Xerox 2002 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2002 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

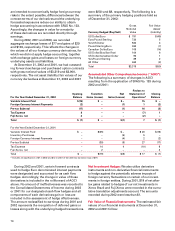

60

$215, $132 and $86 for the years ended December 31,

2002, 2001 and 2000, respectively.

In 2001, we extended our information technology

contract with Electronic Data Systems Corp. (“EDS”)

for five years through June 30, 2009. Services to be

provided under this contract include support of

global mainframe system processing, application

maintenance, desktop and helpdesk support, voice

and data network management and server manage-

ment. There are no minimum payments due EDS

under the contract. Payments to EDS, which are

recorded in SAG, were $357, $445 and $555 for the

years ended December 31, 2002, 2001 and 2000,

respectively.

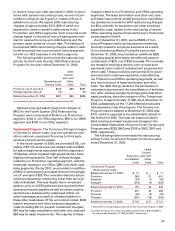

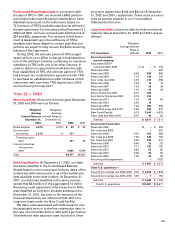

Note 8 — Investments in Affiliates,

at Equity

Investments in corporate joint ventures and other

companies in which we generally have a 20 to 50 per-

cent ownership interest at December 31, 2002 and

2001 were as follows:

2002 2001

Fuji Xerox(1) $563 $532

Other investments 65 100

Investments in affiliates at equity $628 $632

1 Our investment in Fuji Xerox of $563 at December 31, 2002 differs from

our implied 25 percent interest in the underlying net assets, or $627, due

primarily to our deferral of gains resulting from sales of assets by us to Fuji

Xerox, partially offset by goodwill we allocated to the Fuji Xerox investment

at the time we acquired our remaining 20 percent of Xerox Limited from

The Rank Group (plc). We cannot recognize such gains related to our por-

tion of ownership interest in Fuji Xerox.

Fuji Xerox is headquartered in Tokyo and operates

in Japan and other areas of the Pacific Rim, Australia

and New Zealand. As discussed in Note 4, we sold half

our interest in Fuji Xerox to Fuji Film in March 2001.

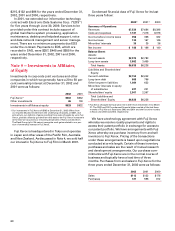

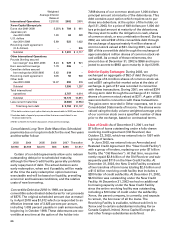

Condensed financial data of Fuji Xerox for its last

three years follow:

2002(1) 2001(1) 2000

Summary of Operations:

Revenues $7,539 $7,684 $8,398

Costs and expenses 7,181 7,316 8,076

Income before income taxes 358 368 322

Income taxes 134 167 146

Minorities’ interests 36 35 36

Net income $ 188 $ 166 $ 140

Balance Sheet:

Assets:

Current assets $2,976 $2,783

Long-term assets 3,862 3,455

Total Assets $6,838 $6,238

Liabilities and Shareholders'

Equity:

Current Liabilities $2,152 $2,242

Long-term debt 868 796

Other long-term liabilities 1,084 632

Minorities’ interests in equity

of subsidiaries 227 201

Shareholders’ equity 2,507 2,367

Total Liabilities and

Shareholders’ Equity $6,838 $6,238

1 Fuji Xerox changed its fiscal year end in 2001 from December 31 to March

31. The 2002 and 2001 condensed financial data consists of the last three

months of Fuji Xerox’s fiscal year 2002 and 2001 and the first nine months

in fiscal year 2003 and 2002, respectively.

We have a technology agreement with Fuji Xerox

whereby we receive royalty payments and rights to

access their patent portfolio in exchange for access to

our patent portfolio. We have arrangements with Fuji

Xerox whereby we purchase inventory from and sell

inventory to Fuji Xerox. Pricing of the transactions

under these arrangements is based upon negotiations

conducted at arm’s length. Certain of these inventory

purchases and sales are the result of mutual research

and development arrangements. Our purchase com-

mitments with Fuji Xerox are in the normal course of

business and typically have a lead time of three

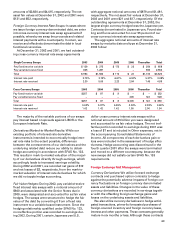

months. Purchases from and sales to Fuji Xerox for the

three years ended December 31, 2002 were as follows:

2002 2001 2000

Sales $113 $132 $178

Purchases 727 598 812