Xerox 2002 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2002 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

53

to receive lump-sum cash payments in 2003. In accor-

dance with pension accounting rules, we are not per-

mitted to recognize such gains or losses until such

settlement occurs. We expect 2003 restructuring

charges of approximately $115, $90 of which are

expected to relate to pension settlements in the

Production and Office segments. Such amounts could

change based on the actual level of participants who

elect to receive the lump-sum distributions and the

pension asset values as of such date. The balance of

the planned 2003 restructuring charges relate to addi-

tional severance and cost reduction actions associat-

ed with our XES business in the Other segment.

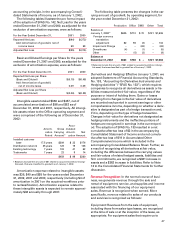

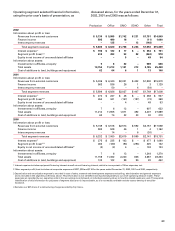

The following table summarizes the restructuring

activity for the Fourth Quarter 2002 Restructuring

Program for the year ended December 31, 2002:

Lease

Cancell-

ation and

Severance and Other

Related Costs Costs Total

Provision, net of accretion $312 $45 $357

Charges against reserve(1) (71) – (71)

Balance December 31, 2002 $241 $45 $286

1 Includes the impact of currency translation adjustments of $3.

Restructuring and asset impairment charges of

$402 for the Fourth Quarter 2002 Restructuring

Program were comprised of $145 in our Production

segment, $102 in our Office segment, $55 in our DMO

segment and $100 in our Other segment.

Turnaround Program: The Turnaround Program began

in October to reduce costs, improve operations, tran-

sition customer equipment financing to third-party

vendors and sell certain assets.

In the fourth quarter of 2000, we provided $105, con-

sisting of $71 for severance and related costs and $34

for asset impairments associated with the disposition

of Delphax, which supplied high-speed election beam

digital printing systems. Over half of these charges

related to our Production operating segment, with the

remainder relating to our Office, DMO and Other oper-

ating segments. During 2001, we provided an addition-

al $403 of restructuring and asset impairment charges,

net of reversals of $26. The reversals related to actual

employee separation costs being lower than we origi-

nally anticipated. This was largely due to employee

attrition, prior to fulfilling the services required before

severance became payable as well as certain employ-

ees that were subsequently redeployed within our

other businesses as a result of unrelated attrition in

these other businesses. Of the amounts provided, $339

was for severance and other employee separation

costs (including $21 for pension curtailment charges),

$36 was for lease cancellation and other exit costs and

$28 was for asset impairments. The majority of these

charges related to our Production and Office operating

segments. The lease termination and other exit costs

and asset impairments related primarily to manufactur-

ing operations. Included in 2001 restructuring charges

are $24, primarily for severance and other employee

separation costs, related to the outsourcing of certain

Office operating segment manufacturing to Flextronics,

as discussed in Note 4.

As of December 31, 2001, we had $223 of Turn-

around Program restructuring reserves remaining,

primarily related to employee severance as a result

of our downsizing efforts. During the year ended

December 31, 2002, we provided an additional $253

(including special termination benefits and pension

curtailments of $27), net of $33 reversals. The reversals

are related to employee attrition prior to severance

payments, lower costs of outplacement programs and

other costs. These provisions were primarily for sever-

ance and other employee separation costs affecting

our Production and Office operating segments, as well

as a minor amount of lease termination and other

costs. The 2002 charge related to the elimination of

redundant resources and the consolidation of activities

into other existing operations, bringing the total elimi-

nated positions, since the inception of the Turnaround

Program, to approximately 11,200. As of December 31,

2002, substantially all the 11,200 affected employees

had separated under the program. The Turnaround

Program reserve balance at December 31, 2002 was

$131, which is expected to be substantially utilized in

the first half of 2003. The total net costs included in

Restructuring and asset impairment charges in the

Consolidated Statements of Income for the Turnaround

Program were $253, $403 and $105 in 2002, 2001 and

2000, respectively.

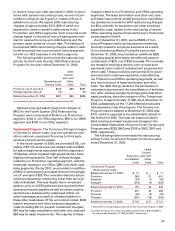

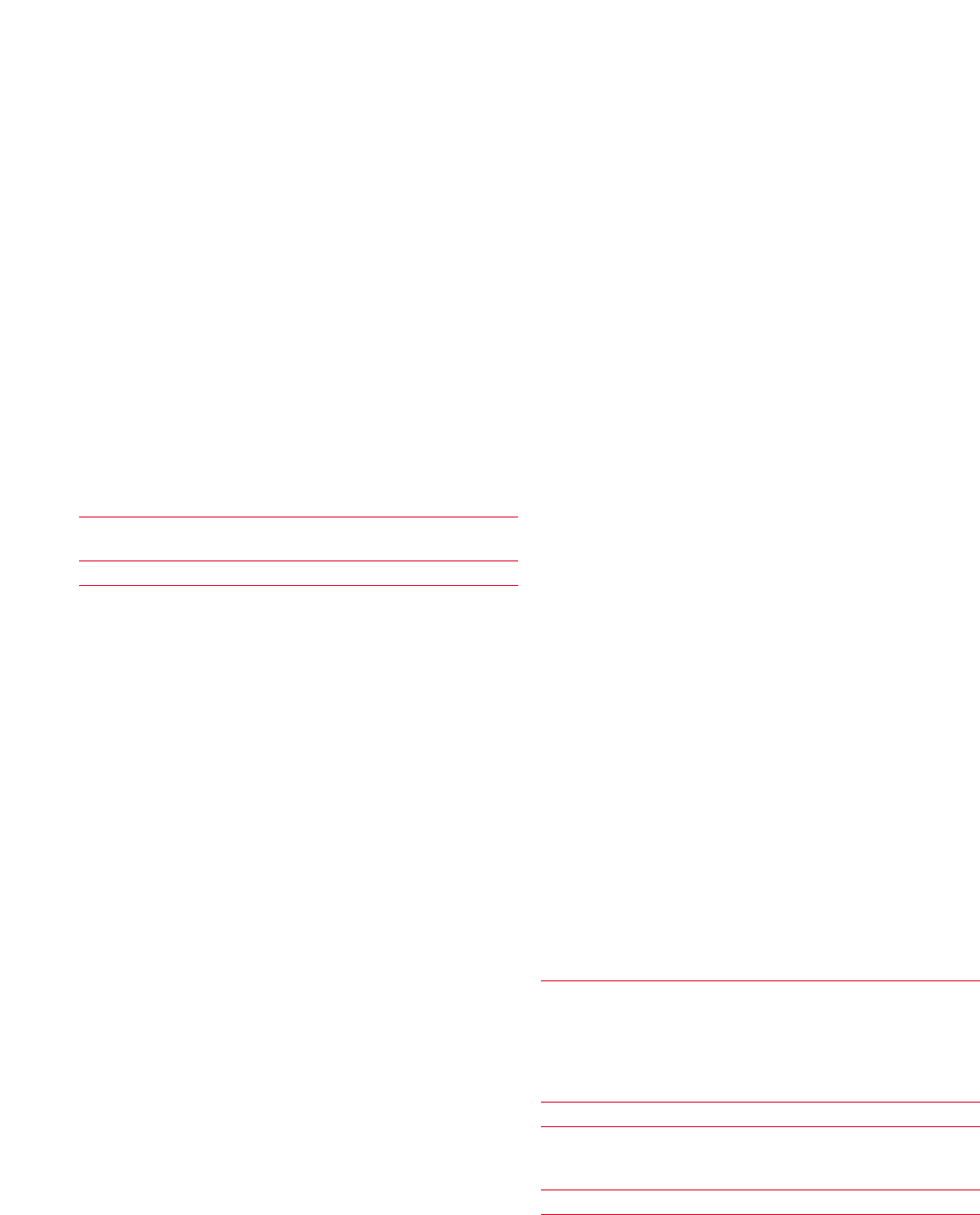

The following table summarizes the restructuring

activity for the Turnaround Program for the two years

ended December 31, 2002:

Lease

Cancell-

Severance ation and

and Related Other

Costs Costs Total

Turnaround Program

Restructuring Costs:

Balance December 31, 2000(1) $ 71 $ – $ 71

Provision 364 37 401

Reversal (25) (1) (26)

Charges(2) (219) (4) (223)

Balance December 31, 2001 191 32 223

Provision 261 25 286

Reversal (28) (5) (33)

Charges(2) (320) (25) (345)

Balance December 31, 2002 $ 104 $ 27 $ 131

1 There were no charges against reserves for the Turnaround Program in 2000.

2 Includes the impact of currency translation adjustments of $12 and ($8) for

the years ended December 31, 2002 and 2001, respectively.