Xerox 2002 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 2002 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

28

Capital Resources and Liquidity:

References to “Xerox Corporation” below refer to the

stand-alone parent company and do not include sub-

sidiaries. References to “we,” “our” or “us” refer to

Xerox Corporation and its subsidiaries.

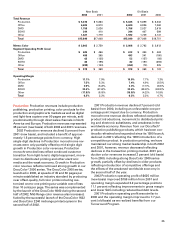

Cash Flow Analysis: The following summarizes our

cash flows for the years ended December 31, 2002,

2001 and 2000 as reported in our Consolidated

Statement of Cash Flows in the accompanying con-

solidated financial statements ($ in millions):

2002 2001 2000

Operating cash flows $ 1,876 $1,566 $ 207

Investing cash flows (usage) 197 873 (855)

Financing cash (usage) flows (3,292) (189) 2,255

Effect of exchange rate changes

on cash 116 (10) 11

(Decrease) increase in cash and

cash equivalents (1,103) 2,240 1,618

Cash and cash equivalents at

beginning of year 3,990 1,750 132

Cash and cash equivalents at

end of year $ 2,887 $3,990 $1,750

2002 Versus 2001: For the year ended December 31,

2002, operating cash flows of $1,876 million include

net income before restructuring and other non-

cash items of $2,124 million and finance receivable

reductions of $754 million due to collection of receiv-

ables from prior year’s sales without an offsetting

receivables increase due to lower equipment sales in

2002, together with a transition to third-party vendor

financing arrangements in the Nordic countries, Italy,

Brazil and Mexico. These cash flows were partially

offset by $442 million of tax payments, including

$346 million related to the 2001 sale of half of our

interest in Fuji Xerox, $392 million of restructuring

related cash payments, approximately $300 million

of other working capital uses, primarily related to

the October 2002 termination of our U.S. revolving

accounts receivable securitization, $127 million of

on-lease equipment expenditures and a $138 million

cash contribution to our pension plans.

The $310 million improvement in operating cash

flow versus 2001 reflects increased finance receivable

collections of $666 million, the absence of cash pay-

ments related to the 2001 early termination of deriva-

tive contracts of $148 million and lower on lease

equipment spending of $144 million. The decline in

2002 on lease equipment spending reflected declining

rental placement activity and populations, particularly

in our older-generation light-lens products. These

items were partially offset by higher cash taxes of

$385 million, higher pension contributions of $96 mil-

lion and increased working capital uses of over $300

million, much of which was caused by the accounts

receivable securitization termination noted above. In

addition, cash flow generated by reducing inventory

during 2002 occurred at a much slower rate than in

2001 as inventory reductions were offset by increased

requirements for new product launches.

Investing cash flows for the year ended December

31, 2002 consisted primarily of proceeds of $200 mil-

lion from the sale of our Italian leasing business,

$53 million related to the sale of certain manufactur-

ing locations to Flextronics, $67 million related to the

sale of our interest in Katun and $19 million from the

sale of our investment in Prudential common stock.

These inflows were partially offset by our capital and

internal use software spending of $196 million.

Investing cash flows in 2001 largely consisted of the

$1,768 million of cash received from sales of business-

es, including one half of our interest in Fuji Xerox, our

leasing businesses in the Nordic countries and certain

manufacturing assets to Flextronics. These cash pro-

ceeds were offset by capital and internal use software

spending of $343 million, a $255 million payment relat-

ed to our funding of trusts to replace Ridge

Reinsurance letters of credit, $115 million of payments

for the funding of escrow requirements related to the

lease contracts transferred to GE, $229 million of pay-

ments for the funding of escrow requirements related

to the 2002 and 2003 scheduled distribution payments

for the trust preferred securities and $29 million of pay-

ments for other contractual requirements.

Financing activities for the year ended December 31,

2002 consisted of $2.8 billion of debt repayments on

the Old Revolver and $710 million on the New Credit

Facility, $1.9 billion of other scheduled payments of

maturing debt, and dividends of $67 million on our pre-

ferred stock. These cash outflows were partially offset

by proceeds of $746 million from our 9.75 percent

Senior Notes offering and $1.4 billion of net proceeds

from secured borrowing activity with GE and other

vendor financing partners. Financing activities for the

comparable 2001 period consisted of scheduled debt

repayments of $2.4 billion and dividends on our com-

mon and preferred stock of $93 million. These outflows

were offset by net proceeds from secured borrowing

activity of $1,350 million and proceeds from the

issuance of trust preferred securities of $1.0 billion.

2001 Versus 2000: For the year ended December 31,

2001 operating cash flows of $1,566 million reflected

net income before restructuring charges and other

non-cash items of $2,312 million (including a net gain

of $304 related to the sale of half our interest in Fuji

Xerox). Operating cash flow improved significantly

compared to 2000, primarily due to working capital

improvements. Although our revenue declined, which