Xerox 2002 Annual Report Download - page 26

Download and view the complete annual report

Please find page 26 of the 2002 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Acquisitions: In January 2000, we acquired the Color

Printing and Imaging Division of Tektronix, Inc.

(“CPID”) for $907 million in cash, net of an $18 million

purchase price adjustment received in 2001, including

$73 million paid by Fuji Xerox for the Asia/Pacific oper-

ations. CPID manufactures and sells color printers, ink

and related products and supplies. At that time, the

acquisition accelerated us to the number two market

position in office color printing, improved our reseller

and dealer distribution network and provided us with

scalable solid ink technology. The acquisition also

enabled significant product development and expense

synergies with our monochrome printer organization.

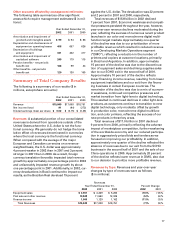

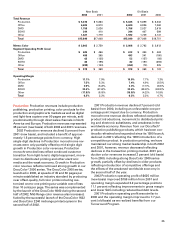

Business Performance by Segment:

Our reportable segments are consistent with how we

manage the business and how we view the markets

we serve. Our reportable segments are as follows:

Production, Office, DMO, SOHO, and Other. The table

below summarizes our business performance by

operating segment for the three-year period ended

December 31, 2002. Revenues and associated per-

centage changes, along with operating profits and

margins by segment are included. Segment operating

profit (loss) excludes certain non-segment items, such

as restructuring charges and gains on sales of busi-

nesses, as further described in Note 9 to the

Consolidated Financial Statements where we present

a reconciliation of segment profit/(loss) to pre-tax

profit (loss) as presented in our Consolidated

Statements of Income.

Operating segment information for 2001 has been

adjusted to reflect a change in operating segment

structure that was made in 2002. The nature of the

changes related primarily to corporate expense and

other allocations associated with internal reorganiza-

tions made in 2002, as well as decisions concerning

direct applicability of certain overhead expenses to the

segments. The adjustments increased (decreased) full

year 2001 revenues as follows: Production – ($16 mil-

lion), Office – ($16 million), DMO – ($1 million), SOHO

– $3 million and Other – $30 million. The full year 2001

segment profit was increased (decreased) as follows:

Production – $12 million, Office – $24 million, DMO –

$32 million, SOHO – $2 million and Other – ($70 mil-

lion). The operating segment information for 2000 has

not been restated, as it was impracticable to do so.

Therefore, we have presented 2002 and 2001 on the

new basis and 2002, 2001 and 2000 on the old basis.

24

well as recurring losses in certain jurisdictions where

we are not providing tax benefits.

The difference between the 2001 effective tax rate

and the U.S. federal statutory income tax rate, relates

primarily to the recognition of deferred tax asset valua-

tion allowances of $247 million from our recoverability

assessments, the taxes incurred in connection with the

sale of our partial interest in Fuji Xerox and recurring

losses in low tax jurisdictions. The gain for tax purpos-

es on the sale of Fuji Xerox was disproportionate to the

gain for book purposes as a result of a lower tax basis

in the investment. Other items favorably impacting the

tax rate included a tax audit resolution of approximate-

ly $140 million and additional tax benefits arising from

prior period restructuring provisions.

The difference between the 2000 effective tax rate

and the U.S. federal statutory income tax rate, relates

primarily to recurring losses in low tax jurisdictions, the

recognition of deferred tax asset valuation allowances

resulting from our recoverability assessments, as offset

by $125 million of additional tax benefits arising from

the favorable resolution of tax audits.

Our effective tax rate will change based on nonre-

curring events (such as new restructuring actions) as

well as recurring factors including the geographical

mix of income before taxes. We expect our 2003 con-

solidated effective tax rate will approximate 40 percent.

Equity in Net Income of Unconsolidated Affiliates:

Equity in net income of unconsolidated affiliates is prin-

cipally related to our 25 percent share of Fuji Xerox

income, subsequent to our sale of 25 percent of Fuji

Xerox in March 2001. Equity in net income in 2002 of

$54 million was in line with our 2001 result of $53 mil-

lion, as compared with $66 million in 2000. The 2000

results primarily reflected our 50 percent ownership

share in Fuji Xerox, partially offset by our $37 million

share of a restructuring charge recorded by Fuji Xerox.

Minorities’ Interest in Earnings of Subsidiaries:

Minorities’ interest in earnings of subsidiaries

includes the minority share of subsidiaries that we do

not own, as well as dividends on our preferred securi-

ties. The increase of $50 million in 2002 to $92 million

from 2001, primarily related to a full year of the quar-

terly distributions on the Convertible Trust Preferred

Securities, issued in November 2001, as more fully

discussed in Note 16 to the Consolidated Financial

Statements.