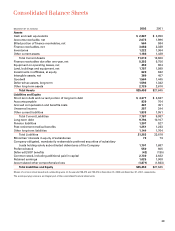

Xerox 2002 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2002 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

47

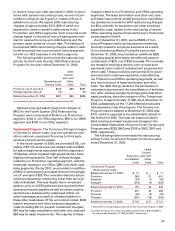

The following table presents the changes in the car-

rying amount of goodwill, by operating segment, for

the year ended December 31, 2002:

Production Office DMO Other Total

Balance at

January 1, 2002(1) $605 $710 $ 70 $121 $1,506

Foreign currency

translation

adjustment 82 55 (3) – 134

Impairment Charge – – (63) – (63)

Divestitures (4) – (1) – (5)

Other – (5) (3) – (8)

Balance at

December 31, 2002 $683 $760 $ – $121 $1,564

1 Balances include the amount of $61 related to acquired workforce intangi-

ble asset, that was classified to goodwill as of January 1, 2002.

Derivatives and Hedging: Effective January 1, 2001, we

adopted Statement of Financial Accounting Standards,

No. 133, “Accounting for Derivative Instruments and

Hedging Activities” (“SFAS No. 133”), which requires

companies to recognize all derivatives as assets or lia-

bilities measured at their fair value, regardless of the

purpose or intent of holding them. Gains or losses

resulting from changes in the fair value of derivatives

are recorded each period in current earnings or other

comprehensive income, depending on whether a deriv-

ative is designated as part of a hedge transaction and,

if it is, depending on the type of hedge transaction.

Changes in fair value for derivatives not designated as

hedging instruments and the ineffective portions of

hedges are recognized in earnings in the current peri-

od. The adoption of SFAS No. 133 resulted in a net

cumulative after-tax loss of $2 in the accompanying

Consolidated Statement of Income and a net cumula-

tive after-tax loss of $19 in Accumulated Other

Comprehensive Income which is included in the

accompanying Consolidated Balance Sheet. Further, as

a result of recognizing all derivatives at fair value,

including the differences between the carrying values

and fair values of related hedged assets, liabilities and

firm commitments, we recognized a $361 increase in

assets and a $382 increase in liabilities. Refer to Note

12 to the Consolidated Financial Statements for further

discussion.

Revenue Recognition: In the normal course of busi-

ness, we generate revenue through the sale and

rental of equipment, service, and supplies and income

associated with the financing of our equipment

sales. Revenue is recognized when earned. More

specifically, revenue related to sales of our products

and services is recognized as follows:

Equipment: Revenues from the sale of equipment,

including those from sales-type leases, are recognized

at the time of sale or at the inception of the lease, as

appropriate. For equipment sales that require us to

accounting principle, in the accompanying Consoli-

dated Statements of Income, as of January 1, 2002.

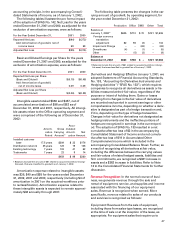

The following tables illustrate the pro forma impact

of the adoption of SFAS No. 142. Net Loss for the years

ended December 31, 2001 and 2000, as adjusted for the

exclusion of amortization expense, were as follows:

For the Year Ended December 31, 2001 2000

Reported Net Loss $(94) $(273)

Add: Amortization of goodwill, net of

income taxes 59 58

Adjusted Net Loss $(35) $(215)

Basic and Diluted Earnings per Share for the years

ended December 31, 2001 and 2000, as adjusted for the

exclusion of amortization expense, were as follows:

For the Year Ended December 31, 2001 2000

Reported Net Loss per Share

(Basic and Diluted) $(0.15) $(0.48)

Add: Amortization of goodwill,

net of income taxes 0.09 0.09

Adjusted Net Loss per Share

(Basic and Diluted) $(0.06) $(0.39)

Intangible assets totaled $360 and $457, net of

accumulated amortization of $98 and $62 as of

December 31, 2002 and 2001, respectively. All intangi-

ble assets relate to the Office operating segment and

were comprised of the following as of December 31,

2002:

Accu-

Amorti- Gross mulated

zation Carrying Amorti- Net

Period Amount(1) zation Amount

Installed customer

base 17.5 years $209 $ 33 $176

Distribution network 25 years 123 15 108

Existing technology 7 years 103 41 62

Trademarks 7 years 23 9 14

$458 $ 98 $360

1 Balances exclude the amount of $61 related to acquired workforce intangi-

ble asset, that was classified to goodwill as of January 1, 2002.

Amortization expense related to intangible assets

was $36, $40 and $55 for the years ended December

31, 2002, 2001 and 2000, respectively (including $4 of

amortization in 2001 on the acquired workforce prior

to reclassification). Amortization expense related to

these intangible assets is expected to remain approxi-

mately $36 annually through 2007.