Xerox 2002 Annual Report Download - page 94

Download and view the complete annual report

Please find page 94 of the 2002 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

92

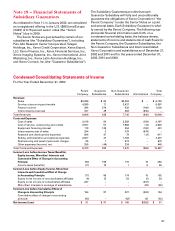

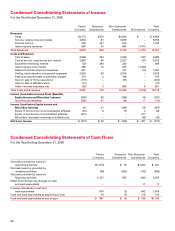

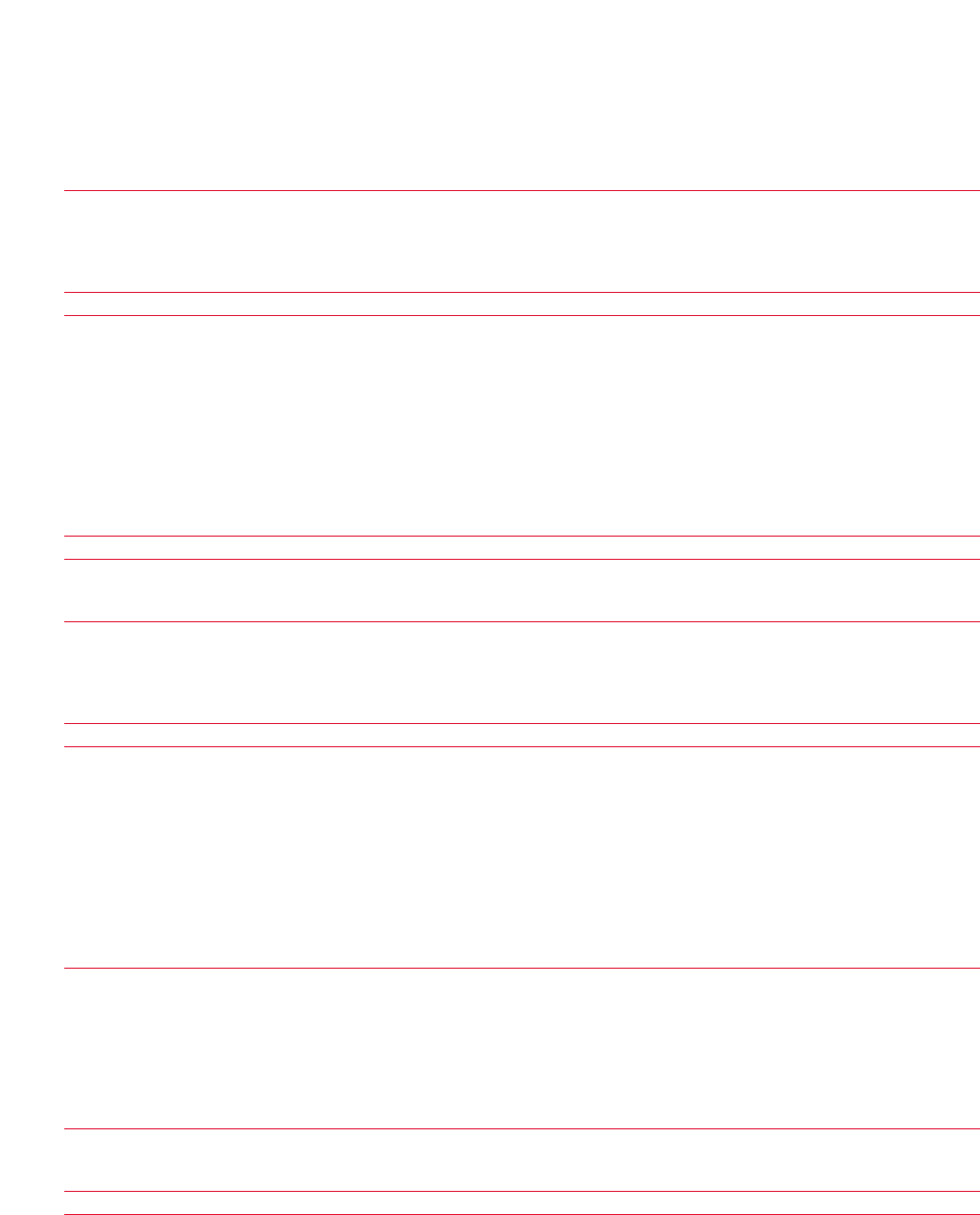

Condensed Consolidating Statements of Income

For the Year Ended December 31, 2000

Parent Guarantor Non-Guarantor Total

Company Subsidiaries Subsidiaries Eliminations Company

Revenues

Sales $4,173 $272 $4,394 $ – $ 8,839

Service, outsourcing and rentals 4,834 81 3,835 – 8,750

Finance income 205 441 516 – 1,162

Intercompany revenues 467 10 994 (1,471) –

Total Revenues 9,679 804 9,739 (1,471) 18,751

Costs and Expenses

Cost of sales 2,628 254 3,345 (147) 6,080

Cost of service, outsourcing and rentals 2,863 84 2,227 (21) 5,153

Equipment financing interest (22) 290 230 – 498

Intercompany cost of sales 455 10 875 (1,340) –

Research and development expenses 951 – 127 (14) 1,064

Selling, administrative and general expenses 2,930 69 2,519 – 5,518

Restructuring and asset impairment charges 274 3 198 – 475

Gain on sale of China operations (119) – (81) – (200)

Gain on sale of affiliate’s stock (21) – – – (21)

Other (income) expenses, net (52) 2 595 6 551

Total Costs and Expenses 9,887 712 10,035 (1,516) 19,118

Income (Loss) before Income Taxes (Benefits),

Equity Income and Minorities’ Interests (208) 92 (296) 45 (367)

Income taxes (benefits) (236) 61 88 17 (70)

Income (Loss) before Equity Income and

Minorities’ Interests 28 31 (384) 28 (297)

Equity in net income of unconsolidated affiliates (24) 8 78 4 66

Equity in net income of consolidated affiliates (277) – – 277 –

Minorities’ interests in earnings of subsidiaries – – – (42) (42)

Net (Loss) Income $ (273) $ 39 $ (306) $ 267 $ (273)

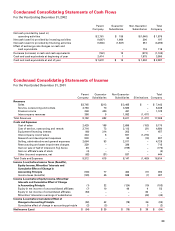

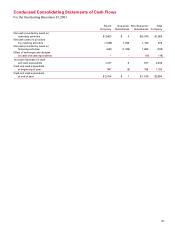

Condensed Consolidating Statements of Cash Flows

For the Year Ending December 31, 2000

Parent Guarantor Non-Guarantor Total

Company Subsidiaries Subsidiaries Company

Net cash provided by (used in)

operating activities $(1,073) $ 76 $1,204 $ 207

Net cash (used in) provided by

investing activities (99) (624) (132) (855)

Net cash provided by (used in)

financing activities 2,151 545 (441) 2,255

Effect of exchange rate changes on cash

and cash equivalents – – 11 11

Increase (decrease) in cash and

cash equivalents 979 (3) 642 1,618

Cash and cash equivalents at beginning of year 18 (2) 116 132

Cash and cash equivalents at end of year $ 997 $ (5) $ 758 $1,750