Xerox 2002 Annual Report Download - page 22

Download and view the complete annual report

Please find page 22 of the 2002 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

20

Finance income margins of approximately 60 per-

cent reflect interest expense related to our financing

operations. Equipment financing interest rates are

determined based on a combination of actual interest

expense incurred on financing debt, as well as our esti-

mated cost of funds, applied against the estimated

level of debt required to support our financed receiv-

ables. The estimate is based on an assumed ratio of

debt as compared to our finance receivables. This ratio

ranges from 80-90 percent of our average finance

receivables. This methodology has been consistently

applied for all periods presented. We expect our 2003

Finance income gross margin to be in line with 2002.

Research and Development: 2002 research and

development (“R&D”) spending of $917 million, was

$80 million lower than 2001. Approximately 40 per-

cent of the decline was due to our SOHO exit, another

40 percent of the decline reflects both benefits from

cost restructuring actions and the receipt of external

funding and the balance reflects the previously dis-

cussed favorable ESOP compensation expense

adjustment. R&D spending represented our continued

investment in technological development, particularly

color, to maintain our position in the rapidly changing

document processing market. We believe our R&D

remains technologically competitive. Our R&D is

strategically coordinated with that of Fuji Xerox,

which invested $580 million in R&D in 2002, which

together with our R&D spending resulted in a com-

bined total of $1.5 billion. To maximize the synergies

of our relationship, our R&D expenditures are focused

on the Production segment while Fuji Xerox R&D

expenditures are focused on the Office segment. In

2002, we were awarded over 700 U.S. patents ranking

us 19th on the list of companies that had been award-

ed the most U.S. patents during the year. Together

with Fuji Xerox, we were awarded close to 900 U.S.

patents in 2002. Our patent portfolio evolves as new

patents are awarded to us and as older patents expire.

As of December 31, 2002, we held approximately

7,700 U.S. patents. These patents expire at various

dates up to 17 years from the date of award. While we

believe that our portfolio of patents and applications

has value, in general no single patent is essential to

our business or the individual segments. In addition,

any of our proprietary rights could be challenged,

invalidated or circumvented, or may not provide sig-

nificant competitive advantages.

2001 R&D spending of $997 million declined by

$67 million from 2000. Over half the reduction reflects

the second half 2001 SOHO disengagement, with the

balance due to cost reduction initiatives in 2000 and

2001.

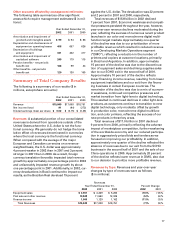

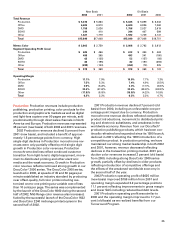

Selling, Administrative and General Expenses: Selling,

administrative and general (“SAG”) expense informa-

tion was as follows ($ in millions):

Year Ended December 31,

2002 2001 2000

Total Selling, administrative

and general expenses $4,437 $ 4,728 $ 5,518

SAG as a percentage of

revenue 28.0% 27.8% 29.1%

2002 SAG expense of $4,437 million declined by

$291 million from 2001. The reduction includes lower

bad debt expenses of $106 million, lower SOHO

spending of $84 million and a $34 million favorable

property tax adjustment in North America. These

decreases were partially offset by $106 million of

internal-use software impairment charges, $65 million

of higher advertising and marketing communications

spending, $18 million of increased professional fees

and $26 million of losses associated with the exit from

certain leased facilities. The balance of the reduction

primarily reflects employment reductions associated

with our cost base restructuring which has resulted in

lower labor, benefit and related expenses.

2001 SAG expense of $4,728 million declined

$790 million from 2000 reflecting significantly lower

labor costs and other benefits derived from our cost

reduction initiatives, temporarily lower advertising and

marketing communications spending of $88 million and

reduced SOHO spending of $62 million, partially offset

by increased professional costs related to litigation,

regulatory issues and related matters of $52 million.

We expect 2003 total SAG expense reductions in

line with the 2002 decline.

Bad debt expense included in SAG, was $332 mil-

lion, $438 million and $472 million in 2002, 2001 and

2000, respectively. Lower expense in 2002 is due to

improved customer administration, collection prac-

tices and credit approval policies, as well as our rev-

enue declines. 2001 provisions were lower than 2000

due to lower equipment sales, partially offset by

reserve increases due to the weakened worldwide

economy. Bad debt expenses as a percent of total rev-

enue were 2.1 percent, 2.6 percent, and 2.5 percent for

2002, 2001 and 2000, respectively.

As with Finance income, the bad debt provision will

be impacted to the extent we sell portions of our

financing businesses, including existing receivables,

or enter into agreements with third parties to provide

financing directly to our customers. Any provision for

customer credit would accordingly be factored in the

proceeds we receive from the counterparty and the

resultant revenue or gain recognized on the sale of

equipment or receivables. However, as noted above,

since most of our transactions with third parties

involve secured borrowing structures, the associated