Xerox 2002 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2002 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

48

install the product at the customer location, revenue

is recognized when the equipment has been delivered

to and installed at the customer location. Sales of cus-

tomer installable and retail products are recognized

upon shipment or receipt by the customer according to

the customer’s shipping terms. Revenues from equip-

ment under other leases and similar arrangements are

accounted for by the operating lease method and are

recognized as earned over the lease term, which is gen-

erally on a straight-line basis.

Service: Service revenues are derived primarily from

maintenance contracts on our equipment sold to cus-

tomers and are recognized over the term of the con-

tracts. A substantial portion of our products are sold

with full service maintenance agreements for which

the customer typically pays a base service fee plus a

variable amount based on usage. As a consequence,

we do not have any significant product warranty obli-

gations, including any obligations under customer

satisfaction programs.

Supplies: Supplies revenue generally is recognized

upon shipment or utilization by customer in accord-

ance with sales terms.

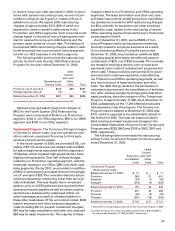

Revenue Recognition Under Bundled Arrangements:

We sell most of our products and services under bun-

dled contract arrangements, which contain multiple

deliverable elements. These contractual lease arrange-

ments typically include equipment, service, supplies

and financing components for which the customer

pays a single negotiated price for all elements. These

arrangements typically also include a variable compo-

nent for page volumes in excess of contractual mini-

mums, which are often expressed in terms of price

per page, which we refer to as the “cost per copy.”

In a typical bundled arrangement, our customer is

quoted a fixed minimum monthly payment for (1)

the equipment, (2) the associated services and other

executory costs and (3) the financing element. The

fixed minimum monthly payments are multiplied by

the number of months in the contract term to arrive at

the total fixed minimum payments that the customer

is obligated to make (“Fixed Payments”) over the

lease term. The payments associated with page vol-

umes in excess of the minimums are contingent on

whether or not such minimums are exceeded

(“Contingent Payments”). The minimum contractual

committed copy volumes are typically negotiated to

equal the customer’s estimated copy volume at lease

inception. In applying our lease accounting methodol-

ogy, we consider the Fixed Payments for purposes of

allocating to the fair value elements of the contract. We

do not consider the Contingent Payments for purposes

of allocating to the elements of the contract or recog-

nizing revenue on the sale of the equipment, given the

inherent uncertainties as to whether such amounts will

ever be received. Contingent Payments are recognized

as revenue in the period when the customer exceeds

the minimum copy volumes specified in the contract.

When separate prices are listed in multiple element

customer contracts, such prices may not be representa-

tive of the fair values of those elements, because the

prices of the different components of the arrangement

may be modified through customer negotiations,

although the aggregate consideration may remain the

same. Therefore, revenues under these arrangements

are allocated based upon estimated fair values of each

element. Our revenue allocation methodology first

begins by determining the fair value of the service

component, as well as other executory costs and any

profit thereon and second, by determining the fair

value of the equipment based on comparison of the

equipment values in our accounting systems to a range

of cash selling prices or, if applicable, other verifiable

objective evidence of fair value. We perform extensive

analyses of available verifiable objective evidence of

equipment fair value based on cash selling prices dur-

ing the applicable period. The cash selling prices are

compared to the range of values included in our lease

accounting systems. The range of cash selling prices

must support the reasonableness of the lease selling

prices, taking into account residual values that accrue

to our benefit, in order for us to determine that such

lease prices are indicative of fair value. Our interest

rates are developed based upon a variety of factors

including local prevailing rates in the marketplace and

the customer’s credit history, industry and credit class.

These rates are recorded within our pricing systems.

The resultant implicit interest rate, which is the same

as our pricing interest rate, unless adjustment to equip-

ment values is required, is then compared to fair

market value rates to assess the reasonableness of the

fair value allocations to the multiple elements.

Determination of Appropriate Revenue Recognition

for Leases: Our accounting for leases involves spe-

cific determinations under Statement of Financial

Accounting Standards No. 13 “Accounting for

Leases” (“SFAS No. 13”) which often involve com-

plex provisions and significant judgments. The two

primary criteria of SFAS No. 13 which we use to clas-

sify transactions as sales-type or operating leases

are (1) a review of the lease term to determine if it is

equal to or greater than 75 percent of the economic

life of the equipment and (2) a review of the minimum

lease payments to determine if they are equal to or

greater than 90 percent of the fair market value of the

equipment. Under our current product portfolio and

business strategies, a non-cancelable lease of 45

months or more generally qualifies as a sale. Certain

of our lease contracts are customized for larger cus-

tomers, which results in complex terms and

conditions and requires significant judgment in apply-

ing the above criteria. In addition to these, there are