Xerox 2002 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2002 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

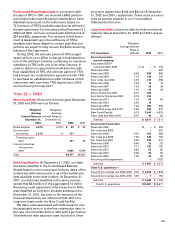

58

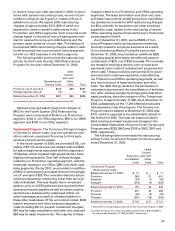

ly. In connection with these transactions, $150 is in

escrow, as security for our continuing obligations

under the transferred contracts. At December 31,

2002, the remaining balance was $2,323 and is includ-

ed in debt in our Consolidated Balance Sheet.

In May 2002, we launched the Xerox Capital

Services (“XCS”) venture with GE, under which XCS

now manages our customer administration and leas-

ing activities in the U.S., including various financing

programs, credit approval, order processing, billing

and collections. We account for XCS as a consolidated

entity since we are responsible to fund all of its opera-

tions, and, further, all events of termination result in

GE receiving back their entire equity investment and

total ownership reverting to us.

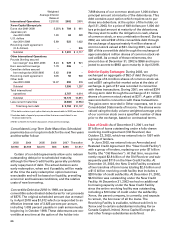

France Secured Borrowings: In December 2002, we

received $362, net of escrow requirements, in financ-

ing from Merrill Lynch Capital Markets Bank Limited

and Merrill Lynch International Bank Limited (sub-

sidiaries of Merrill Lynch) secured by some of our

lease receivables in France. At December 31, 2002,

the remaining balance is $377 and is included in debt

in our Consolidated Balance Sheet.

The Netherlands Secured Borrowings: Beginning in

the second half of 2002, we received a series of

financings from our unconsolidated joint venture with

De Lage Landen International BV (“DLL”) secured by

some of our lease receivables in The Netherlands. At

December 31, 2002, the remaining balance is $112

and is included in debt in our Consolidated Balance

Sheet.

Germany Secured Borrowings: In May 2002, we

entered into an agreement to transfer part of our

financing operations in Germany to GE. In conjunc-

tion with this transaction, we received loans from

GE secured by lease receivables in Germany. Initial

cash proceeds of $79 were net of $15 of escrow

requirements. As part of the transaction we

transferred leasing employees to a GE entity which

will also finance certain new leasing business in the

future. We currently consolidate this joint venture

since we retain substantive rights related to the bor-

rowings. At December 31, 2002, the remaining

balance, which includes additional proceeds received

since May 2002, is $95 and is included in debt in our

Consolidated Balance Sheet.

United Kingdom Secured Borrowings: During 2002

and 2001, we received $268 and $885, respectively, in

financing from GE Capital Equipment Finance Limited

(a subsidiary of GE), secured by our portfolios of lease

receivables in the United Kingdom. At December 31,

2002, the remaining balance of $529 is included in

debt in our Consolidated Balance Sheets.

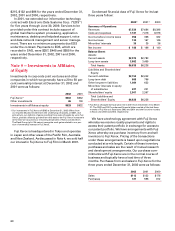

Canada Secured Borrowings: In 2002, we received $443

of financing from GE, secured by lease receivables in

Canada. Cash proceeds of $428 were net of $8 of

escrow requirements and $7 of fees. At December 31,

2002, the remaining balance is $319 and is included in

debt in our Consolidated Balance Sheet.

U.S. Asset-backed Securities Transaction: In July

2001, we transferred U.S. lease contracts to a consoli-

dated trust, which in turn sold $513 of floating-rate

asset-backed notes (the “Notes”). We received cash

proceeds of $480, net of $3 of expenses and fees. An

additional $30 of proceeds are being held in reserve

by the trust until the Notes are repaid, which is

currently estimated to be in or around August 2003.

Since the trust is consolidated in our financial state-

ments, we effectively recorded the proceeds received

as a secured borrowing. At December 31, 2002, the

remaining balance was $139 and is included as debt

in our Consolidated Balance Sheet.

In 2000, we transferred domestic lease contracts to

a special purpose entity (“SPE”) as part of a financing

transaction, for gross proceeds of $411. The proceeds

received were accounted for as a secured borrowing.

At December 31, 2002, the remaining balance was $7

and is included in debt in our Consolidated Balance

Sheet.

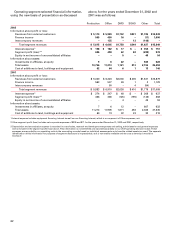

As of December 31, 2002, $4,218 of Finance receiv-

ables and $219 of Billed finance receivables are held

as collateral in various trusts and SPEs, as security for

the borrowings noted above. Total outstanding debt

being secured by these receivables at December 31,

2002 was $3,900. The SPEs are consolidated in our

financial statements due to their holding non-financial

assets and other conditions which preclude sale

accounting. Although the transferred assets are

included in our total assets, we received an opinion

from outside legal counsel that the trusts and SPEs to

which the assets were transferred were deemed bank-

ruptcy remote. As a result, the assets of the trust are

not available to satisfy any of our other obligations.

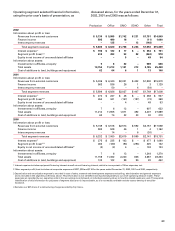

Accounts Receivable: In 2000, we established two

revolving accounts receivable securitization facilities

in the U.S. and Canada aggregating $330. The facili-

ties enabled us to sell, on an ongoing basis, undivided

interests in a portion of our accounts receivable in

exchange for cash.

In May 2002, a credit rating agency downgrade

caused a termination event under our U.S. trade receiv-

able securitization facility. The undivided interest sold

under the U.S. trade receivable securitization facility

amounted to $290 at December 31, 2001 and was

accounted for as a sale of receivables. We continued to

sell receivables into the U.S trade receivable securitiza-

tion facility pending renegotiation of the facility as a

result of this termination event. In October 2002, the

facility was terminated and no additional receivables