security of the guaranteed party. Other

guarantees are subject to the disclosure requirements

of FIN 45 but not to the recognition provisions and

include, among others, a guarantee accounted for as

a derivative instrument under SFAS 133, a parent’s

guarantee of debt owed to a third party by its

subsidiary or vice versa, and a guarantee which is

based on performance. The disclosure requirements of

FIN 45 are effective as of December 31, 2002, and

require information as to the nature of the guarantee,

the maximum potential amount of future payments

that the guarantor could be required to make under the

guarantee, and the current amount of the liability, if

any, for the guarantor’s obligations under the guaran-

tee. The recognition requirements of FIN 45 are to be

applied prospectively to guarantees issued or modified

after December 31, 2002. Significant guarantees that

we have entered are disclosed in Note 15. We do not

expect the requirements of FIN 45 to have a material

impact on our results of operations, financial position

or liquidity.

Stock-Based Compensation: In 2002, the FASB issued

Statement of Financial Accounting Standards No. 148

“Accounting for Stock-Based Compensation -

Transition and Disclosure, an amendment of FASB

Statement No. 123” (“SFAS No. 148”) which provides

alternative methods of transition for an entity that vol-

untarily changes to the fair value based method of

accounting for stock-based employee compensation. It

also amends the disclosure provisions of SFAS No. 123

to require prominent disclosure about the effects on

reported net income of an entity’s accounting policy

decisions with respect to stock-based employee com-

pensation. Finally, this Statement amends APB Opinion

No. 28, “Interim Financial Reporting,” to require disclo-

sure about those effects in interim financial informa-

tion. We adopted SFAS No. 148 in the fourth quarter of

2002. Since we have not changed to a fair value

method of stock-based compensation, the applicable

portion of this statement only affects our disclosures.

We do not recognize compensation expense relat-

ing to employee stock options because we only grant

options with an exercise price equal to the fair value

of the stock on the effective date of grant. If we had

elected to recognize compensation expense using a

fair value approach, and therefore determined the

compensation based on the value as determined by

the modified Black-Scholes option pricing model, the

pro forma net income (loss) and earnings (loss) per

share would have been as follows:

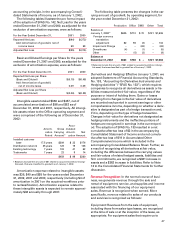

2002 2001 2000

Net income (loss) – as reported $91 $ (94) $ (273)

Deduct: Total stock-based

employee compensation

expense determined under

fair value based method

for all awards, net of tax (83) (93) (112)

Net income (loss) – pro forma $8 $ (187) $ (385)

Basic EPS – as reported $ 0.02 $(0.15) $(0.48)

Basic EPS – pro forma (0.09) (0.28) (0.65)

Diluted EPS – as reported 0.02 (0.15) (0.48)

Diluted EPS – pro forma (0.09) (0.28) (0.65)

As reflected in the pro forma amounts in the previ-

ous table, the fair value of each option granted in

2002, 2001 and 2000 was $6.34, $2.40 and $7.50,

respectively. The fair value of each option was

estimated on the date of grant using the following

weighted average assumptions:

2002 2001 2000

Risk-free interest rate 4.8% 5.1% 6.7%

Expected life in years 6.5 6.5 7.1

Expected price volatility 61.5% 51.4% 37.0%

Expected dividend yield –% 2.7% 3.7%

Costs Associated with Exit or Disposal Activities: In

2002, the FASB issued Statement of Financial

Accounting Standards No. 146, “Accounting for Costs

Associated with Exit or Disposal Activities” (“SFAS No.

146”). This standard requires companies to recognize

costs associated with exit or disposal activities when

they are incurred, rather than at the date of a commit-

ment to an exit or disposal plan. Examples of costs

covered by the standard include lease termination

costs and certain employee severance costs that are

associated with a restructuring, plant closing, or other

exit or disposal activity. SFAS No. 146 is required to be

applied prospectively to exit or disposal activities initi-

ated after December 31, 2002, with earlier application

encouraged. We adopted SFAS No. 146 in the fourth

quarter of 2002. Refer to Note 2 for further discussion.

Gains from Extinguishment of Debt: On April 1, 2002,

we adopted the provisions of Statement of Financial

Accounting Standards No. 145, “Rescission of FASB

Statements No. 4, 44 and 64, Amendment of FASB

Statement No. 13, and Technical Corrections” (“SFAS

No. 145”). The portion of SFAS No. 145 that is applica-

ble to us resulted in the reclassification of extraordi-

nary gains on extinguishment of debt previously

reported in the Consolidated Statements of Income

as extraordinary items to Other expenses, net. The

effect of this reclassification in the accompanying

Consolidated Statements of Income was a decrease