Xerox 2002 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2002 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

tax expense recorded for the ongoing examination in

India, the sale of our interest in Katun Corporation as

well as recurring losses in certain jurisdictions where

we are not providing tax benefits.

The difference between the 2001 effective tax rate

of 126.1 percent and the U.S. federal statutory income

tax rate relates primarily to the recognition of deferred

tax asset valuation allowances resulting from our

recoverability assessments, the taxes incurred in con-

nection with the sale of our partial interest in Fuji Xerox

and recurring losses in low tax jurisdictions. The gain

for tax purposes on the sale of Fuji Xerox was dispro-

portionate to the gain for book purposes as a result

of a lower tax basis in the investment. Other items

favorably impacting the tax rate included a tax audit

resolution and additional tax benefits arising from prior

period restructuring provisions.

The difference between the 2000 effective tax rate

of 19.1 percent and the U.S. federal statutory income

tax rate relates primarily to recurring losses in low tax

jurisdictions, the recognition of deferred tax asset

valuation allowances resulting from our recoverability

assessments and additional tax benefits arising from

the favorable resolution of tax audits.

On a consolidated basis, we paid a total of $442,

$57 and $354 in income taxes to federal, foreign and

state jurisdictions in 2002, 2001 and 2000, respectively.

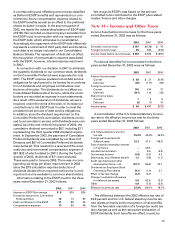

Total income tax expense (benefit) for the three years

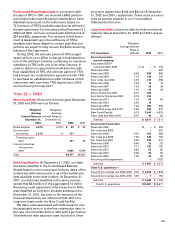

ended December 31, 2002 was allocated as follows:

2002 2001 2000

Income taxes (benefits) on

income (loss) $ 60 $497 $(70)

Tax benefit included in

minorities’ interests(1) (55) (23) (20)

Cumulative effect of change in

accounting principle – 1 –

Common shareholders’ equity(2) (173) 1 38

Total $(168) $476 $(52)

1 Benefit relates to preferred securities’ dividends as more fully described in

Note 16.

2 For dividends paid on shares held by the ESOP, tax effects of items in accumu-

lated other comprehensive loss and tax benefit on nonqualified stock options.

In substantially all instances, deferred income taxes

have not been provided on the undistributed earnings of

foreign subsidiaries and other foreign investments car-

ried at equity. The amount of such earnings included in

consolidated retained earnings at December 31, 2002

was approximately $5 billion. These earnings have been

permanently reinvested and we do not plan to initiate

any action that would precipitate the payment of income

taxes thereon. It is not practicable to estimate the

amount of additional tax that might be payable on the

foreign earnings. As a result of the March 31, 2001 dispo-

sition of one-half of our ownership interest in Fuji Xerox,

the investment no longer qualifies as a foreign corporate

joint venture. Accordingly, deferred taxes are required to

be provided on the undistributed earnings of Fuji Xerox,

arising subsequent to such date, as we no longer have

the ability to ensure permanent reinvestment.

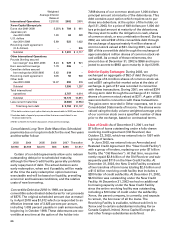

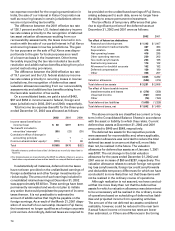

The tax effects of temporary differences that give

rise to significant portions of the deferred taxes at

December 31, 2002 and 2001 were as follows:

2002 2001

Tax effect of future tax deductions

Research and development $ 1,142 $ 1,007

Post-retirement medical benefits 487 464

Depreciation 475 438

Net operating losses 416 295

Other operating reserves 230 202

Tax credit carryforwards 204 185

Restructuring reserves 174 122

Allowance for doubtful accounts 162 182

Deferred compensation 159 180

Other 356 207

3,805 3,282

Valuation allowance (524) (474)

Total deferred tax assets $ 3,281 $ 2,808

Tax effect of future taxable income

Installment sales and leases $ (376) (358)

Unearned income (987) (820)

Other (76) (150)

Total deferred tax liabilities (1,439) (1,328)

Total deferred taxes, net $ 1,842 $ 1,480

The above amounts are classified as current or long-

term in the Consolidated Balance Sheets in accordance

with the asset or liability to which they relate. Current

deferred tax assets at December 31, 2002 and 2001

amounted to $449 and $548, respectively.

The deferred tax assets for the respective periods

were assessed for recoverability and, where applicable,

a valuation allowance was recorded to reduce the total

deferred tax asset to an amount that will, more likely

than not, be realized in the future. The valuation

allowance for deferred tax assets as of January 1, 2001

was $187. The net change in the total valuation

allowance for the years ended December 31, 2002 and

2001 was an increase of $50 and $287, respectively. The

valuation allowance relates to certain foreign net operat-

ing loss carryforwards, foreign tax credit carryforwards

and deductible temporary differences for which we have

concluded it is more likely than not that these items will

not be realized in the ordinary course of operations.

Although realization is not assured, we have conclud-

ed that it is more likely than not that the deferred tax

assets for which a valuation allowance was determined

to be unnecessary will be realized in the ordinary course

of operations based on scheduling of deferred tax liabil-

ities and projected income from operating activities.

The amount of the net deferred tax assets considered

realizable, however, could be reduced in the near term

if actual future income or income tax rates are lower

than estimated, or if there are differences in the timing

74