Xerox 2002 Annual Report Download - page 19

Download and view the complete annual report

Please find page 19 of the 2002 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

17

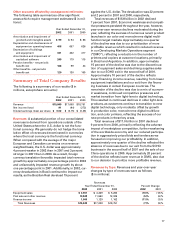

Other accounts affected by management estimates:

The following table summarizes other significant

areas which require management estimates ($ in mil-

lions):

Year Ended December 31,

2002 2001 2000

Amortization and impairment of

goodwill and intangible assets $ 99 $ 94 $ 86

Depreciation and obsolescence of

equipment on operating leases 408 657 626

Depreciation of buildings

and equipment 341 402 417

Amortization and impairment of

capitalized software 249 179 115

Pension benefits – net periodic

benefit cost 168 99 44

Other benefits – net periodic

benefit cost 120 130 109

Summary of Total Company Results:

The following is a summary of our results ($ in

millions, except share amounts):

Year Ended December 31,

2002 2001 2000

Revenue $15,849 $17,008 $18,751

Net income (loss) 91 (94) (273)

Diluted earnings (loss) per share $ 0.02 $ (0.15) $ (0.48)

Revenues: A substantial portion of our consolidated

revenues is derived from operations outside of the

United States where the U.S. dollar is not the func-

tional currency. We generally do not hedge the trans-

lation effect of revenues denominated in currencies

where the local currency is the functional currency.

When compared with the average of the major

European and Canadian currencies on a revenue-

weighted basis, the U.S. dollar was approximately

4 percent weaker in 2002 than in 2001 and 3 percent

stronger in 2001 than in 2000. As a result, foreign

currency translation favorably impacted total revenue

growth by approximately one percentage point in 2002

and unfavorably impacted revenue growth by about

one percentage point in 2001. Additionally, in 2002, cur-

rency devaluations in Brazil continued to impact our

results, as the Brazilian Real devalued 19 percent

against the U.S. dollar. The devaluation was 22 percent

and 2 percent in 2001 and 2000, respectively.

Total revenues of $15.8 billion in 2002 declined

7 percent from 2001. Economic weakness and competi-

tive pressures persisted throughout the year, however,

year-over-year revenue declines moderated during the

year, reflecting the success of numerous recent product

launches in our color and monochrome digital multi-

function target markets. Approximately one quarter

of the decline was due to our prioritization of more

profitable revenue which resulted in reduced revenue

in our Developing Markets Operations segment

(“DMO”), reflecting a reduction in the number of

printers and copiers at customer locations, primarily

in Brazil and Argentina. In addition, approximately

15 percent of the decline was due to the discontinua-

tion of equipment sales and declining supplies sales

due to our SOHO exit in the second half of 2001.

Approximately 10 percent of the decline reflects

lower financing income revenue, resulting from lower

equipment installations and our exit from the financ-

ing business in certain European countries. The

remainder of the decline was due to a mix of econom-

ic weakness, continued competitive pressures and

market transition from light-lens to digital technology.

This resulted in continued declines in older light-lens

products, as customers continue to transition to new

digital technology, only modestly offset by growth

in production color, monochrome digital multifunc-

tion, and color printers, reflecting the success of our

new products in these key areas.

Total revenues of $17.0 billion in 2001 declined

9 percent from 2000, primarily reflecting the adverse

impact of marketplace competition, further weakening

of the worldwide economy and our reduced participa-

tion in aggressively priced bids and tenders as we

focused on improving our profitability. In addition,

approximately one quarter of the decline reflected the

absence of revenues due to our exit from the SOHO

business in the second half of 2001 and the sale of our

China operations in 2000. Approximately 20 percent

of the decline reflects lower revenue in DMO, also due

to our decision to prioritize more profitable revenue.

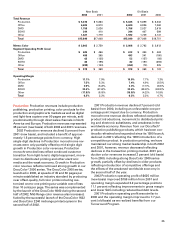

Revenues by Type: Revenues and year-over-year

changes by type of revenues were as follows

($ in millions):

Revenues

Year Ended December 31, Percent Change

2002 2001 2000 2002 2001

Equipment sales $ 3,901 $ 4,329 $ 5,264 (10)% (18)%

Post sale and other revenue 10,948 11,550 12,325 (5)% (6)%

Finance income 1,000 1,129 1,162 (11)% (3)%

Total Revenues $15,849 $17,008 $18,751 (7)% (9)%