Xerox 2002 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2002 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

64

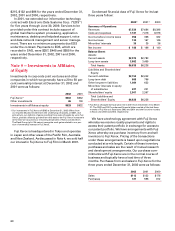

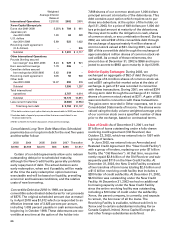

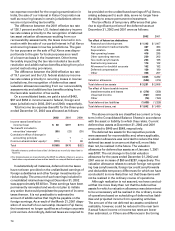

The following is a reconciliation of segment profit

to total company pre-tax income (loss):

Years ended December 31, 2002 2001 2000

Total segment profit $ 978 $ 368 $ 122

Unallocated items:

Restructuring and asset

impairment charges (670) (715) (475)

Gain on early extinguishment

of debt –63 –

Restructuring related inventory

write-down charges (2) (42) (84)

In-process research and

development charges –– (27)

Gains on sales of Fuji Xerox

interest and China operations –773 200

Allocated item:

Equity in net income of

unconsolidated affiliates (54) (53) (103)

Pre-tax income (loss) $ 252 $ 394 $(367)

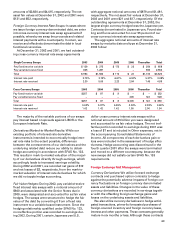

Geographic area data follow:

Revenues Long-Lived Assets(1)

2002 2001 2000 2002 2001 2000

United States $ 9,897 $10,034 $10,706 $1,524 $1,880 $2,423

Europe 4,425 5,039 5,511 718 767 940

Other Areas 1,527 1,935 2,534 379 706 1,052

Total $15,849 $17,008 $18,751 $2,621 $3,353 $4,415

1 Long-lived assets are comprised of (i) Land, buildings and equipment, net, (ii) On lease equipment, net, and (iii) Internal and external-use capitalized software

costs, net.

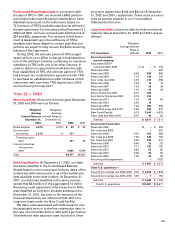

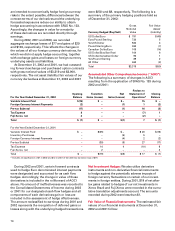

Note 10 — Net Investment in

Discontinued Operations

Our net investment in discontinued operations is

included in the Consolidated Balance Sheets in Other

long-term assets and totaled $728 and $749 at

December 31, 2002 and 2001, respectively. Our net

investment is primarily related to the disengagement

from our former insurance holding company, Talegen

Holdings, Inc. (“Talegen”).

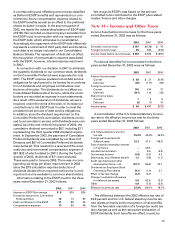

Reinsurance Obligation: Xerox Financial Services, Inc.

(“XFSI”), a wholly-owned subsidiary, continues to

provide aggregate excess of loss reinsurance cover-

age (the “Reinsurance Agreements”) to two of the for-

mer Talegen units, Crum and Forster Inc. (“C&F”) and

The Resolution Group, Inc. (“TRG”) through Ridge

Reinsurance Limited (“Ridge Re”), a wholly-owned

subsidiary of XFSI. The coverage limits for these two

remaining Reinsurance Agreements total $578, which

is exclusive of $234 in C&F coverage that Ridge Re

reinsured during the fourth quarter of 1998.

We, and XFSI, have guaranteed that Ridge Re will

meet all its financial obligations under the two remain-

ing Reinsurance Agreements. Although unlikely, XFSI

may be required, under certain circumstances, to

purchase, over time, additional redeemable preferred

shares of Ridge Re, up to a maximum of $301.

During 2001, we replaced $660 of letters of credit,

which supported Ridge Re ceded reinsurance obliga-

tions, with trusts which included the then existing

Ridge Re investment portfolio of approximately $405

plus $255 in cash. During 2002, Ridge Re repaid $20 of

this cash to us and expects to repay the remaining

$235 during 2003 at the time of the expected novation

of the C&F reinsurance contract to another insurance

company. These trusts are required to provide securi-

ty with respect to aggregate excess of loss

reinsurance obligations under the two remaining

Reinsurance Agreements. At December 31, 2002 and

2001, the balance of the investments in the trusts,

consisting of U.S. government, government agency

and high quality corporate bonds, was $759 and $684,

respectively.

Our remaining net investment in Ridge Re was

$325 and $319 at December 31, 2002 and 2001,

respectively. Based on Ridge Re’s current projections

of investment returns and reinsurance payment obli-

gations, we expect to fully recover our remaining

investment. The projected reinsurance payments are

based on actuarial estimates.