Xerox 2002 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 2002 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

26

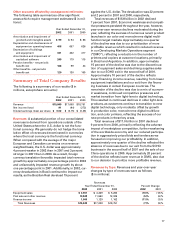

Office: Office revenues include our family of Document

Centre®digital multifunction products, color laser, solid

ink and monochrome laser printers, digital and light-

lens copiers under 90 pages per minute, and facsimile

products sold through direct and indirect sales chan-

nels in North America and Europe. Office revenues rep-

resented 42 percent (new basis) of 2002 revenues

compared with 41 percent in 2001.

2002 Office revenues declined 4 percent (new

basis) from 2001 including a one percentage point

benefit from currency. Declines in older light-lens

products were only partially offset by growth in

monochrome digital multifunction devices and office

color printers. Office color printer revenue grew in the

mid single digits reflecting the success of the 2002

launches of the Phaser®6200 laser and 8200 solid ink

printers and strong Phaser color printers and

Document Centre Color Series 50 post sales revenue

growth. Monochrome digital multifunction revenues

grew in the mid-single digits reflecting strong post

sale growth and the initial benefits of the launch of

the Document 500 series in the second half of 2002.

2001 Office revenues declined 2 percent (old basis)

from 2000 including a one percent adverse impact

from currency. Strong double-digit Office color

growth was more than offset by monochrome

declines. Office color revenue growth was driven by

the Document Centre Color Series 50 and strong color

printer equipment sales, including the Phaser 860

solid ink and Phaser 7700 laser printers. 2001 Office

monochrome revenues declined as growth in digital

multifunction was more than offset by declines in

light lens as customers continued to transition to digi-

tal technology. This decline was exacerbated further

by our reduced participation in very aggressively

priced competitive customer bids and tenders in

Europe, as we prioritized profitable revenue over mar-

ket share. Monochrome declines were slightly miti-

gated by the successful North American launch of the

Document Centre 490 in September 2001.

2002 Office operating profit of $498 million (new

basis) improved by $133 million from 2001 and the

operating margin expanded by 2.2 percentage points

to 7.5 percent. The operating profit improvement was

driven by improved gross margins, as we focused on

more profitable revenue, improved our manufactur-

ing and service productivity and reduced SAG

expenses.

2001 operating profit of $341 million (old basis)

improved compared to a $180 million loss in 2000,

reflecting higher gross margins and decreased SAG

expenses due to restructuring activities.

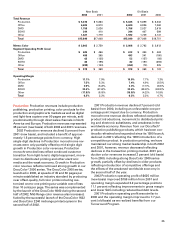

DMO: DMO includes operations in Latin America, the

Middle East, India, Eurasia, Russia and Africa. DMO

revenues represented 11 percent of 2002 revenues, as

compared to 12 percent of 2001 revenues.

2002 DMO revenue declined 13 percent from 2001

entirely due to reductions in post sale revenue as the

result of decreases in the amount of equipment at

customer locations and a 19 percent currency devalu-

ation in Brazil.

2001 DMO revenue declined 23 percent (old basis)

from 2000, with approximately 45 percent of that

decline due to the December 2000 sale of our China

operations. An additional one-third of the 2001 DMO

decline was due to lower post sale revenue, as a

result of a lower number of printers and copiers at

customer locations and a currency devaluation of

22 percent in Brazil. The remainder of the decline was

due to lower equipment revenue, which resulted

from implementation of a new business model that

emphasizes liquidity and profitable revenue rather

than market share.

2002 DMO operating profit of $62 million (new

basis), was $187 million better than 2001. The profit

improvement was due to lower SAG spending result-

ing from our cost base actions and lower bad debt

levels, as well as, significant gross margin improve-

ment, reflecting our focus on profitability and lower

bad debt levels. DMO continued to refine its business

model in 2002, by transitioning equipment financing

to third parties, improving credit requirements for

equipment sale transactions and implementing addi-

tional cost reduction actions. In addition, we imple-

mented a strategy to move to distributors in smaller

countries, including Jamaica and Nigeria, which we

expect will benefit operations by removing fixed

costs.

The 2001 DMO loss of $157 million (old basis) was

due to the revenue decline from the preceding year,

weak gross margins and the currency devaluation in

Argentina. These declines were only partially offset by

initial cost restructuring benefits.

SOHO: We announced our disengagement from our

worldwide SOHO business in June 2001 and sold our

remaining equipment inventory by the end of that

year. SOHO revenues now consist primarily of prof-

itable consumables for the inkjet printers and person-

al copiers previously sold through retail channels in

North America and Europe.

2002 SOHO segment profit of $82 million (new

basis) improved $277 million from 2001 due to the

sales of high margin supplies as compared to losses

previously incurred on equipment sales. We expect

sales of these supplies to decline over time as the

existing equipment population is replaced.