Xerox 2002 Annual Report Download - page 25

Download and view the complete annual report

Please find page 25 of the 2002 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

23

$36 million, a $17 million exchange loss resulting

from the peso devaluation in Argentina and other cur-

rency exchange losses of $25 million. In 2000, large

gains on both the yen and Euro loans contributed to

the $103 million gain. The 2001 and 2000 currency

gains and losses were the result of net unhedged

positions largely caused by our restricted access to

the derivatives markets beginning in the fourth quar-

ter 2000. Despite restoration of hedging capability in

our key markets in the latter half of 2002, we are

unable to predict the amount of the re-measurement

gains or losses in future periods resulting from our

remaining unhedged positions, due to the inherent

volatility in the foreign currency markets. Such gains

or losses could be material to the financial statements

in any future reporting period.

Legal and regulatory matters includes $27 million

of expenses related to certain litigation, indemnifica-

tions and associated claims, as well as the $10 million

penalty incurred in connection with our settlement

with the SEC. See Note 15 to the Consolidated

Financial Statements for additional information.

Prior to 2002, goodwill and other intangible asset

amortization related primarily to our acquisitions of

the remaining minority interest in Xerox Limited in

1995 and 1997, XL Connect in 1998 and Color Printing

and Imaging Division of Tektronix, Inc. in 2000.

Effective January 1, 2002 and in connection with the

adoption of SFAS No. 142, we no longer record amor-

tization of goodwill. Intangible assets continue to be

amortized over their useful lives. Further discussion is

provided in Note 1 to the Consolidated Financial

Statements.

Interest income is derived primarily from our signifi-

cant invested cash balances since the latter part of

2000. 2002 interest income was lower than 2001 due to

lower invested cash balances in the second half of

2002, resulting from the pay-down of the Old Revolver,

as well as lower interest rates. 2001 interest income

was $24 million higher than 2000 due to higher interest

income resulting from a full year of invested cash bal-

ances in 2001, partially offset by lower interest from tax

audit refunds. We expect 2003 interest income to be

lower than 2002 based on projected lower average

cash balances.

In 2002, we retired $52 million of long-term debt

through the exchange of 6.4 million shares of com-

mon stock valued at $51 million. In 2001, we retired

$374 million of long-term debt through the exchange

of 41 million shares of common stock valued at

$311 million. The shares were valued using the daily

volume weighted average price of our common

stock over a specified number of days prior to the

exchange, based on contractual terms. These transac-

tions resulted in gains of $1 million and $63 million

in 2002 and 2001, respectively.

(Gains) losses on business divestitures and asset

sales include the sales of our leasing business in Italy,

our investment in Prudential Insurance Company

common stock and our equity investment in Katun

Corporation all in 2002, the sale of our Nordic leasing

business in 2001 and the sale of our North American

paper product line and a 25 percent interest in

ContentGuard in 2000, as well as miscellaneous land,

buildings and equipment in all years. Further discus-

sion of our divestitures follows and is also contained

in Note 4 to the Consolidated Financial Statements.

Purchased in-process research and development

related to a 2000 acquisition. The charge represented

the fair value of acquired research and development

projects that were determined not to have reached tech-

nological feasibility as of the date of the acquisition.

Gain on Affiliate’s Sale of Stock: In 2001 and 2000,

gain on affiliate’s sale of stock of $4 million and

$21 million, respectively, reflects our proportionate

share of the increase in equity of ScanSoft Inc., result-

ing from issuance of their stock in connection with

one of their acquisitions. The 2000 gain was partially

offset by a $5 million charge reflecting our share of

in-process research and development associated with

one of their acquisitions, which is included in Equity

in net income of unconsolidated affiliates. ScanSoft,

an equity affiliate, is a developer of digital imaging

software that enables users to leverage the power of

their scanners, digital cameras and other electronic

devices.

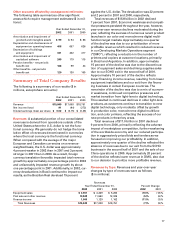

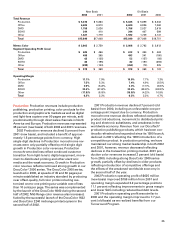

Income Taxes: The following table summarizes our

consolidated income tax (benefits) and the related

effective tax rate for each respective period:

Year Ended December 31,

2002 2001 2000

Pre-tax income (loss) $252 $394 $(367)

Income taxes (benefits) 60 497 (70)

Effective tax rate 23.8% 126.1% 19.1%

The difference between the 2002 consolidated

effective tax rate of 23.8 percent and the U.S. federal

statutory income tax rate of 35 percent relates prima-

rily to the recognition of tax benefits resulting from

the favorable resolution of a foreign tax audit of

approximately $79 million, tax law changes of

approximately $26 million, as well as the impact of

ESOP dividends. Such benefits were offset, in part, by

tax expense recorded for the on-going examination in

India, the sale of our interest in Katun Corporation, as