Xerox 2002 Annual Report Download - page 88

Download and view the complete annual report

Please find page 88 of the 2002 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

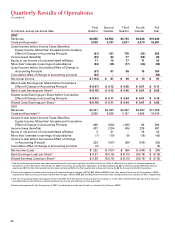

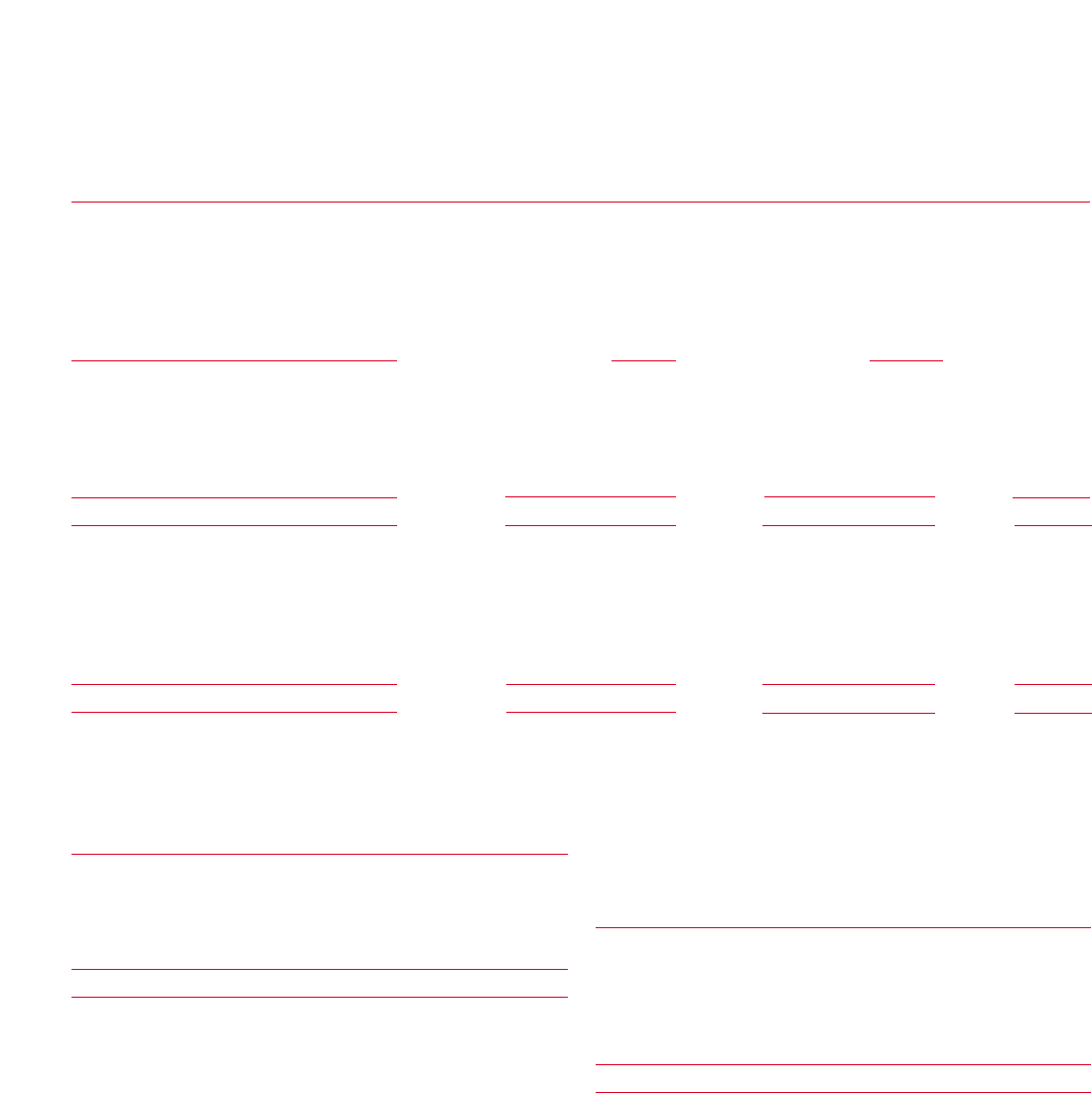

A reconciliation of the numerators and denominators of the basic and diluted EPS calculation follows:

2002 2001 2000

Per- Per- Per-

Share (Loss) Share (Loss) Share

(Shares in thousands) Income Shares Amount Income Shares Amount Income Shares Amount

Basic EPS

Net income (loss) before

cumulative effect of

change in accounting

principle $154 $(92) $(273)

Accrued dividends on

preferred stock, net (73) (12) (46)

Basic EPS before

cumulative effect of

change in accounting

principle $ 81 731,280 $ 0.11 $(104) 704,181 $(0.15) $(319) 667,581 $(0.48)

Cumulative effect of change

in accounting principle (63) 731,280 (0.09) (2) 704,181 – – 667,581 –

Basic EPS $ 18 731,280 $ 0.02 $(106) 704,181 $(0.15) $(319) 667,581 $(0.48)

Diluted EPS before

cumulative effect of

change in accounting

principle $ 81 807,144 $ 0.10 $(104) 704,181 $(0.15) $(319) 667,581 $(0.48)

Cumulative effect of

change in accounting

principle (63) 807,144 (0.08) (2) 704,181 – – 667,581 –

Diluted EPS $ 18 807,144 $ 0.02 $(106) 704,181 $(0.15) $(319) 667,581 $(0.48)

A reconciliation of the individual weighted average

shares outstanding was as follows:

2002 2001 2000

Weighted – average common

shares outstanding:

Basic 731,280 704,181 667,581

Stock options 5,401 ––

ESOP Preferred stock 70,463 ––

Diluted 807,144 704,181 667,581

The 2002, 2001 and 2000 computation of diluted

loss per share did not include the effects of 63 million,

69 million and 58 million issued and outstanding stock

options, respectively, because either: i) their respective

exercise prices were greater than the corresponding

market value per share of our common stock or ii)

where the respective exercise prices were less than the

corresponding market value per share of our common

stock, the inclusion of such options would have been

anti-dilutive.

In addition, the following securities that could poten-

tially dilute basic EPS in the future were not included in

the computation of diluted EPS because to do so would

have been anti-dilutive for 2002, 2001 and 2000 (in

thousands of shares):

2002 2001 2000

Convertible preferred stock –78,473 50,605

Mandatorily redeemable

preferred securities – Trust II 113,426 113,426 –

3.625% Convertible

subordinated debentures 7,129 7,129 7,903

Other convertible debt 1,992 1,992 5,287

Total 122,547 201,020 63,795

86