Xerox 2002 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2002 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

52

geographies to improve productivity and reduce

costs; and

• Integrating Xerox Engineering Systems (“XES”) into

our North American and European operations from

its previous stand-alone structure.

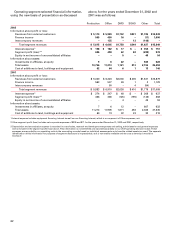

The severance and other employee separation

costs are related to the elimination of approximately

4,700 positions worldwide. Approximately 55 percent,

31 percent, 11 percent and 3 percent of the positions

related to the U.S., Europe, Latin America and

Canada, respectively. As of December 31, 2002,

approximately 1,700 of the 4,700 affected employees

had been separated under the program, and a majori-

ty of the remainder are expected to be separated in

the first quarter of 2003.

SFAS No. 146 requires recognition and measure-

ment of a liability for lease and other contract termi-

nation costs. For those lease contracts that are not

terminated, a liability must be recorded when the enti-

ty ceases using the leased property. This liability is

based on remaining rentals over the lease term, net of

estimated sublease rentals that can be reasonably

obtained for the property, regardless of whether the

entity intends to enter a sublease. The sublease rates

are based on estimated market rental rates. External

factors, such as appraisals, recent rental activities in

local markets, history of subleases in the same or sim-

ilar space and other factors are all considered when

estimating sublease rentals. Our estimated lease

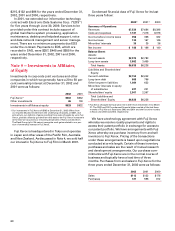

costs of $45 for properties exited as part of the Fourth

Quarter 2002 Restructuring Program are net of future

sublease rentals of $19.

The lease termination and asset impairment charge

related primarily to the exiting and consolidation of

office facilities, distribution centers and warehouses

worldwide. The majority of the U.S. consolidation

resulted in a provision of $36, and was for facilities

located in California and other smaller locations.

The remaining provision of $9 related to the consoli-

dation of certain European facilities as a result of the

reduction in personnel. The Fourth Quarter 2002

Restructuring Program reserve balance at December

31, 2002 of $286 is expected to be substantially

utilized in 2003. As mentioned above, we recorded

$32 in special termination benefits and pension cur-

tailment charges representing enhanced retirement

benefits given to early retirees and the recognition

of previously unrecognized pension and other benefit

costs that will be paid to such employees. In addition

to these pension related costs, we also incur others

such as pension settlements. A pension settlement

occurs when we make lump-sum cash payments

to plan participants in exchange for their rights to

receive pension benefits in the future. We are

required to recognize a loss if, at the time of the settle-

ment, the assets attributable to those participants

included unrecognized losses. We expect that many

of the terminated employees will subsequently elect

in the Consolidated Statements of Income totaled $670,

$715 and $475 in 2002, 2001 and 2000, respectively.

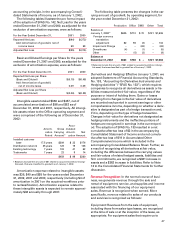

The restructuring initiatives and a summary of the

impacts on our financial statements were as follows:

Restructuring Action Initiation of Plan

• Fourth Quarter 2002

Restructuring Program November 2002

• Turnaround Program October 2000

• SOHO Disengagement June 2001

• March 2000 Restructuring March 2000

Detailed information about each of the above

restructuring programs and the applicable accounting

rules we applied are outlined below.

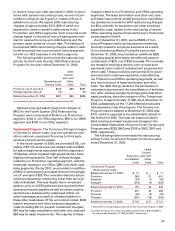

Fourth Quarter 2002 Restructuring Program: As more

fully discussed in Note 1, on October 1, 2002, we adopt-

ed the provisions of SFAS No. 146. During the fourth

quarter of 2002, we announced a worldwide restructur-

ing program and subsequently recorded a provision

of $402. The fair value of the initial liability was deter-

mined by discounting the future cash outflows using

our credit-adjusted risk-free borrowing rate of 5.9 per-

cent. The provision consisted of $312 for severance and

related costs (including $32 for special termination

benefits and pension curtailment charges) and $45 of

costs associated with lease terminations and future

rental obligations, net of estimated future sublease

rents. We also recorded $45 for asset impairments

associated with the exit activities. Of the total asset

impairment charge, $32 relates to the recognition of

currency translation adjustment losses on our invest-

ment that were recognized in conjunction with the

shutdown of a foreign subsidiary. The remaining asset

impairment related to the write-off of leasehold

improvements in exited facilities. The total included in

Restructuring and asset impairment charges in the

Consolidated Statements of Income for the Fourth

Quarter 2002 Restructuring Program was $402.

Key initiatives of this restructuring include the

following:

• Streamlining manufacturing and administrative

operations;

• Transitioning to an indirect sales and service model

for our Office segment in Europe;

• Implementing an average 10 percent reduction in

the number of middle and upper managers across

all our businesses in the United States;

• Outsourcing work in areas not related to our core

business operations and where there is an economic

advantage. This includes the outsourcing of certain

service functions and moving towards an indirect

sales model where it was deemed cost beneficial to

do so.

• Implementing a wide-ranging series of initiatives

across Developing Markets Operations (“DMO”)