Xerox 2002 Annual Report Download - page 89

Download and view the complete annual report

Please find page 89 of the 2002 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

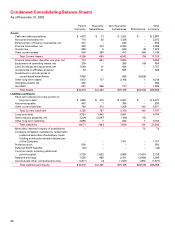

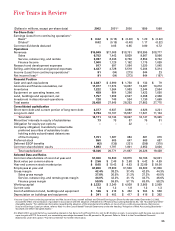

Note 19 — Financial Statements of

Subsidiary Guarantors

As indicated in Note 11, in January 2002, we completed

an unregistered offering in the U.S. ($600) and Europe

(225) of 9.75 percent senior notes (the “Senior

Notes”) due in 2009.

The Senior Notes are guaranteed by certain of our

subsidiaries (the “Subsidiary Guarantees”), including

Palo Alto Research Center Incorporated, Talegen

Holdings, Inc., Xerox Credit Corporation, Xerox Export,

LLC, Xerox Finance, Inc., Xerox Financial Services, Inc.,

Xerox Imaging Systems, Inc., Xerox International Joint

Marketing, Inc., Xerox Latin-American Holdings, Inc.,

and Xerox Connect, Inc. (the “Guarantor Subsidiaries”).

The Subsidiary Guarantees provide that each

Guarantor Subsidiary will fully and unconditionally

guarantee the obligations of Xerox Corporation (“the

Parent Company”) under the Senior Notes on a joint

and several basis. Each Subsidiary Guarantor is whol-

ly-owned by the Parent Company. The following sup-

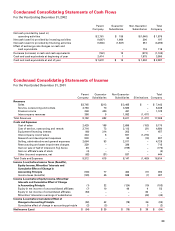

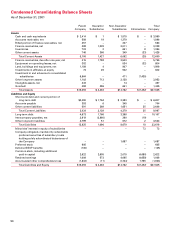

plemental financial information sets forth, on a

condensed consolidating basis, the balance sheets,

statements of income and statements of cash flows for

the Parent Company, the Guarantor Subsidiaries, the

Non-Guarantor Subsidiaries and total consolidated

Xerox Corporation and subsidiaries as of December 31,

2002 and 2001 and for the years ended December 31,

2002, 2001 and 2000.

87

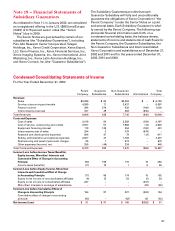

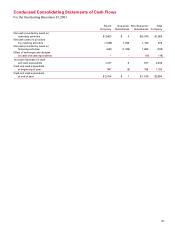

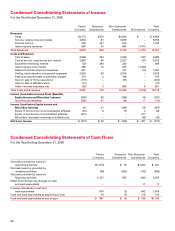

Condensed Consolidating Statements of Income

For the Year Ended December 31, 2002

Parent Guarantor Non-Guarantor Total

Company Subsidiaries Subsidiaries Eliminations Company

Revenues

Sales $3,396 $ 62 $3,294 $ – $ 6,752

Service, outsourcing and rentals 4,589 71 3,437 – 8,097

Finance income 294 276 530 (100) 1,000

Intercompany revenues 327 29 484 (840) –

Total Revenues 8,606 438 7,745 (940) 15,849

Costs and Expenses

Cost of sales 2,019 50 2,282 (154) 4,197

Cost of service, outsourcing and rentals 2,507 51 1,986 (14) 4,530

Equipment financing interest 119 128 254 (100) 401

Intercompany cost of sales 294 3 379 (676) –

Research and development expenses 804 47 78 (12) 917

Selling, administrative and general expenses 2,607 47 1,783 – 4,437

Restructuring and asset impairment charges 95 1 574 – 670

Other expenses (income), net 255 (44) 234 – 445

Total Costs and Expenses 8,700 283 7,570 (956) 15,597

Income (Loss) before Income Taxes (Benefits),

Equity Income, Minorities’ Interests and

Cumulative Effect of Change in Accounting

Principle (94) 155 175 16 252

Income taxes (benefits) (17) 70 1 6 60

Income (Loss) before Equity Income, Minorities’

Interests and Cumulative Effect of Change

in Accounting Principle (77) 85 174 10 192

Equity in net income of unconsolidated affiliates (6) 12 53 (5) 54

Equity in net income of consolidated affiliates 237 – – (237) –

Minorities’ interests in earnings of subsidiaries – – – (92) (92)

Income (Loss) before Cumulative Effect of

Change in Accounting Principle 154 97 227 (324) 154

Cumulative effect of change in accounting

principle (63) – (62) 62 (63)

Net Income (Loss) $ 91 $ 97 $ 165 $(262) $ 91