Xerox 2002 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 2002 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

30

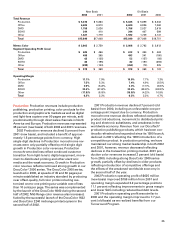

The following table summarizes our secured and

unsecured debt as of December 31, 2002:

New Credit Facility – debt secured within

the 20 percent net worth limitation $ 875(1)

New Credit Facility – debt secured

outside the 20 percent net worth limitation 50

Debt secured by finance receivables 3,900

Capital leases 40

Debt secured by other assets 90

Total Secured Debt 4,955

New Credit Facility – unsecured 2,565(1)

Senior Notes 852

Subordinated debt 575

Other Debt 5,224

Total Unsecured Debt 9,216

Total Debt $14,171

(1) The amount of New Credit Facility debt secured under the 20 percent

consolidated net worth limitation represents an estimate based on

Consolidated Net Worth at December 31, 2002 and the amount of other

debt, as defined, secured under the 20 percent limitation. Any change to

the amount indicated would correspondingly change the amount of the

unsecured portion of the New Credit Facility.

Liquidity, Financial Flexibility and Funding Plans:

We manage our worldwide liquidity using internal

cash management practices, which are subject to (1)

the statutes, regulations and practices of each of the

local jurisdictions in which we operate, (2) the legal

requirements of the agreements to which we are

parties and (3) the policies and cooperation of the

financial institutions we utilize to maintain such cash

management practices. In 2000, our operational

issues were exacerbated by significant competitive

and industry changes, adverse economic conditions,

and significant technology and acquisition spending.

Together, these conditions negatively impacted our

liquidity, which from 2000 to 2002 led to a series of

credit rating downgrades, eventually to below invest-

ment grade. Consequently, our access to capital and

derivative markets has been restricted. The down-

grades also required us to cash-collateralize certain

derivative and securitization arrangements to prevent

them from terminating, and to immediately settle

terminating derivative contracts. Further, we are

required to maintain minimum cash balances in

escrow on certain borrowings and letters of credit. In

addition, the SEC would not allow us to publicly regis-

ter any securities offerings while their investigation,

which commenced in June 2000, was ongoing. This

additional constraint essentially prevented us from

raising funds from sources other than unregistered

capital markets offerings and private lending or equity

sources. Consequently, our credit ratings, which were

already under pressure, came under greater pressure

since credit rating agencies often include access to

capital sources in their rating criteria.

While the 2002 conclusion of the SEC investigation

removed our previous inability to access public capi-

tal markets, we expect our ability to access unsecured

credit sources to remain limited as long as our credit

ratings remain below investment grade, and we

expect our incremental cost of borrowing will remain

relatively high as a result of our credit ratings and

could potentially result in our having to increase our

level of intercompany lending to our affiliates.

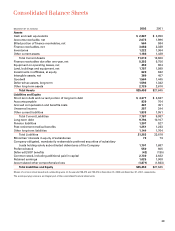

Our current ratings are as follows:

Senior Senior Corporate

Secured Unsecured Credit

Debt Debt Rating Outlook

Moody’s B1 B1 B1 Negative

S&P BB- B+ BB- Negative

Fitch BB- BB- BB- Negative

As a result of the various factors described above, in

2000 we abandoned our historical liquidity practice of

repaying debt with available cash and relying on low

interest commercial paper borrowings. Instead, we

have been accumulating cash in an effort to maintain

financial flexibility. We expect to maintain a minimum

cash balance of at least $1 billion on an ongoing basis.

Financing Business and Restructuring: In 2000, as part

of our Turnaround Program, we announced our intent

to exit the financing business, wherever practical, in

order to reduce our consolidated debt levels and

accelerate the liquidity within our finance receivable

portfolios. We altered our strategy in 2002, announc-

ing plans to securitize our finance receivables, thereby

retaining the customer relationship and financing

income.

Other Turnaround initiatives included selling cer-

tain assets, improving operations, and reducing annu-

al costs by over $1 billion. These initiatives are

expected to significantly improve our liquidity going

forward. We have (1) securitized portions of our exist-

ing finance receivables portfolios, (2) implemented

vendor financing programs with third parties in the

United States, The Netherlands, the Nordic countries,

Italy, Brazil and Mexico, (3) announced major initia-

tives with GE and other third party vendors to securi-

tize our finance receivables in other countries,

including the completion of the New U.S. Vendor

Financing Agreement (see Note 5 to our Consolidated

Financial Statements), (4) sold several non-core assets

and (5) reduced our annual costs by $1.7 billion.

As more fully discussed in Note 5 to the

Consolidated Financial Statements, we have complet-

ed the following securitization initiatives: