Xerox 2002 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2002 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

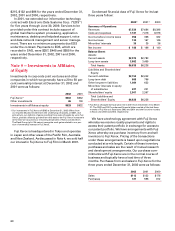

65

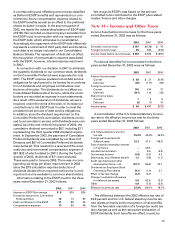

Performance-Based Instrument: In connection with

the sale of TRG in 1997, we received a $462 perform-

ance-based instrument as partial consideration. Cash

distributions are paid on the instrument, based on

72.5 percent of TRG’s available cash flow as defined in

the sale agreement. For the years ended December 31,

2002 and 2001, we have received cash distributions of

$24 and $28, respectively. The recovery of this instru-

ment is dependent upon the sufficiency of TRG’s

available cash flows. Based on current cash flow pro-

jections, we expect to fully recover the $410 remaining

balance of this instrument.

During 2002, the ultimate parent of TRG sought

approval from us to affect a change in business struc-

ture of the entities it holds by combining an insurance

subsidiary of TRG with one of its other insurers. In

order to obtain our approval and enhance the cash

flow capabilities of TRG, the ultimate parent of TRG

has entered into a subscription agreement with TRG

to purchase an established number of shares of this

instrument each year from TRG beginning in 2003

and continuing through 2017.

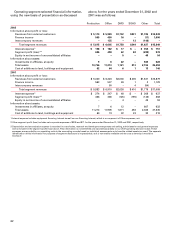

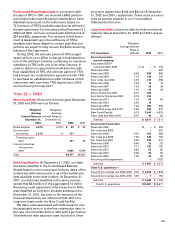

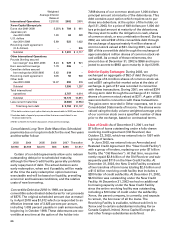

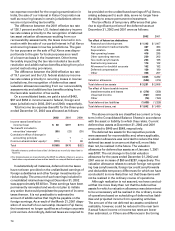

Note 11 — Debt

Short-Term Debt: Short-term borrowings at December

31, 2002 and 2001 were as follows:

Weighted Weighted

Average Average

Interest Rates at Interest Rates at

December 31, December 31,

2002 2001 2002 2001

Notes payable 6.22% 11.07% $ 20 $ 53

Euro secured

borrowing 3.27% –% 377 –

Total short-term

debt 397 53

Current maturities

of long-term

debt 3,980 6,584

Total $4,377 $6,637

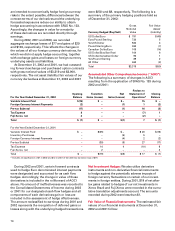

Debt Classification: At December 31, 2002, our debt

has been classified in the Consolidated Balance

Sheets based on the contractual maturity dates of the

underlying debt instruments or as of the earliest put

date available to the debt holders. At December 31,

2001, our debt was classified in the same manner,

except that $3.5 billion of the aggregate $7.0 billion

Revolving credit agreement, which was due in 2002,

was classified as long-term because subsequent to

December 31, 2001, but prior to the issuance of the

financial statements, we refinanced that debt on a

long-term basis under the New Credit Facility.

We defer costs associated with debt issuance over

the applicable term or to the first redemption date, in

the case of convertible debt or debt with a put feature.

Total deferred debt issuance costs included in Other

long-term assets were $133 and $33 as of December

31, 2002 and 2001, respectively. These costs are amor-

tized as interest expense in our Consolidated

Statements of Income.

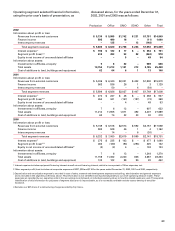

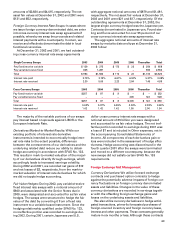

Long-Term Debt: Long-term debt by final contractual

maturity date at December 31, 2002 and 2001 was as

follows:

Weighted

Average Interest

Rates at

U.S. Operations 12/31/02 2002 2001

Xerox Corporation

(parent company)

Guaranteed ESOP

notes due 2001-2003 –% $ – $ 135

Notes due 2002 – –300

Notes due 2003 5.62 883 896

Notes due 2004 7.15 196 197

Euro notes due 2004 3.50 315 266

Notes due 2006 7.25 15 15

Notes due 2007 7.38 25 25

Notes due 2008 1.41 25 25

Senior Notes due 2009 9.75 626 –

Euro Senior Notes due 2009 9.75 226 –

Notes due 2011 7.01 50 50

Notes due 2014 9.00 19 –

Notes due 2016 7.20 255 255

Convertible notes due 2018(1) 3.63 556 579

New Credit Facility 6.15 3,440 4,675

Other debt due 2001-2018 6.97 40 93

Subtotal $ 6,671 $ 7,511

Xerox Credit Corporation

Notes due 2002 – $ – $ 229

Yen notes due 2002 – –381

Notes due 2003 6.61 463 465

Yen notes due 2005 1.50 845 762

Yen notes due 2007 2.00 255 231

Notes due 2008 6.45 25 25

Notes due 2012 7.11 125 125

Notes due 2013 6.50 59 60

Notes due 2014 6.06 50 50

Notes due 2018 7.00 25 25

Revolving credit agreement – –1,020

Subtotal $ 1,847 $ 3,373

Other U.S. operations(2)(3)

Secured borrowings due 2002-2006 5.03 $ 2,462 $ 1,639

Secured borrowings due 2001-2003 3.25 7154

Subtotal $ 2,469 $ 1,793

Total U.S. operations $10,987 $12,677