Xerox 2002 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2002 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

69

amounts of $3,820 and $4,415, respectively. The net

asset fair values at December 31, 2002 and 2001 were

$121 and $52, respectively.

Foreign Currency Interest Rate Swaps: In cases where

we issue foreign currency-denominated debt, we enter

into cross-currency interest rate swap agreements if

possible, whereby we swap the proceeds and related

interest payments with a counterparty. In return, we

receive and effectively denominate the debt in local

functional currencies.

At December 31, 2002 and 2001, we had outstand-

ing cross-currency interest rate swap agreements

with aggregate notional amounts of $879 and $1,481,

respectively. The net asset fair values at December 31,

2002 and 2001 were $21 and $17, respectively. Of the

outstanding agreements at December 31, 2002, the

largest single currency hedged was the Japanese yen.

Contracts denominated in Japanese yen, Pound ster-

ling and Euros accounted for over 95 percent of our

cross-currency interest rate swap agreements.

The aggregate notional amounts of interest rate

swaps by maturity date and type at December 31,

2002 follow:

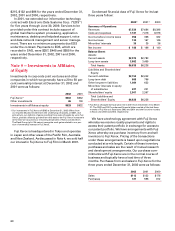

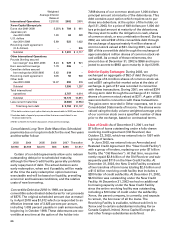

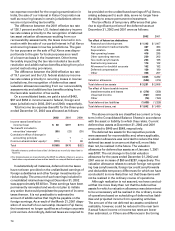

Single Currency Swaps 2003 2004 2005 2006 Thereafter Total

Pay fixed/receive variable $ 139 $ 275 $ 172 $ 22 $ 250 $ 858

Pay variable/receive fixed 825 1,287 – – 850 2,962

Total $ 964 $1,562 $ 172 $ 22 $1,100 $3,820

Interest rate paid 0.79% 3.19% 6.61% 6.02% 5.37% 3.38%

Interest rate received 2.30 5.00 2.23 2.84 7.45 4.89

Cross Currency Swaps 2003 2004 2005 2006 Thereafter Total

Pay fixed/receive variable $257 $ 87 $ 8 $ – $ – $ 352

Pay variable/receive fixed – – – 406 122 528

Total $257 $ 87 $ 8 $ 406 $ 122 $ 880

Interest rate paid 5.02% 5.97% 6.85% 2.53% 2.93% 3.69%

Interest rate received 1.42 1.42 1.42 1.50 2.00 1.54

The majority of the variable portions of our swaps

pay interest based on spreads against LIBOR or the

European Interbank Rate.

Derivatives Marked-to-Market Results: While our

existing portfolio of interest rate derivative

instruments is intended to economically hedge inter-

est rate risks to the extent possible, differences

between the contract terms of our derivatives and the

underlying related debt reduce our ability to obtain

hedge accounting in accordance with SFAS No. 133.

This results in mark-to-market valuation of the majori-

ty of our derivatives directly through earnings, which

accordingly leads to increased earnings volatility.

During 2002 and 2001, we recorded net gains of $12

and net losses of $2, respectively, from the mark-to-

market valuation of interest rate derivatives for which

we did not apply hedge accounting.

Fair Value Hedges: During 2002, pay variable/receive

fixed interest rate swaps with a notional amount of

$600 and associated with the Senior Notes due in

2009, were designated and accounted for as fair value

hedges. The swaps were structured to hedge the fair

value of the debt by converting it from a fixed rate

instrument to a variable based instrument. Since the

hedging relationship qualified under SFAS No. 133,

no ineffective portion was recorded to earnings dur-

ing 2002. During 2001, certain Japanese yen/U.S.

dollar cross-currency interest rate swaps with a

notional amount of 65 billion yen were designated

and accounted for as fair value hedges. The net inef-

fective portion recorded to earnings during 2001 was

a loss of $7 and is included in Other expenses, net in

the accompanying Consolidated Statements of

Income. All components of each derivatives gain or

loss were included in the assessment of hedge effec-

tiveness. Hedge accounting was discontinued in the

fourth quarter 2001 after the swaps were terminated

and moved to a different counterparty, because the

new swaps did not satisfy certain SFAS No. 133

requirements.

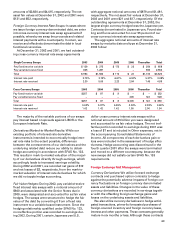

Foreign Exchange Risk Management:

Currency Derivatives: We utilize forward exchange

contracts and purchased option contracts to hedge

against the potentially adverse impacts of foreign cur-

rency fluctuations on foreign currency denominated

assets and liabilities. Changes in the value of these

currency derivatives are recorded in earnings togeth-

er with the offsetting foreign exchange gains and

losses on the underlying assets and liabilities.

We also utilize currency derivatives to hedge antici-

pated transactions, primarily forecasted purchases of

foreign-sourced inventory and foreign currency lease,

interest and other payments. These contracts generally

mature in six months or less. Although these contracts