Xerox 2002 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2002 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

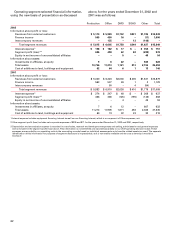

56

Statements of Income, was $27 primarily related to

recognition of cumulative translation adjustment loss-

es and final sale contingency settlements.

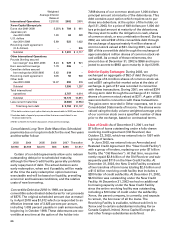

Prudential Insurance Company Common Stock: In the

first quarter of 2002, we sold common stock of

Prudential Insurance Company, associated with that

company’s demutualization. In connection with this

sale, we recognized a pre-tax gain of $19 that is

included in Other Expenses, net, in the accompanying

Consolidated Statement of Income.

Delphax: In December 2001, we sold Delphax

Systems and Delphax Systems, Inc. (“Delphax”) to

Check Technology Canada LTD and Check Technology

Corporation for $16. The transaction was essentially

break-even. Delphax designs, manufactures and sup-

plies high-speed electron beam imaging digital print-

ing systems and related parts, supplies and services.

Nordic Leasing Business: In April 2001, we sold our

leasing businesses in four Nordic countries to a com-

pany now owned by GE, for $352 in cash and retained

interests in certain finance receivables for total pro-

ceeds of approximately $370 which approximated

book value. These sales are part of an agreement

under which that company will provide ongoing,

exclusive equipment financing to our customers in

those countries.

Fuji Xerox Interest: In March 2001, we sold half of our

ownership interest in Fuji Xerox to Fuji Photo Film

Co., Ltd (“Fuji Film”) for $1.3 billion in cash. In

connection with the sale, we recorded a pre-tax gain

of $773. Under the agreement, Fuji Film’s ownership

interest in Fuji Xerox increased from 50 percent to 75

percent. Our ownership interest decreased to 25 per-

cent and we retain significant rights as a minority

shareholder. We have product distribution and tech-

nology agreements that ensure that both parties have

access to each other’s portfolio of patents, technology

and products. Fuji Xerox continues to provide prod-

ucts to us as well as collaborate with us on R&D.

Xerox China: In December 2000, we sold our China

operations to Fuji Xerox for $550. In connection

with the sale, Fuji Xerox also assumed $118 of

indebtedness. We recorded a pre-tax gain of $200 in

connection with this transaction. Prior to the sale, our

China operations had revenue of $262 in 2000, which

is included in the accompanying Consolidated

Statement of Income. While Fuji Xerox is our affiliate,

we believe the negotiations for this transaction were

similar to those that would have been entered into

with an unaffiliated third party, both in terms of price

and conditions. Both parties were represented by sep-

arate legal counsel.

Commodity Paper Product Line: In June 2000, we

entered an agreement with Georgia Pacific to sell our

U.S. and Canadian commodity paper product line and

customer list and recorded a pre-tax gain of $40 which

is included in Other expenses, net, which represented

the proceeds from the sale. We also granted a ten-year

exclusive license related to the use of the Xerox brand

name on future paper sales in exchange for a fair value

royalty agreement. In conjunction with the sale, we

also became an agent of Georgia Pacific for which we

earn a market-based commission on sales of commod-

ity paper. Subsequently, in January 2003, we discontin-

ued the agency relationship without penalty, and

resumed direct commodity paper sales.

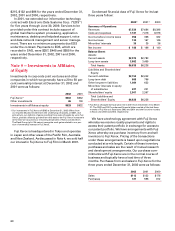

ContentGuard: In April 2000, we sold a 25 percent

ownership interest in our wholly-owned subsidiary,

ContentGuard, to Microsoft, Inc. for $50 and recognized

a pre-tax gain of $23, which is included in Other

expenses, net in the accompanying Consolidated

Statement of Income. An additional pre-tax gain of $27

was deferred, pending the achievement of certain per-

formance criteria. In May 2002, we repaid Microsoft

$25, as the performance criteria had not been achieved.

In connection with the sale, ContentGuard also

received $40 from Microsoft for a non-exclusive license

of its patents and other intellectual property and a $25

advance against future royalty income from Microsoft

on sales of products incorporating ContentGuard’s

technology. The license payment is being amortized

over the ten-year life of the license agreement due to

continuing obligations we have, related to our majority

ownership of ContentGuard. The royalty advance will

be recognized in income as earned. These amounts are

not refundable.

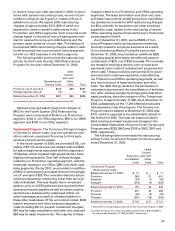

Flextronics Manufacturing Outsourcings: In the fourth

quarter of 2001, we entered into purchase and supply

agreements with Flextronics, a global electronics

manufacturing services company. Under the agree-

ments, Flextronics purchased related inventory,

property and equipment. Pursuant to the purchase

agreement, we sold our operations in Toronto,

Canada; Aguascalientes, Mexico; Penang, Malaysia;

Venray, The Netherlands and Resende, Brazil to

Flextronics in a series of transactions, which were

completed in 2002. In total, approximately 4,100

Xerox employees in certain of these operations trans-

ferred to Flextronics. Total proceeds from the sales in

2002 and 2001 were $167, plus the assumption of cer-

tain liabilities, representing a premium over book

value. The premium is being amortized over the life of

the supply contract.

Under the supply agreement, Flextronics manufac-

tures and supplies equipment and components,

including electronic components, for the Office seg-

ment of our business. This represents approximately

50 percent of our overall worldwide manufacturing