Xerox 2002 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 2002 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

29

normally leads to a reduction in receivables and

payables balances, our collections of receivables

exceeded our payments on accounts payable and

other current liability accounts by approximately

$500 million. We reduced our inventory balances and

spending for on-lease equipment by approximately

$480 million. We also had a one-year benefit of

approximately $350 million associated with the timing

of taxes due on the gain from our sale of half our

interest of Fuji Xerox, which we did not have to pay

until first quarter 2002. The overall impact of our

reported net loss on our operating cash flows, after

considering the impacts of non-cash items associated

with restructuring charges, provisions, tax valuation

allowances and gains did not vary significantly

between 2001 and 2000.

Investing cash flows were higher in 2001 primarily

due to $1,768 million of cash received from the sales

of businesses, including Fuji Xerox and our leasing

businesses in the Nordic countries. These cash pro-

ceeds were greater than the $640 million received

from the sale of businesses in 2000. In 2001 we also

reduced capital spending and internal-use software

spending significantly. Other factors contributing to

the 2001 improvement were the acquisition of CPID in

2000, which utilized cash of $856 million, while in

2001 we were required to fund $628 million of certain

escrow and insurance trusts based on contractual

requirements.

Our 2001 financing cash flows largely consisted of

a net repayment of approximately $1.1 billion of debt,

offset by a private placement of $1.0 billion of trust

preferred securities. The suspension of dividends on

our common and preferred stock also positively

impacted our cash flows in 2001. 2000 financing activ-

ities consisted of net borrowing of $2.9 billion, which

funded the CPID acquisition and increased our cash

balance, partially offset by common and preferred

stock dividends of $587 million.

Capital Structure and Liquidity: Historically, we have

provided equipment financing to a significant majori-

ty of our customers. Because the finance leases allow

our customers to pay for equipment over time rather

than at the date of purchase, we have needed to

maintain significant levels of debt to provide operat-

ing liquidity, as liquidity generated from receivable

collections has generally been used to fund new

equipment leases. A significant portion of our debt is

directly related to the funding requirements of our

financing business.

During the years ended December 31, 2002 and

2001, we originated loans, secured by finance receiv-

ables, with cash proceeds of $3,055 million and

$2,418 million, respectively. Approximately half of our

total finance receivable portfolio has been securitized

at December 31, 2002 compared with 24 percent a

year earlier. We expect to increase the proportion of

our finance receivables which are securitized to

approximately 60 percent by the end of 2004. The

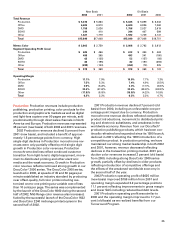

following table compares finance receivables to

financing-related debt as of December 31, 2002 ($ in

millions):

Finance

Receivables Debt(2)

Finance Receivables Encumbered

by Loans(1):

GE Loans – U.S. and Canada $ 2,777 $ 2,642

Merrill Lynch Loan – France 413 377

U.S. Asset-backed notes 247 139

XCC securitizations 101 7

Subtotal – Special Purpose Entities 3,538 3,165

GE Loans – UK 691 529

GE Loans – Other Europe 95 95

Other Europe 113 111

Total 4,437 $ 3,900

Unencumbered Finance

Receivables 4,568

Total Finance Receivables(3) $ 9,005

(1) Encumbered finance receivables represent the book value of finance

receivables that secure each of the indicated loans.

(2) Represents the debt secured by finance receivables, including transac-

tions utilizing special purpose entities, which are described below.

(3) Includes (i) Billed portion of finance receivables, net (ii) Finance receiv-

ables, net and (iii) Finance receivables due after one year, net as included

in the consolidated balance sheets as of December 31, 2002.

As of December 31, 2002, debt secured by finance

receivables was approximately 28 percent of total

debt. As we increase the proportion of our finance

receivables that are securitized, we expect this per-

centage to increase to approximately 40 percent by

the end of 2004.

The following represents our aggregate debt matu-

rity schedule ($ in millions):

2003 2004 2005 2006 Thereafter

First Quarter $ 626 $ 992

Second Quarter 1,315 907

Third Quarter 658 910

Fourth Quarter 1,778 1,100

Full Year $4,377 $3,909 $4,016 $56 $1,813

Of the full year amounts shown in the above table,

$1,887 million and $1,426 million for 2003 and 2004,

respectively, relate to debt secured by finance receiv-

ables. For a discussion on the contractual maturities

of our mandatorily redeemable preferred securities,

refer to the section entitled “Contractual Cash

Obligations and Other Commercial Commitments

and Contingencies.”