Xerox 2002 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2002 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

44

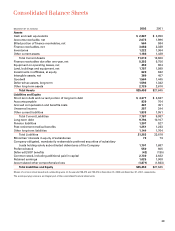

The following table summarizes the more significant

charges that require management estimates:

Year ended December 31,

(in millions) 2002 2001 2000

Restructuring provisions and

asset impairments $670 $ 715 $ 475

Amortization and impairment

of goodwill and intangible assets 99 94 86

Provisions for receivables 353 506 613

Provisions for obsolete and

excess inventory 115 242 235

Depreciation and obsolecence

of equipment on

operating leases 408 657 626

Depreciation of buildings

and equipment 341 402 417

Amortization of capitalized software 249 179 115

Pension benefits – net periodic

benefit cost 168 99 44

Other post-retirement benefits –

net periodic benefit cost 120 130 109

Deferred tax asset valuation

allowance provisions 15 247 12

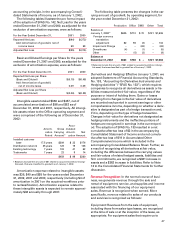

Changes in Estimates: In the ordinary course of

accounting for items discussed above, we make

changes in estimates as appropriate, and as we

become aware of circumstances surrounding those

estimates. Such changes and refinements in estima-

tion methodologies are reflected in reported results

of operations in the period in which the changes are

made and, if material, their effects are disclosed in the

Notes to the Consolidated Financial Statements.

New Accounting Standards and Accounting Changes:

Variable Interest Entities: In January 2003, the FASB

issued Interpretation No. 46, “Consolidation of

Variable Interest Entities, an interpretation of ARB 51”

(“FIN 46”). The primary objectives of FIN 46 are to

provide guidance on the identification of entities for

which control is achieved through means other than

through voting rights (“VIEs”) and how to determine

when and which business enterprise should consoli-

date the VIE. This new model for consolidation

applies to an entity which either (1) the equity

investors (if any) do not have a controlling financial

interest or (2) the equity investment at risk is

insufficient to finance that entity’s activities without

receiving additional subordinated financial support

from other parties. We do not expect the adoption of

this standard to have any impact on our results of

operations, financial position or liquidity.

Guarantees: In November 2002, the FASB issued

Interpretation No. 45, “Guarantor’s Accounting and

Disclosure Requirements for Guarantees, Including

Indirect Guarantees of Indebtedness of Others” (“FIN

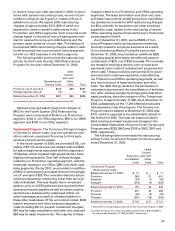

accounting. Upon the sale of stock of a subsidiary,

we recognize a gain or loss in our Consolidated

Statements of Income equal to our proportionate

share of the corresponding increase or decrease in

that subsidiary’s equity. Operating results of acquired

businesses are included in the Consolidated

Statements of Income from the date of acquisition.

For further discussion of acquisitions, refer to Note 3.

Certain reclassifications of prior year amounts

have been made to conform to the current year

presentation.

Income (Loss) before Income Taxes (Benefits), Equity

Income, Minorities’ Interests and Cumulative Effect of

Change in Accounting Principle: Throughout the

Notes to the Consolidated Financial Statements, we

refer to the effects of certain changes in estimates and

other adjustments on Income (Loss) before Income

Taxes (Benefits), Equity Income, Minorities’ Interests

and Cumulative Effect of Change in Accounting

Principle. For convenience and ease of reference, that

caption in our Consolidated Statements of Income is

hereafter referred to as “pre-tax income (loss).”

Use of Estimates: The preparation of our consolidated

financial statements in accordance with accounting

principles generally accepted in the United States of

America requires that we make estimates and

assumptions that affect the reported amounts of

assets and liabilities, as well as the disclosure of con-

tingent assets and liabilities at the date of the financial

statements, and the reported amounts of revenues

and expenses during the reporting period. Significant

estimates and assumptions are used for, but not limit-

ed to: (i) allocation of revenues and fair values in mul-

tiple element arrangements; (ii) accounting for

residual values; (iii) economic lives of leased assets;

(iv) allowance for doubtful accounts; (v) retained inter-

ests associated with the sales of accounts or finance

receivables; (vi) inventory valuation; (vii) restructuring

and other related charges; (viii) asset impairments;

(ix) depreciable lives of assets; (x) useful lives of

intangible assets and goodwill (in 2002 goodwill is no

longer amortized over an estimated useful life, see

below for further discussion); (xi) pension and post-

retirement benefit plans; (xii) income tax valuation

allowances and (xiii) contingency and litigation

reserves. Future events and their effects cannot be

predicted with certainty; accordingly, our accounting

estimates require the exercise of judgment. The

accounting estimates used in the preparation of our

consolidated financial statements will change as new

events occur, as more experience is acquired, as addi-

tional information is obtained and as our operating

environment changes. Actual results could differ from

those estimates.