Xerox 2002 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2002 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

57

exiting, in some geographies, the business of direct

financing of customers’ purchases may result in fur-

ther acceleration of the collection of these receivables

as a result of associated asset sales or securitizations.

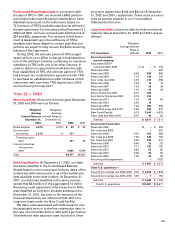

Vendor Financing Initiatives: In 2001, we announced

several Framework Agreements with GE, under which

GE would become our primary equipment-financing

provider in the U.S., Canada, Germany and France. In

connection therewith, in October 2002, we completed

an eight-year agreement in the U.S. (the “New U.S.

Vendor Financing Agreement”), under which GE

Vendor Financial Services, a subsidiary of GE, became

the primary equipment financing provider in the U.S.,

through monthly securitizations of our new lease orig-

inations. In addition to the $2.5 billion already funded

by GE prior to this agreement, which is secured by

portions of our current lease receivables in the U.S.,

the New U.S. Vendor Financing Agreement calls for

GE to provide funding in the U.S. on new lease origi-

nations, of up to an additional $5 billion outstanding

at anytime during the eight-year term, subject to nor-

mal customer acceptance criteria. The $5 billion limit

may be increased to $8 billion, subject to agreement

between the parties. The new agreement contains

mutually agreed renewal options for successive two-

year periods.

Under the agreement, GE is expected to securitize

approximately 70 percent of new U.S. lease origina-

tions at over-collateralization rates, which will vary

over time, but are expected to be approximately 10

percent of the net receivables balance. The securitiza-

tions will be subject to interest rates calculated at

each monthly loan occurrence at yield rates consis-

tent with average rates for similar market based trans-

actions. Refer to Note 11 for further information on

interest rates. Consistent with the loans already

received from GE, the funding received under this

new agreement will be recorded as secured borrow-

ings and the associated receivables will be included in

our Consolidated Balance Sheet. GE’s commitment to

fund under this new agreement is not subject to our

credit ratings. There are no credit rating defaults that

could impair future funding under this agreement.

This agreement contains cross default provisions

related to certain financial covenants contained in

the New Credit Facility and other significant debt facil-

ities. Any default would impair our ability to receive

subsequent funding until the default was cured or

waived but does not accelerate previous borrowings.

As of December 31, 2002, we were in compliance with

all covenants and expect to be in compliance for at

least the next twelve months.

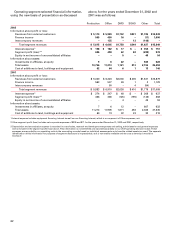

In 2002 and 2001, we received financing totaling

$1,845 and $1,175, respectively, from GE, secured by

lease receivables in the U.S. Net fees of $9 and $7

have been capitalized as debt issue costs during the

years ended December 31, 2002 and 2001, respective-

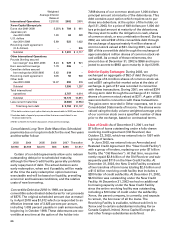

operations. The initial term of the Flextronics supply

agreement is five years subject to our right to extend

for two years. Thereafter it will automatically be

renewed for one-year periods, unless either party

elects to terminate the agreement. We have agreed to

purchase from Flextronics most of our requirements

for certain products in specified product families. We

also must purchase certain electronic components

from Flextronics, so long as Flextronics meets certain

pricing requirements. Flextronics must acquire inven-

tory in anticipation of meeting our forecasted require-

ments and must maintain sufficient manufacturing

capacity to satisfy such forecasted requirements.

Under certain circumstances, we may become obli-

gated to repurchase inventory that remains unused

for more than 180 days, becomes obsolete or upon

termination of the supply agreement. Our remaining

manufacturing operations are primarily located in

Rochester, New York for our high-end production

products and consumables and Wilsonville, Oregon

for consumable supplies and components for the

Office segment products.

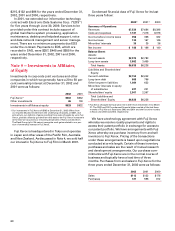

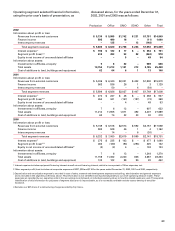

Note 5 — Receivables, Net

Finance Receivables: Finance receivables result from

installment arrangements and sales-type leases aris-

ing from the marketing of our equipment. These

receivables are typically collateralized by a security

interest in the underlying assets. The components of

Finance receivables, net at December 31, 2002 and

2001 follow:

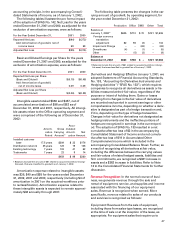

2002 2001

Gross receivables $10,685 $11,466

Unearned income (1,628) (1,834)

Unguaranteed residual values 272 414

Allowance for doubtful accounts (324) (368)

Finance receivables, net 9,005 9,678

Less: Billed portion of finance

receivables, net (564) (584)

Current portion of finance receivables

not billed, net (3,088) (3,338)

Amounts due after one year, net $ 5,353 $ 5,756

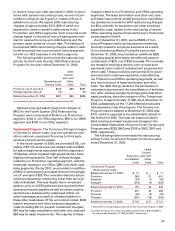

Contractual maturities of our gross finance receiv-

ables subsequent to December 31, 2002 follow

(including those already billed of $564):

There-

2003 2004 2005 2006 2007 after

$4,359 $2,869 $2,031 $982 $349 $95

Our experience has shown that a portion of these

finance receivables will be prepaid prior to maturity.

Accordingly, the preceding schedule of contractual

maturities should not be considered a forecast of

future cash collections. In addition, our strategy of